Summary

A proposal to:

- Increase WBTC’s supply and borrow caps on Venus’s ZkSync deployment.

- Increase USDC’s supply cap on Venus’s ZkSync deployment.

- Increase ZK’s supply cap on Venus’s ZkSync deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

WBTC (ZkSync)

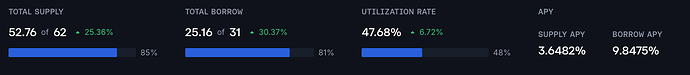

WBTC has reached 85% supply cap utilization and its borrow cap is 81% utilized.

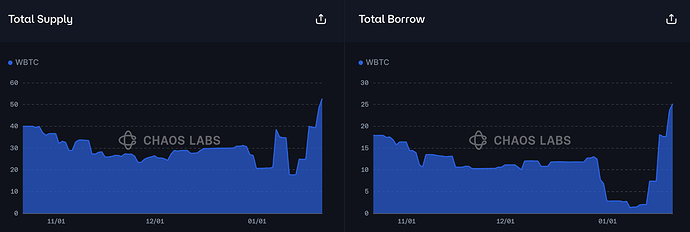

Supply Distribution

The top WBTC supplier accounts for 21.6% of the total supply, creating some concentration risk. This user is collateralizing and borrowing the same assets, thus it does not pose a significant liquidation risk at this time.

Other top suppliers are primarily either supplying and borrowing the same asset or maintain a high health score, reducing the risk of liquidation.

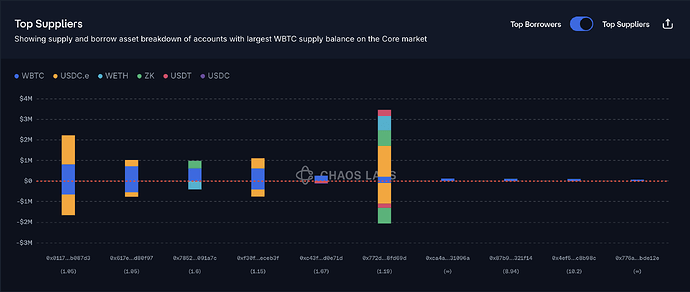

The largest borrowed asset against WBTC is WBTC, followed by WETH and USDC.e.

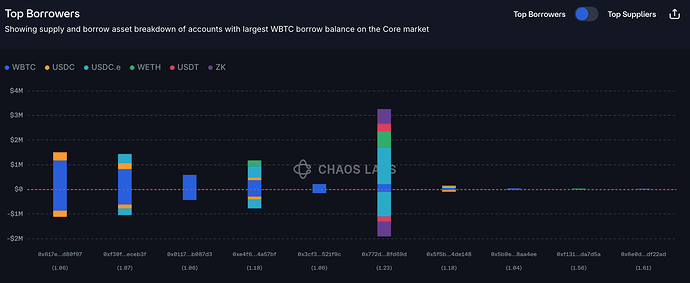

Borrow Distribution

Borrowing of WBTC is almost entirely done by users looping the asset with itself, significantly reducing liquidation risk.

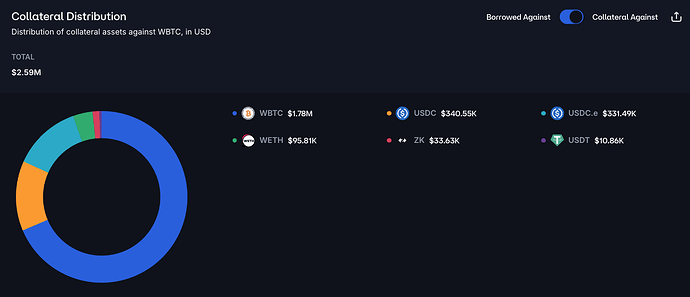

The largest collateral asset against WBTC is WBTC itself, accounting for 68% of the total distribution.

