Summary

A proposal to:

- Increase XRP’s borrow cap on Venus’s BNB Core deployment.

- Increase UNI’s supply cap on Venus’s BNB Core deployment.

- Increase collateral parameters for USDC.e and USDC on Venus’s ZkSync deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

XRP (BNB Core)

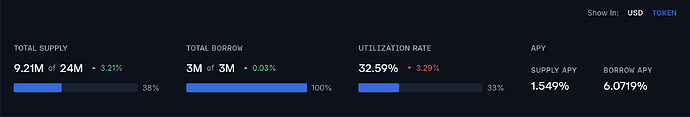

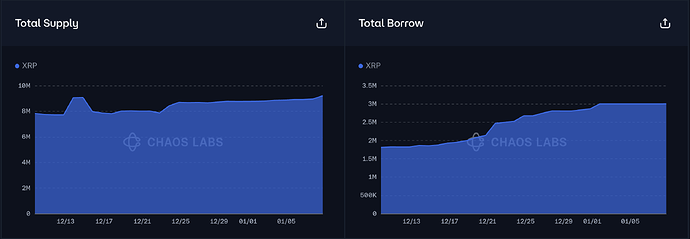

XRP has reached 38% supply cap utilization while its borrow cap is fully utilized.

Supply Distribution

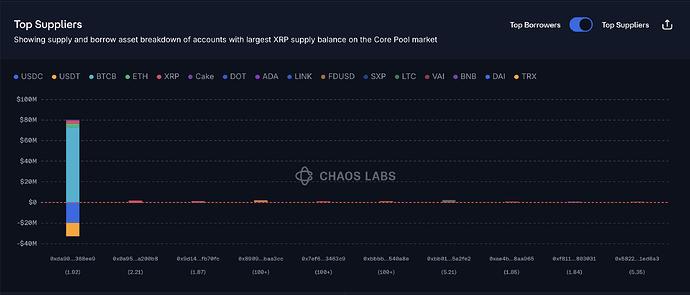

The top supplier of XRP currently accounts for 13.7% of the total distribution, presenting minor concentration risk at the moment.

This top supplier has collateralized multiple assets, including XRP, to borrow stablecoins. While this could pose some risk due to the lack of correlation between the collateral and borrowed assets, the supplier is maintaining a high health score and actively managing their position. Therefore, this does not currently present significant risk.

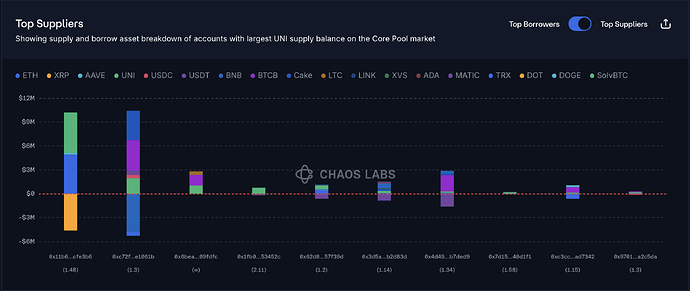

Borrow Distribution

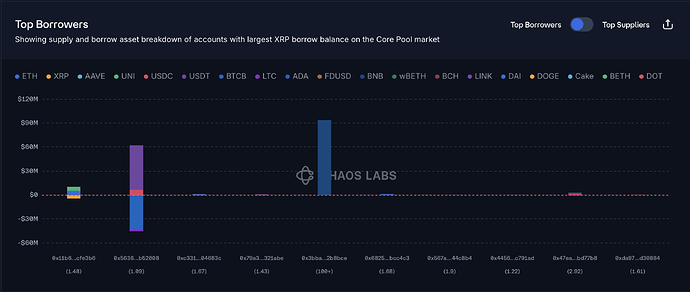

The top borrower of XRP has collateralized UNI, ETH, and AAVX. While this could pose some risk due to the lack of correlation between the collateral and the borrowed asset, the borrower currently maintains a healthy health score of 1.48 and is actively adjusting their position, thereby reducing the liquidation risk.

