Summary

- Increase weETH’s (Ethereum Liquid Staked ETH) supply and borrow caps

- Increase wstETH’s (Ethereum Liquid Staked ETH) borrow cap

Motivation

weETH (Liquid Staked ETH)

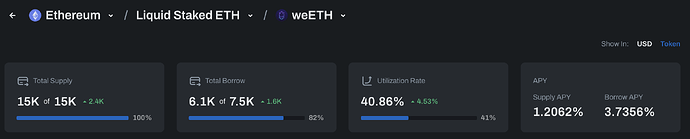

weETH’s supply cap and borrow cap utilization are at 100% and 82%, respectively, following new borrows over the past few days.

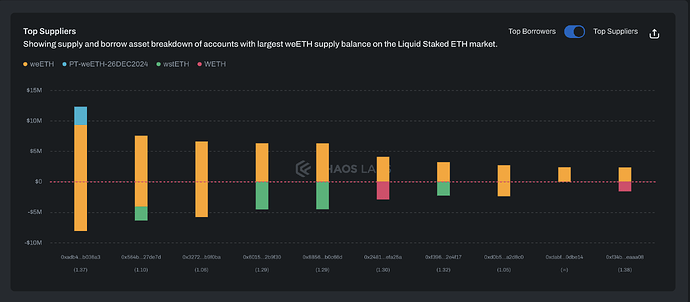

Supply is well distributed amongst wallets, with all top suppliers borrowing ETH-correlated assets against their weETH collateral; those with the lowest health scores are borrowing weETH against itself. This behavior puts the market at lower risk for large-scale liquidations.

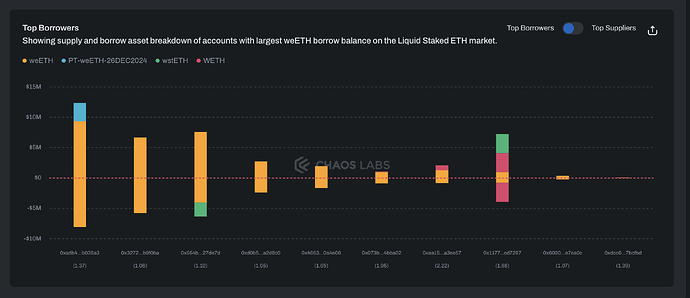

Similar to supply, the three top borrowers are all borrowing weETH against itself, putting these positions at low risk of liquidation.

Given the high demand for weETH supply and borrowing, and considering the current use case primarily for looping ETH-correlated assets against weETH collateral, we recommend increasing the supply and borrow cap to 50k and 25k weETH, respectively

wstETH (Liquid Staked ETH)

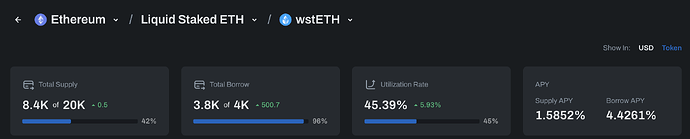

Following a rapid increase in borrowing, wstETH has reached 96% of its borrow cap while its supply cap is at 42% utilization.

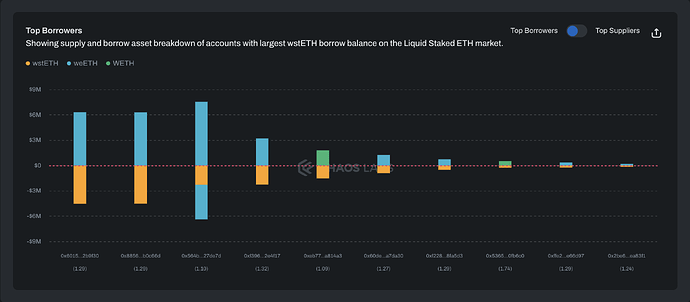

The increase in borrowing has come as a result of looping strategies using weETH as collateral and wstETH as debt. The correlation of these assets puts the positions at low risk of liquidation.

The top 2 borrowers are responsible for over 51% of the total wstETH borrowed; supply is more concentrated, with the largest user responsible for 75% of deposits; they are not borrowing against their wstETH.

Given on-chain liquidity and user distribution, we recommend increasing the borrow cap to 50% of the supply cap of wstETH.

Specification

Cap Increases:

| Pool | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Liquid Staked ETH | weETH | 15,000 | 50,000 | 7,500 | 25,000 |

| Liquid Staked ETH | wstETH | 20,000 | No Change | 4,000 | 10,000 |