Summary

Using historical observations and our methodologies, Chaos Labs recommends parameter changes for WETH in the Liquid Staked ETH pool.

Motivation

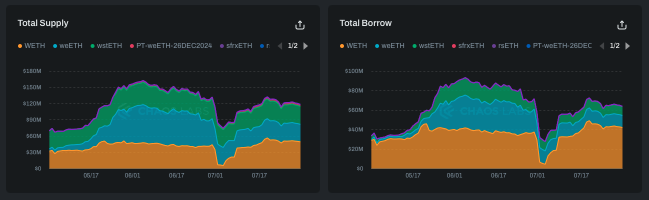

Growth in the aforementioned pool has been relatively limited over the past two months. In order to better optimize this pool, we recommend new parameters for WETH that may stimulate increased leverage yield strategies.

Collateral Factor

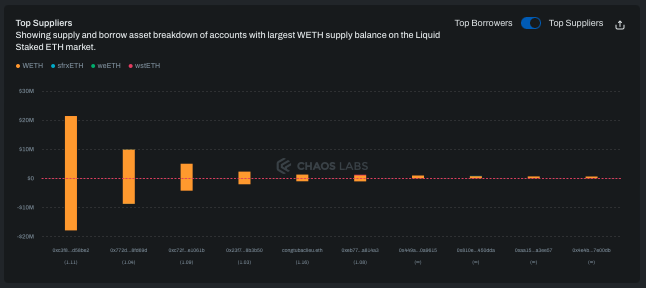

- We recommend lowering WETH’s Collateral Factor to 0% to prevent further looping of WETH with itself. This activity increases borrowing rates for WETH, reducing the profitability for users seeking to deposit ETH derivatives and borrow WETH.

- There is extremely limited demand to borrow any of the other borrowable assets in the pool, ensuring that reducing the CF will not adversely impact users.

IR Curve

- Given WETH’s on-chain liquidity, it is prudent to increase its Kink to 90%, allowing for greater capital efficiency in the pool.

- We recommend increasing the Multiplier given the consistent over utilization in the market, while also ensuring that, at the Kink, leveraged yield strategies are profitable (when factoring in incentives), given ETH’s staking yield of roughly 3.2%.

- Should we see limited borrowing against other collateral following this change, we may recommend decreasing the Multiplier.

- Finally, given the ongoing incentives in this market and current user behavior, we recommend increasing the Reserve Factor to discourage WETH-WETH looping while ensuring that supplying WETH is still appealing.

Recommendations

WETH — Ethereum Liquid Staked ETH Pool

| Asset | Current Value | Recommended Value |

|---|---|---|

| Collateral Factor | 90% | 0% |

| Liquidation Threshold | 93% | 93% |

| Kink | 80% | 90% |

| Base | 0% | 0% |

| Multiplier | 3.5% | 4.5% |

| Jump Multiplier | 80% | 80% |

| Reserve Factor | 15% | 25% |