Summary

A proposal to:

- Increase ZK’s supply cap on Venus’s ZkSync deployment.

- Increase USDC.e’s supply and borrow caps on Venus’s ZkSync deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

ZK (ZkSync)

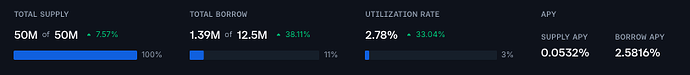

ZK has reached 100% supply cap utilization while its borrow cap is not approaching full utilization.

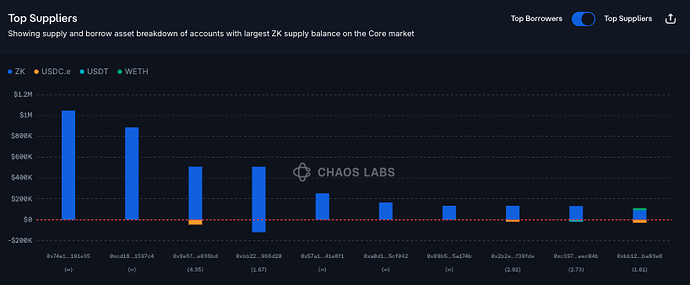

Supply Distribution

ZK’s supply is well distributed, with no single user representing more than 10% of the total supply. Additionally, the largest suppliers are not borrowing against their collateral, reducing the risk of liquidations in this market.

Recommendation

Given user behavior and on-chain liquidity, we recommend doubling the supply cap.

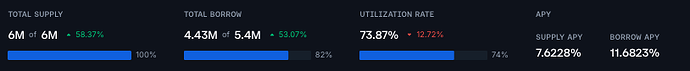

USDC.e (ZkSync)

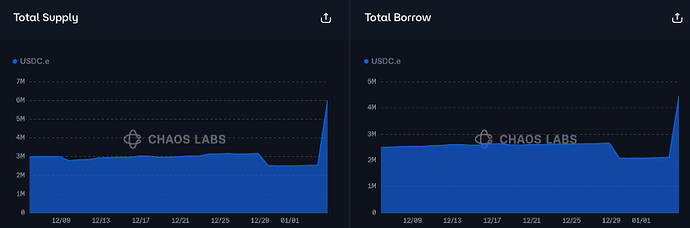

USDC.e has reached 100% of its supply cap and 82% of its borrow cap.

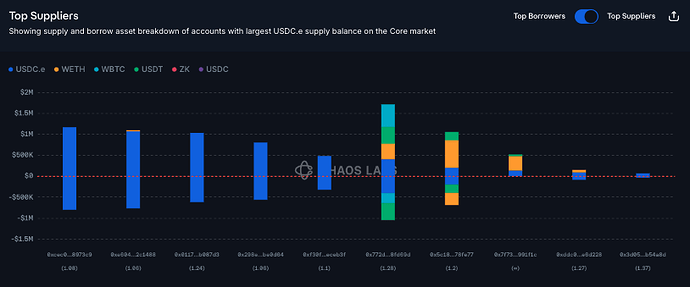

Supply Distribution

USDC.e’s supply is somewhat concentrated, though the small size of the market and the fact that top suppliers are looping the asset with itself significantly reduce risk.

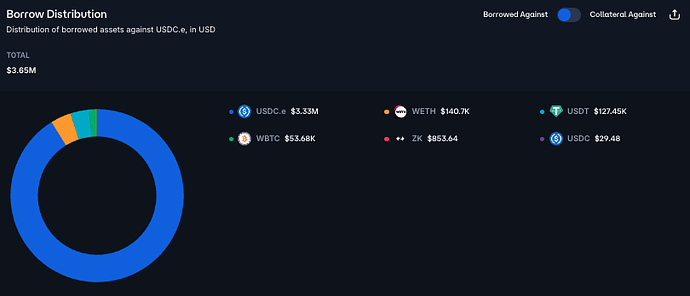

By far the most popular asset borrowed against USDC.e is USDC.e itself.

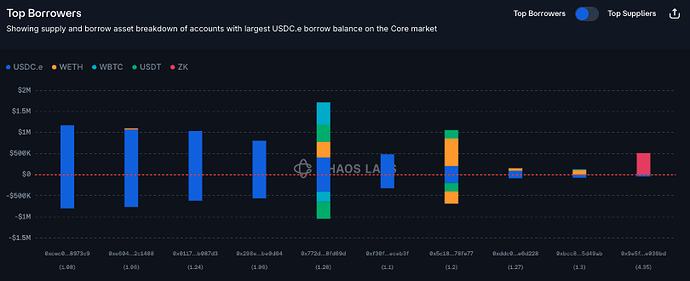

Borrow Distribution

As a result, the top borrowers have significant overlap with top suppliers, again presenting little of risk of liquidation. Those users that are at risk of liquidation are small enough to be efficiently liquidated.

Recommendation

Given user behavior and on-chain liquidity, we recommend doubling the supply and borrow caps.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| ZkSync | ZK | 50,000,000 | 100,000,000 | 12,500,000 | - |

| ZkSync | USDC.e | 6,000,000 | 12,000,000 | 5,400,000 | 10,800,000 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.