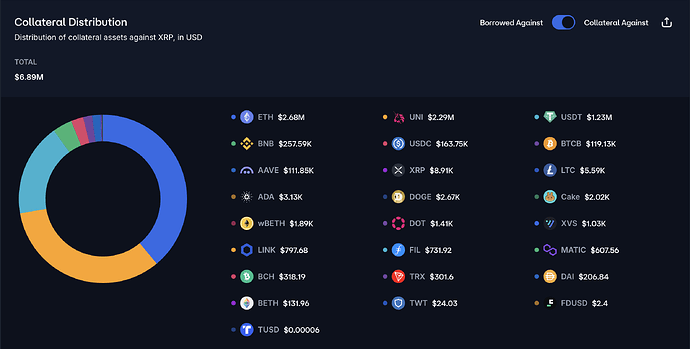

Currently, the largest collateral assets against XRP are ETH, UNI, and USDT, representing 38.96%, 33.28%, and 17.86% of the total collateral, respectively.

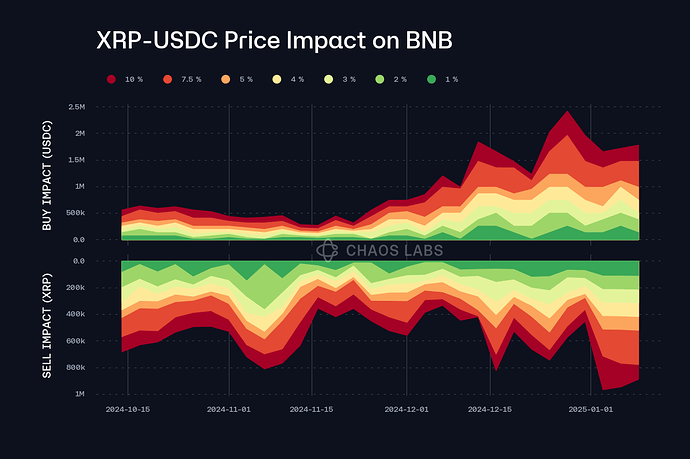

Liquidity

The liquidity of XRP on BNB has recently increased, with a 400K XRP sell resulting in less than 4% price slippage.

Recommendation

Given the user behavior and on-chain liquidity, we recommend double the borrow cap to 6M XRP.

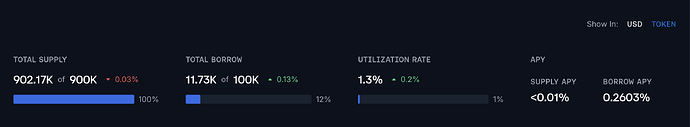

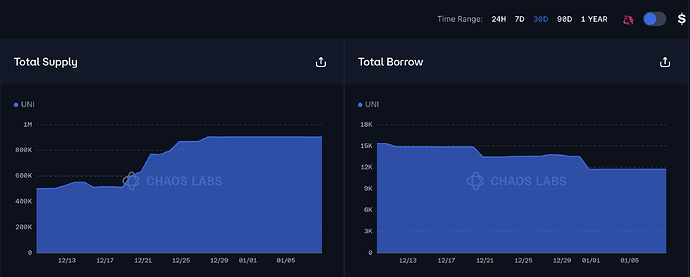

UNI (BNB Core)

The supply utilization of UNI has reached 100%, while its borrow cap utilization remains at 12%.

Supply Distribution

The top UNI supplier is the same position we analyzed in the XRP borrow case. Therefore, again, we do not believe it poses significant risk at the moment.

The remaining top UNI suppliers currently maintain healthy health scores and are actively adjusting their positions, reducing liquidation risks.