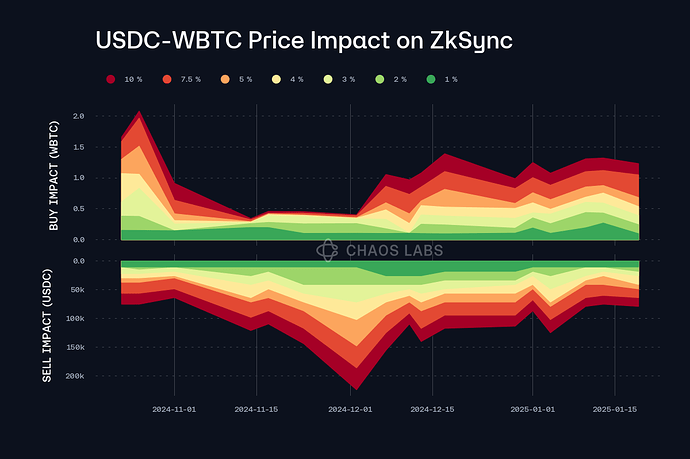

Liquidity

WBTC’s liquidity on ZkSync is low compared to its market size. However, based on our observations of the current top suppliers and borrowers, this does not currently pose a risk to the protocol.

Recommendation

Given the user-behavior and on-chain liquidity, particularly low on-chain supply, we recommend increasing the supply cap to 70 WBTC and the borrow cap to 35 WBTC.

USDC (ZkSync)

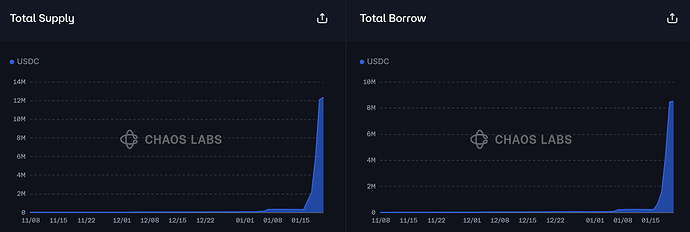

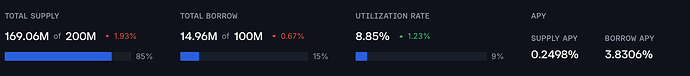

USDC’s supply cap has reached 100% utilization, while it borrow cap utilization stands at 63%.

Supply Distribution

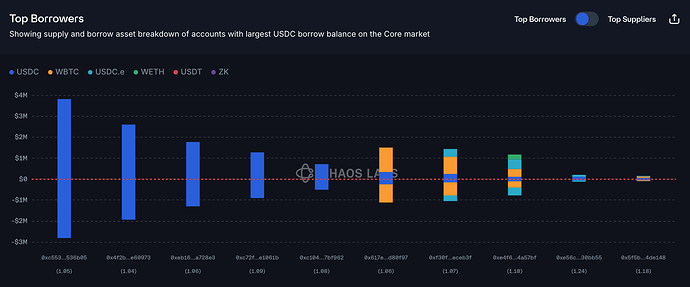

The supply distribution of USDC presents limited liquidation risks. Among the top ten suppliers, three are not borrowing. The other seven positions are looping assets, reducing liquidation risks.

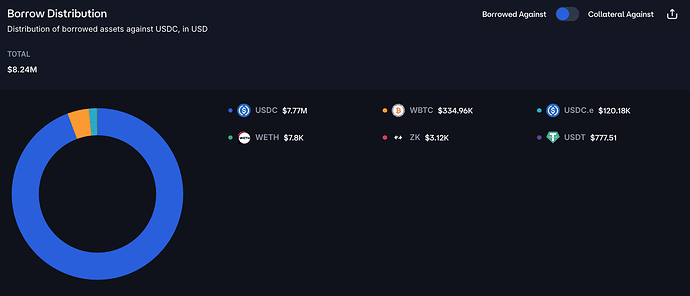

The largest borrowed asset against USDC is USDC itself, accounting for 93.45% of the borrowed asset distribution, which significantly reduces liquidation risks.

Borrow Distribution

As a result of heavy looping, the most common collateral asset against USDC is USDC.

