Summary

Chaos Labs recommends increasing WETH’s collateral factor to 90%, adjusting incentives, and adjusting the multiplier in the Venus Liquid Staked ETH Pool.

Motivation

Following the recent Venus Liquid staked ETH Pool update, which set the WETH Collateral Factor to 0% to prevent new WETH-WETH looping, some users needed additional funds to close their previously looped positions, as they were not able to take any action that increased their leverage. Because these users may not be technically equipped to use flash loans to close their positions, finding a solution that allows them to repay borrowed WETH is critical.

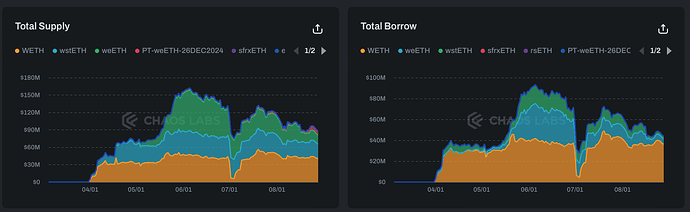

The aforementioned pool has seen limited growth in the last three months. In a previous parameter update, we recommended setting the CF of WETH to 0% — alongside other changes — to optimize the pool.

WETH’s borrow rate is the most critical metric to grow this pool; keeping it below the ETH staking yield rate makes leveraged yield farming strategies profitable. Currently, there is a significant amount of WETH borrow liquidity being utilized by WETH suppliers — looping the asset with itself.

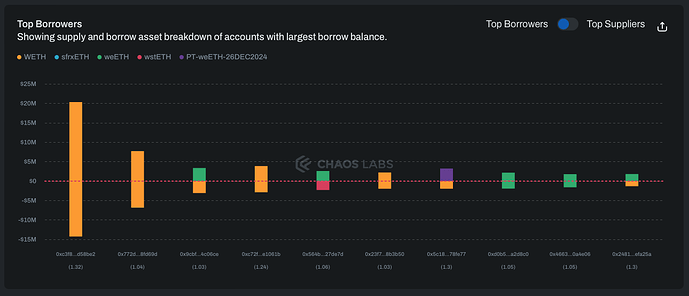

The following users are utilizing the looping strategy:

| User address | Collateral | Borrow | Health Score | Borrowable WETH at 90% | CF required to reduce the position |

|---|---|---|---|---|---|

| Chaos Labs | 21.18M | 14.86M | 1.32 | 19.062 | 70% |

| Chaos Labs | 4.02M | 3M | 1.24 | 3.618 | 74% |

| Chaos Labs | 2.3M | 2.06M | 1.03 | 2.07 | 89.5% |

| Chaos Labs | 1.38M | 934.52K | 1.3 | 1.242 | 67.7% |

| Chaos Labs | 1.01M | 875.11K | 1.07 | 0.909 | 86.6% |

| Chaos Labs | 1.06M | 847.88K | 1.16 | 0.954 | 80% |

We note that the previous recommendation has already improved the pool, with four of the largest users using the pool for leveraged yield farming rather than WETH-WETH looping.

To allow WETH-WETH loopers an opportunity to repay their positions, we propose a multi-tranche reduction of CF following a temporary increase to its previous level of 90%. We plan to implement a new tranche every two weeks, though this is subject to market conditions and progress in the pool.

This will be paired with an adjustment of incentives and WETH’s multiplier. We recommend diverting WETH borrow incentives and instead allocating them to WETH supply and wstETH supply; the former will ensure supplying is lucrative while the latter should help grow wstETH supply on Venus, which has lagged relative to its market cap. This, coupled with the multiplier reduction — targeting 2.7% at the Kink — should ensure that leveraged farming strategies are profitable, as is supplying WETH without looping the asset with itself.

Incentives

The Liquid Staked ETH pool incentives received an adjustment through Venus Governance’s recently passed proposal VIP-367.

The changes are the following:

- WETH. From 16,500 XVS/month to 12,375 XVS/month (-25%)

- wstETH. From 1,800 XVS/month to 0 XVS/month (-100%)

- sfrxETH. From 400 XVS/month to 0 XVS/month (-100%)

To adjust for these changes in the original rewards, we propose a new incentive distribution based on the previously stated objective to reduce the WETH-WETH looping APY while sustaining an attractive APY for LST-WETH looping.

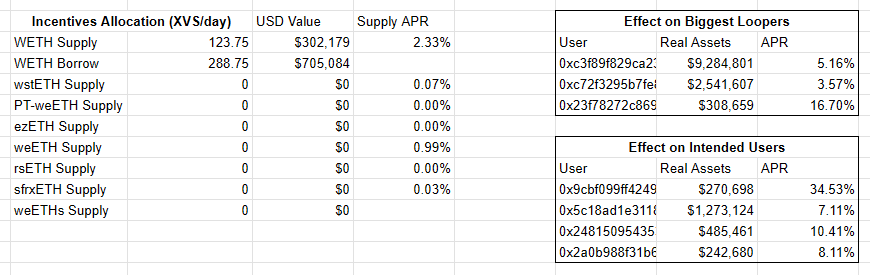

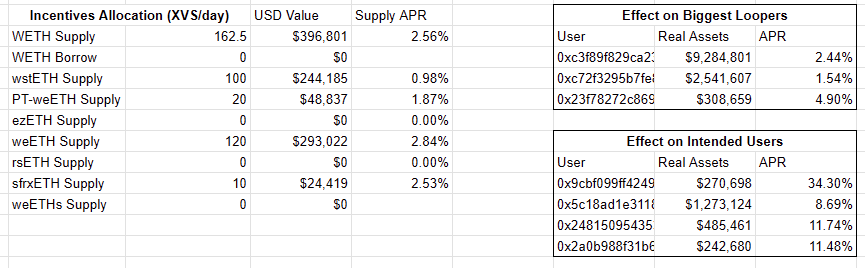

To achieve the objective, we track the top WETH-WETH and LST-WETH loopers to simulate their effective APY after the incentives change.

Our simulation shows that the top 3 WETH-WETH Loopers would still enjoy an above-market average APR after implementing the Market Emission Adjustment.

Left: List of pools, their corresponding XVS incentives, USD value of the incentives and resulting supply APY

Right: List of WETH-WETH Loopers (above) and LST-WETH Loopers (below), their net deposit value and their effective APR

Through the new incentive structure proposed, the WETH-WETH loopers would enjoy a below-market rate but still positive APR, which allows them to gradually exit their positions without causing a severe impact on the market.

By shifting the incentives allocation from WETH Borrow to LST supply, we can maintain an attractive APR for the major LST-WETH loopers.

Recommendation

WETH - Ethereum Liquid Staked Pool

| Current Value | 1st Tranche | 2nd Tranche | 3rd Tranche | Final Tranche | |

|---|---|---|---|---|---|

| Collateral Factor | 0% | 90% | 75% | 50% | 0.0% |

| Multiplier | 4.5% | 3.0% | 3.0% | 3.0% | 3.0% |

| Current Value (XVS/day) | Recommended Value (XVS/day) | |

|---|---|---|

| WETH Supply | 123.75 | 162.5 |

| WETH Borrow | 288.75 | 0 |

| wstETH Supply | 0 | 100 |

| PT-weETH Supply | 0 | 20 |

| ezETH Supply | 0 | 0 |

| weETH Supply | 0 | 120 |

| rsETH Supply | 0 | 0 |

| sfrxETH Supply | 0 | 10 |

| weETHs | 0 | 0 |