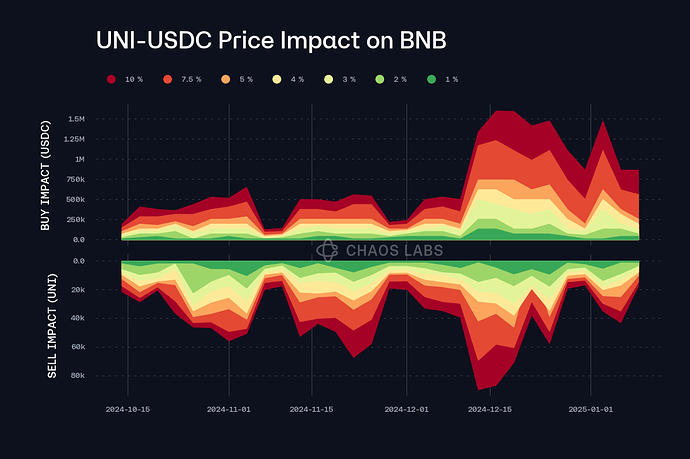

Liquidity

The liquidity of UNI has shown some fluctuations but no consistent downward trend. Although the liquidity is limited compared to the total supply, we believe that, given the behavior of the top supplier, this does not present a significant concern at the moment.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing the supply cap to 990K UNI.

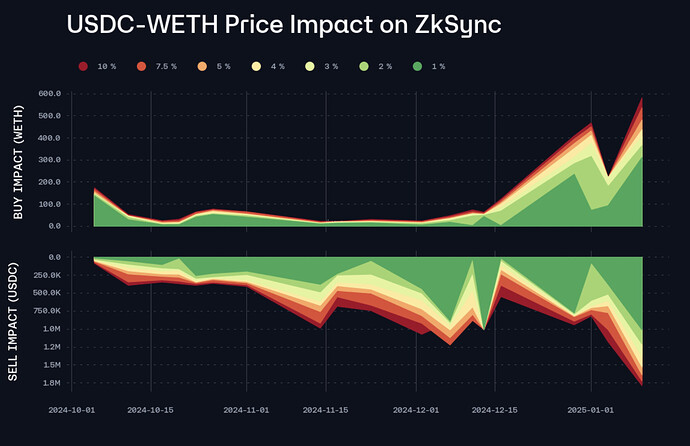

USDC.e/USDC (ZkSync)

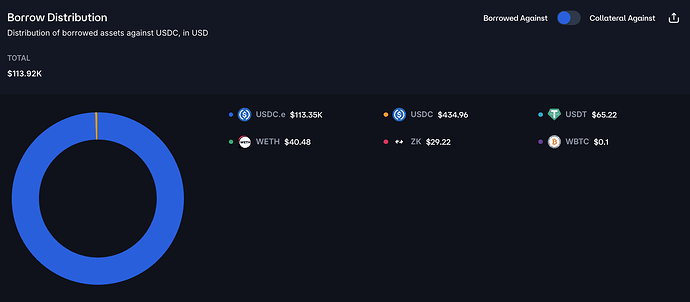

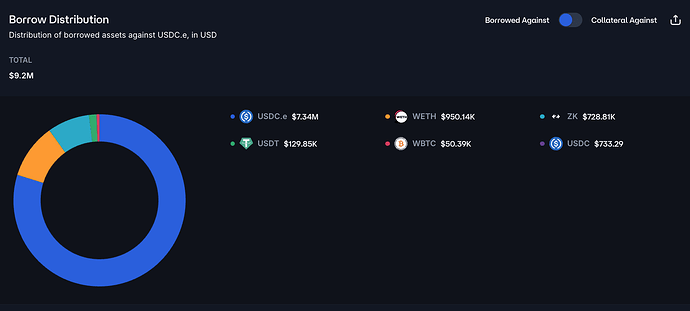

The borrow distributions against USDC and USDC.e do not indicate a high level of risk being taken by the suppliers, with looping behavior dominating both markets.

USDC

USDC.e

Additionally, the liquidity of both tokens has improved significantly since our previous recommendations.

As described in our initial recommendation, we recommended conservative parameters for stablecoins on ZkSync. Following observation of their usage, as well as significantly improved liquidity, it is appropriate to increase their CFs from 72% to 75%, with a matched increase in LTs.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | XRP | 24,000,000 | - | 3,000,000 | 6,000,000 |

| BNB Core | UNI | 900,000 | 990,000 | 100,000 | - |

| Market | Asset | Current Collateral Factor | Recommended Collateral Factor | Current Liquidation Threshold | Recommended Liquidation Threshold |

|---|---|---|---|---|---|

| ZkSync | USDC | 72% | 75% | 75% | 78% |

| ZkSync | USDC.e | 72% | 75% | 75% | 78% |