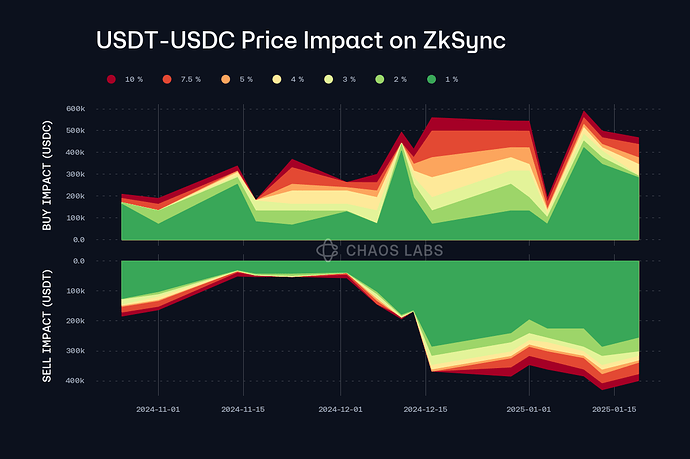

Liquidity

USDC’s liquidity has been increasing over the past two weeks, with a 300K USDC sell currently incurring less than 2% slippage.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 30M and the borrow cap to 27M.

ZK (ZkSync)

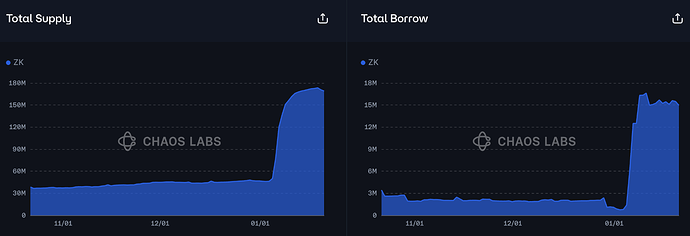

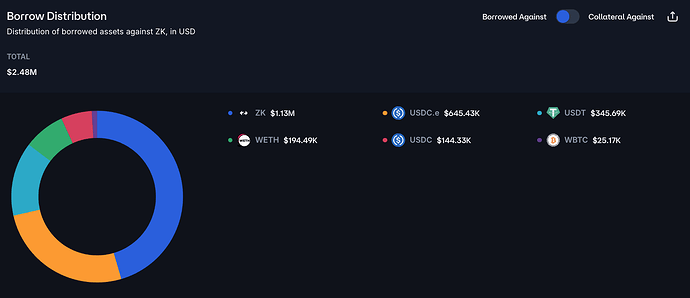

ZK has reached 85% supply cap utilization and 15% borrow cap utilization.

Supply Distribution

Supply is well distributed, with no user accounting for more than 5% of the total supply.

Non-looping borrows are somewhat limited, reducing the risk of liquidations in this market.

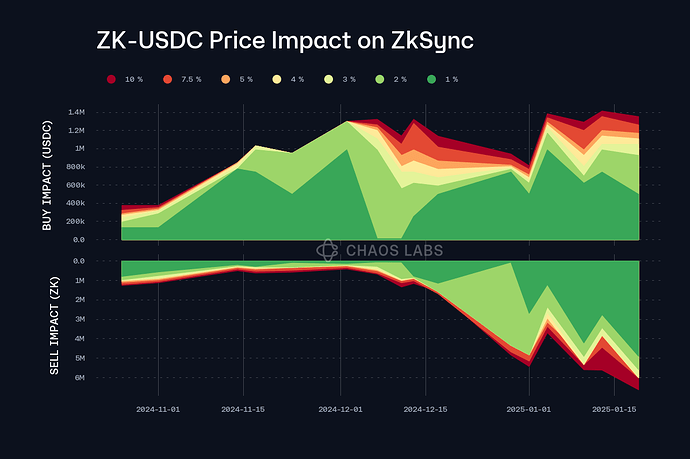

Liquidity

ZK’s liquidity has improved significantly during the ZK Ignite incentive program.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 300M.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| ZkSync | WBTC | 62 | 70 | 31 | 35 |

| ZkSync | USDC | 15,000,000 | 30,000,000 | 13,500,000 | 27,000,000 |

| ZkSync | ZK | 200,000,000 | 300,000,000 | 100,000,000 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0