Summary

A proposal to:

- Increase asBNB supply on Venus’s BNB Core deployment.

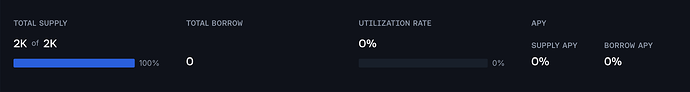

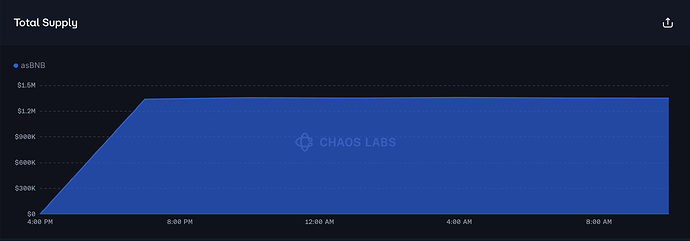

asBNB (BNB Core Pool)

asBNB’s supply cap utilization has reached 100% shortly after its Venus listing.

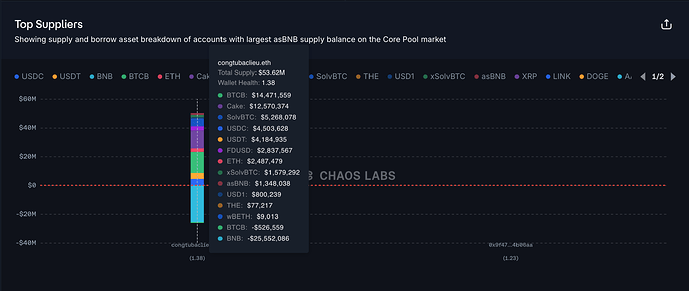

Supply Distribution

The supply of asBNB is highly concentrated, with the top supplier representing ~99% of the total. The user is performing a leveraged staking strategy and does not pose a significant liquidation risk thanks to its varied collateral and active management.

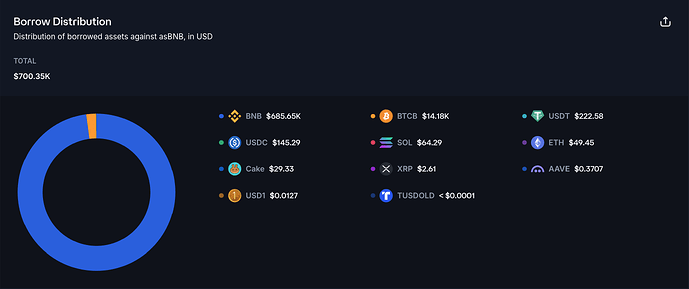

Debt backed by asBNB collateral is dominated by BNB (97 %), with BTCB (≈ 2 %) a distant second. Due to the main borrowed asset sharing the same underlying token as the collateral, liquidation risk is relatively small.

Liquidity

On‑chain liquidity for asBNB itself is shallow - swapping 50 asBNB incurs >10 % slippage. However, as mentioned in the initial listing recommendation, asBNB can be redeemed atomically for slisBNB, which benefits from deeper on‑chain markets. A swap of 5,500 slisBNB to BNB currently results in less than 5 % slippage, giving liquidators an efficient path to unwind larger positions and helping to limit bad‑debt risk.

Recommendation

Given the full utilization, correlation of debt and collateral, and supplier concentration, we recommend increasing the supply cap by 4,000 asBNB.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | asBNB | 2,000 | 6,000 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.