Summary

A proposal to:

- Increase sFRAX’s (Ethereum Core) borrow cap.

- Increase USDT’s (BNB GameFi) supply cap.

Analysis

The recommendations below utilize Chaos Labs’ supply and borrow cap methodologies following an analysis of user positions and market conditions.

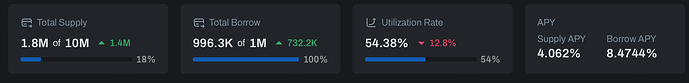

sFRAX (Ethereum Core)

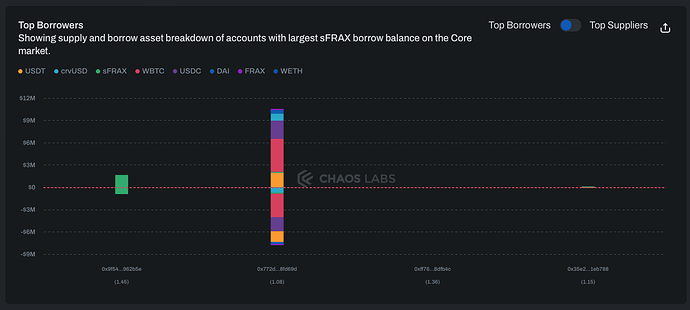

sFRAX has nearly reached its borrow cap despite relatively low supply cap utilization; one user is responsible for over 80% of the total borrows.

This user is looping sFRAX with itself, putting the position at low risk of liquidation. Given the relatively limited risk in this market, we recommend doubling the borrow cap while keeping the supply cap at its current level.

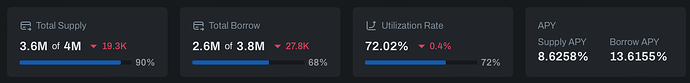

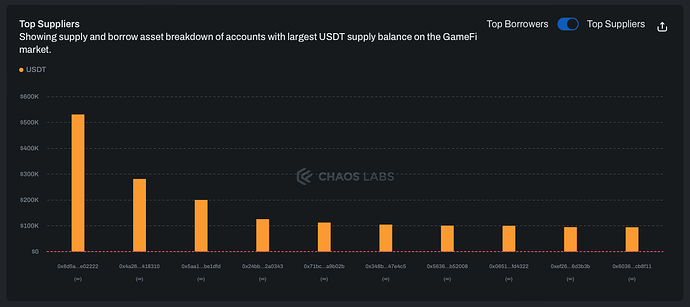

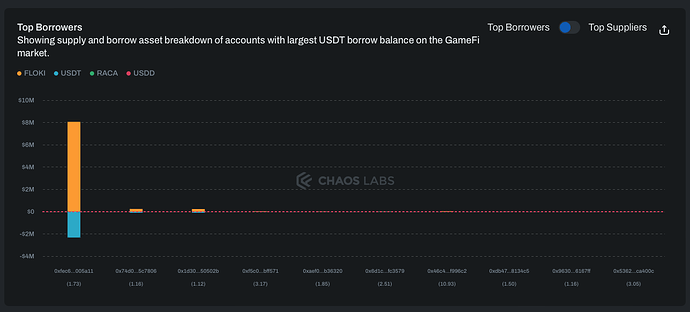

USDT (BNB GameFi)

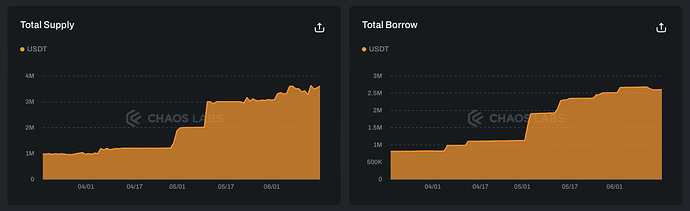

USDT has reached 90% supply cap utilization in the GameFi pool on BNB Chain.

Supply is well distributed, with none of the top 10 suppliers borrowing against their positions.

However, 2.3M of the 2.6M USDT borrowed is being borrowed by a single user against $8M FLOKI. They currently maintain a health score of 1.73, thus not posing an imminent threat of liquidation. The user is has been relativel active, with six Venus-related transactions in May and one so far in June.

Given the on-chain liquidity and user distribution, we recommend increasing the supply cap by 1M while leaving the borrow cap at its current level.

Specification

| Pool | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | sFRAX | 10,000,000 | No Change | 1,000,000 | 2,000,000 |

| BNB GameFi | USDT | 4,000,000 | 5,000,000 | 3,800,000 | No Change |