Summary

A proposal to:

- Increase UNI’s supply cap on the BNB Chain Core deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

UNI (BNB Core)

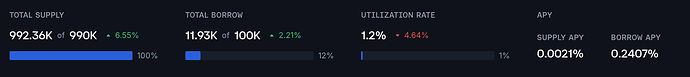

UNI has reached 100% supply cap utilization and its borrow cap is 12% utilized.

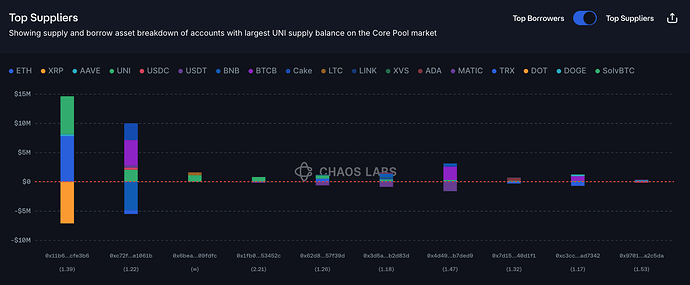

Supply Distribution

UNI’s supply is relatively concentrated, with a single user accounting for nearly 50% of the total supply. This user borrows XRP against ETH and UNI collateral and maintains a health score of 1.39, putting them at moderate risk of liquidation.

The second largest supplier is borrowing ETH and BNB against UNI, BTCB, and Cake, with a health score of 1.22. The varied collateral and debt assets held by these two users reduces the risk of large scale liquidations.

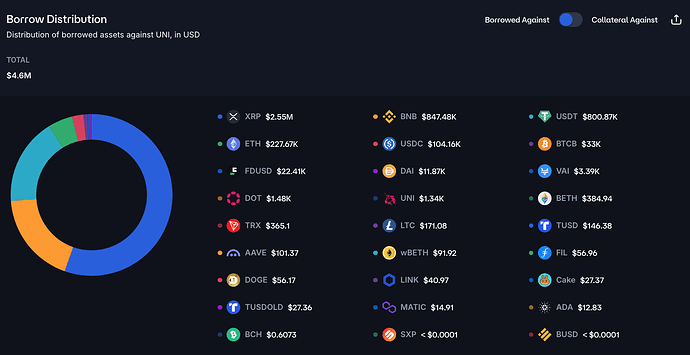

As a result of the top position, XRP is the most popular debt asset against UNI, followed by BNB and USDT.

Liquidity

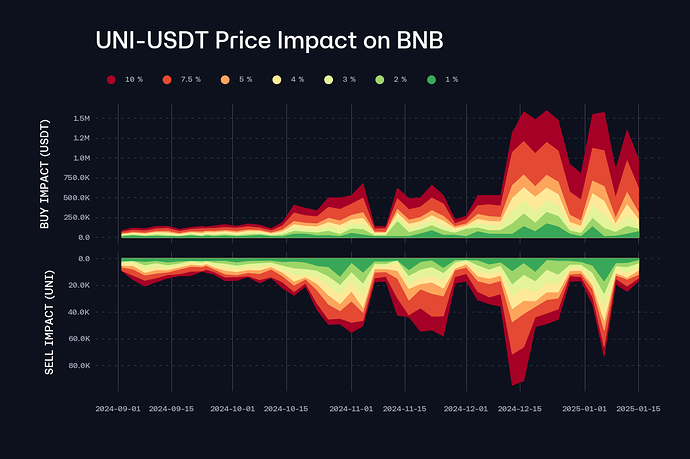

UNI’s liquidity on BNB is somewhat poor, though our simulations indicate that, taking into account user behavior, this is sufficient to support a supply cap increase.

Recommendation

Given the aforementioned factors, we recommend increasing the supply cap to 1.3M.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | UNI | 990,000 | 1,300,000 | 100,000 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0