Summary

A proposal to adjust the liquidation threshold and collateral factor for wstETH and weETH in Venus’s Staked ETH pool.

Motivation

wstETH and weETH have demonstrated strong peg stability, allowing Venus to increase their bowering power — allowing for more looping — without significant additional risks.

Volatility

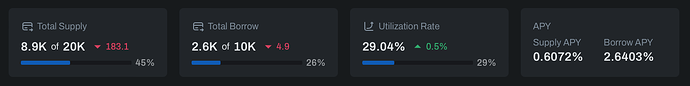

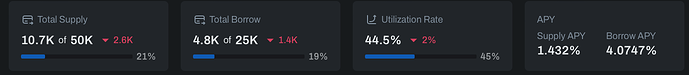

We find that both wstETH and weETH have demonstrated low volatility relative to WETH, allowing for increases in their borrowing power. Additionally, both assets have relatively low cap utilization, suggesting that the protocol can better optimize to encourage deposits and looping.

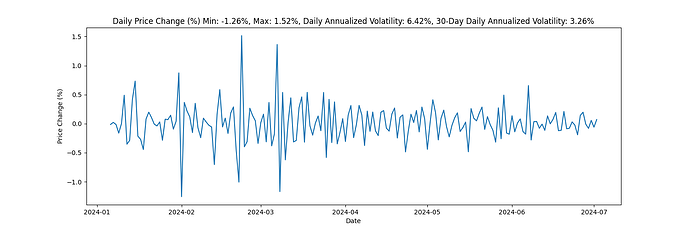

wstETH

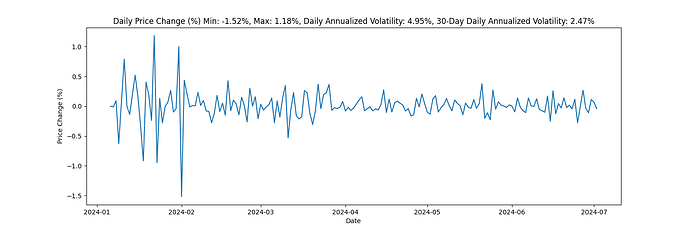

weETH

wstETH has demonstrated strong peg stability, with a 30-day daily annualized volatility of just 3.26% relative to ETH.

weETH’s peg volatility has reduced significantly since March of this year, with 30-day daily annualized volatility of 2.47%, compared to 4.95% over the last 180 days.

Specification:

| Asset | Chain | Pool | Current Collateral Factor | Rec. Collateral Factor | Current Liquidation Threshold | Rec. Liquidation Threshold |

|---|---|---|---|---|---|---|

| wstETH | Ethereum | Staked ETH | 90% | 93% | 93% | 95% |

| weETH | Ethereum | Staked ETH | 90% | 93% | 93% | 95% |