Summary

-

BUSD:

Proposal to gradually deprecate the BUSD market on Venus core pool. As an initial step in the BUSD deprecation plan, we recommend:

- Freezing new supply and borrow by reducing supply and borrow caps to 0.

- Increasing BUSD Reserve Factor to 100%

-

TUSDOLD:

- Reduce jump multiplier from 2.5 to 0.5

-

ankrBNB (Defi Pool)

- Increase supply cap by 2X to 10,000

Analysis

BUSD

Given the ongoing deprecation of BUSD by Paxos leading to increasing risk due to reduced liquidity, we recommend gradually winding down the BUSD market on Venus.

Resources:

- Paxos Will Halt Minting New BUSD Tokens

- Paxos will continue supporting BUSD until at least February 2024

- Binance started delisting BUSD pairs:

- Coinbase has already stopped BUSD trading:

This proposal aims to initiate the deprecation of BUSD from the Venus market. If the community decides to deprecate BUSD, Chaos Labs proposes a phased plan comprising the following actions:

- Limit exposure to BUSD on Venus

- Freeze new supply and borrow

- Gradually reduce Collateral Factors - As CF reductions may lead to user accounts being eligible for liquidations upon their approval, we want to clarify the full implications to the community at each step. To best minimize this impact, we suggest reaching the desired settings by a series of incremental decreases.

- Encourage repayment of BUSD loans by amending IR curves

- Encourage redemption of BUSD supply by reducing supply interest - increasing Reserve Factors

Following each update, we will continue to monitor the market and the impact of the parameter updates on usage. Based on the observed effects and future market conditions, we will continue to supply recommendations as necessary.

Liquidity

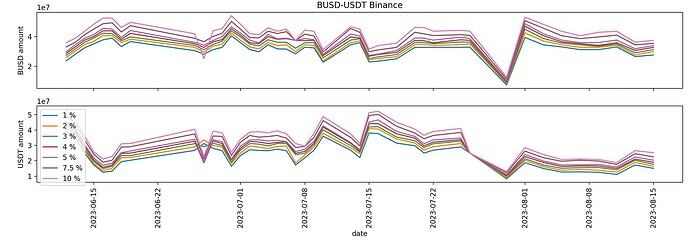

Most of BUSD volume is in off-chain venues, mainly on Binance.

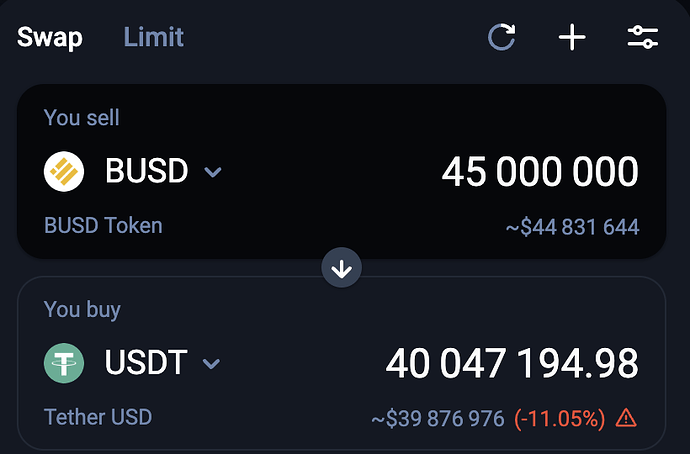

In the past three months, we didn’t observe any significant decrease or increase in BUSD liquidity on DEXes on the BNB chain. there’s currently ~$45M BUSD to USDT liquidity under the LB price impact:

We believe it’s beneficial for Venus to off-board the asset while the liquidity is stable.

Recommendations:

As a first step, we recommend freezing borrows/supplies, as well as increasing RF to 100% to disincentivize any further borrowing and supplying of BUSD on Venus.

| Asset | Supply Cap | Borrow Cap | Reserve Factor |

|---|---|---|---|

| BUSD | 0 | 0 | 100% |

TUSDOLD

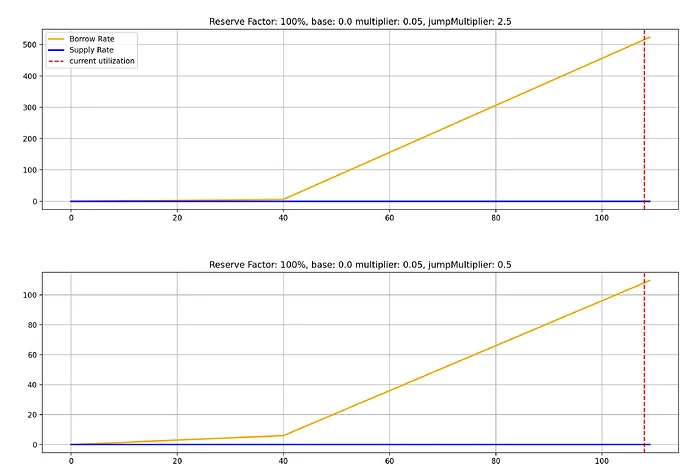

Following recent updates to TUSDOLD IR curves as part of the deprecation plan, current borrow utilization is set at 108% with borrow APY at ~463%. As borrowers are currently inelastic to this update, we recommend reducing the borrowing rate, by decreading the jump multiplier by 5X to minimize the additional debt incurred to underwater accounts that have TUSD borrow positions (for example, wallet 1, wallet 2, wallet 3). This update will bring the borrow APY down to 106%.

We will continue monitoring TUSDOLD positions to analyze the impact of these updates.

ankrBNB (Defi Pool)

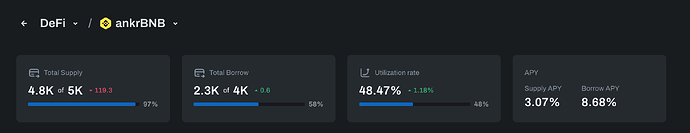

At the time of publishing this post, the ankrBNB supply cap has reached over 97% utilization

Utilizing our supply and borrow cap methodology, we recommend increasing the supply cap to 10,000.

We are actively monitoring the supply and borrow caps as well as the borrow usage and on-chain liquidity, and any significant changes in this aspect are promptly communicated to the community through the Alerts section on the Chaos Labs’ Risk Hub as well as through the dedicated Chaos Labs <> Venus Alerts Telegram channel.