Summary

A proposal to:

- Increase ZK’s supply cap, Collateral Factor, and Liquidation Threshold on Venus’s ZkSync deployment.

- Increase USDC.e’s supply cap on Venus’s ZkSync deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

ZK (ZkSync)

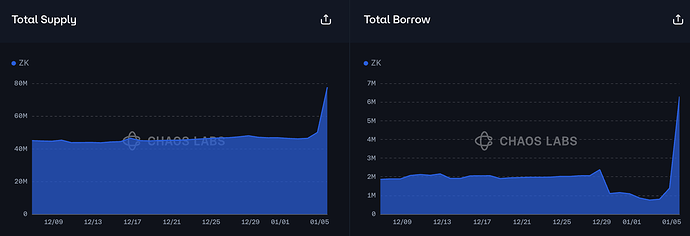

ZK has reached 78% supply cap utilization, while its borrow cap is not approaching full utilization.

Additionally, the asset’s collateral parameters are currently set at 35% and 40% for CF and LT, respectively. Following observations of user behavior and on-chain liquidity, we are able to recommend adjusting these parameters to make the asset more efficient as collateral.

Supply Distribution

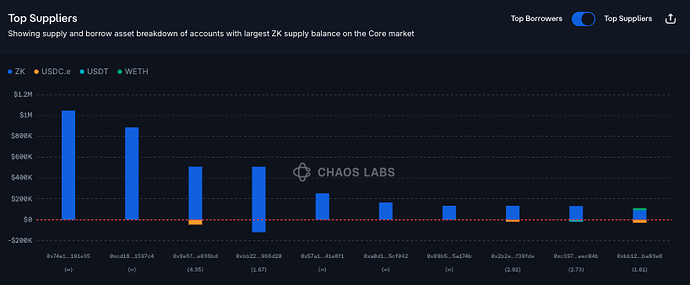

As discussed in yesterday’s cap analysis, ZK’s supply is well distributed. Six of the ten largest suppliers are not borrowing against their ZK. Additionally, ZK-ZK looping behaviors reduce the risk of liquidations in this market. Overall, the biggest ZK suppliers represent a negligible liquidation risk.

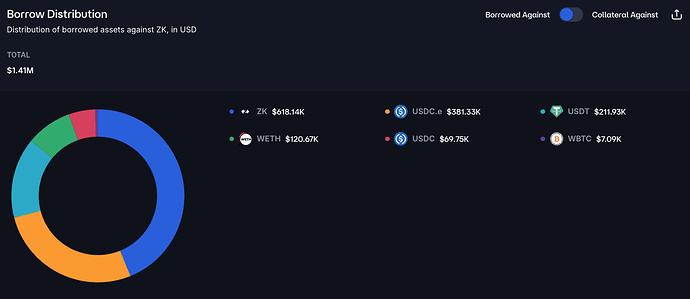

The plurality of debt against ZK is ZK itself, followed by USDC.e, USDT, and WETH.

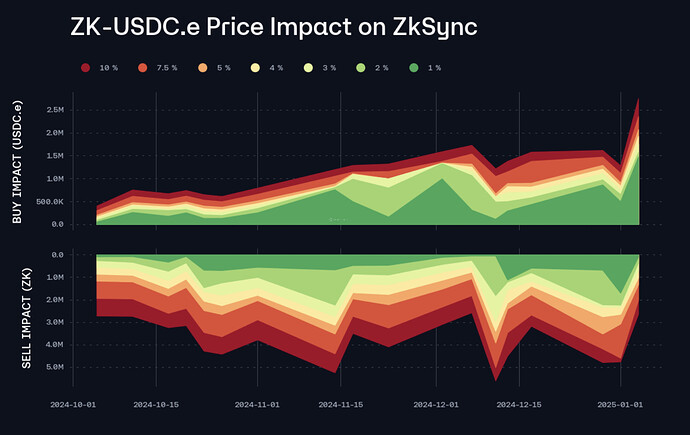

Finally, ZK’s liquidity has proved stable over the past two months and is sufficient to support an increase in the asset’s collateral parameters.

Recommendation

Given user behavior and on-chain liquidity, we recommend doubling the supply cap and increasing the Collateral Factor and Liquidation Threshold.

USDC.e (ZkSync)

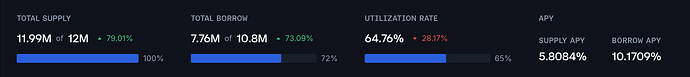

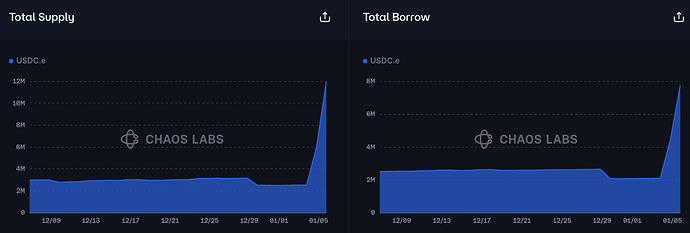

USDC.e has reached 100% of its supply cap and 72% of its borrow cap.

Supply Distribution

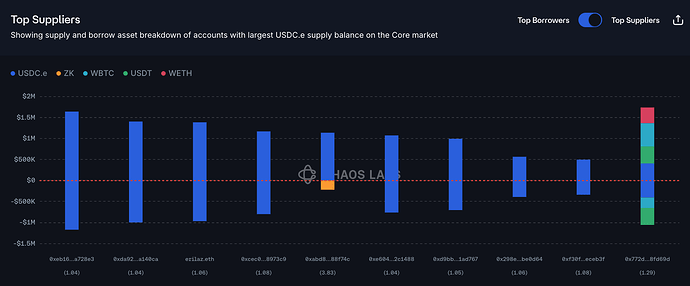

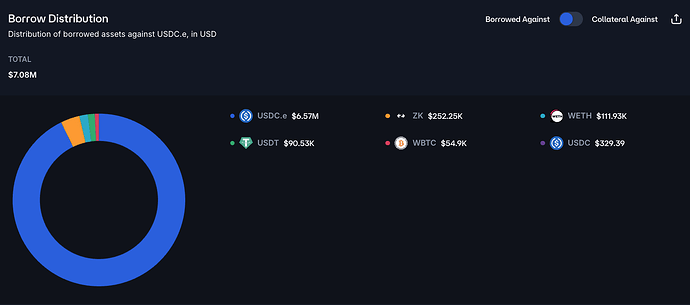

USDC.e’s supply is less concentrated than during our previous cap increase, with the largest suppliers still looping the asset against itself.

Looping continues to be the most popular use case for USDC.e as collateral, as this usage is likely derived from the ZK Ignite incentive program.

Recommendation

Given user behavior and on-chain liquidity, we recommend doubling the supply cap.

Specification

| Asset | Network | Instance | Current CF | Recommended CF | Current LT | Recommended LT |

|---|---|---|---|---|---|---|

| ZK | ZkSync | Core | 35% | 40% | 40% | 45% |

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| ZkSync | ZK | 100,000,000 | 200,000,000 | 12,500,000 | - |

| ZkSync | USDC.e | 12,000,000 | 24,000,000 | 10,800,000 | - |