Summary

A proposal to:

- Increase xSolvBTC’s supply cap on Venus’s BNB Core deployment.

xSolvBTC (BNB Core Pool)

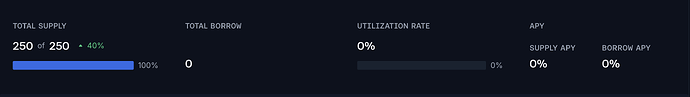

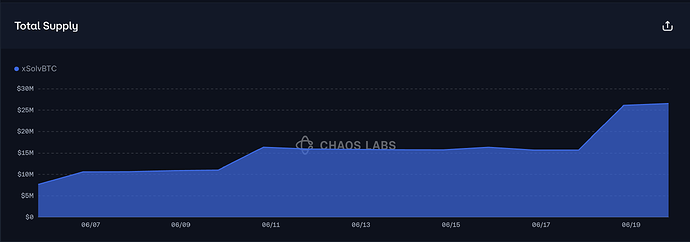

xSolvBTC’s supply cap utilization has reached 100%. This has been reached shortly after the previous parameter update.

### Supply Distribution

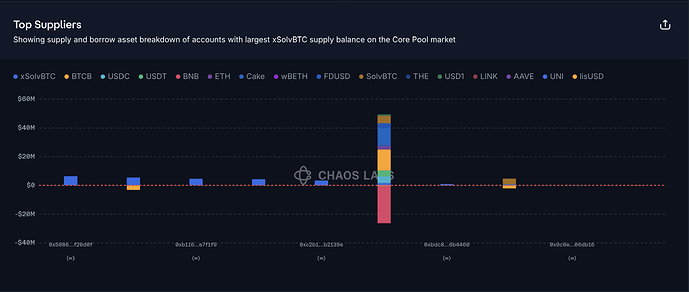

Supply is moderately concentrated: the largest supplier holds ~23 % of all xSolvBTC. Only three out of the top seven suppliers borrow against their positions, however these positions borrow and collateral assets are highly correlated, hence keeping liquidation risk low.

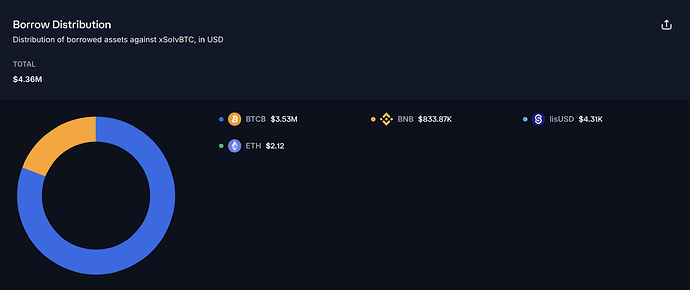

BTCB represents > 81 % of the assets borrowed against xSolvBTC. Because the collateral and borrowed asset share the same underlying, protocol risk is minimized.

Liquidity

On-chain liquidity remains stable; selling 55 xSolvBTC would incur roughly 5% slippage.

Recommendation

Given the safe user behavior and on-chain liquidity, we recommend increasing xSolvBTC’s supply cap by from 250 to 500 xSolvBTC.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | xSolvBTC | 250 | 500 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.