Summary

A proposal to:

- Increase SOL’s supply on Venus’s BNB Core deployment.

SOL (BNB Core Pool)

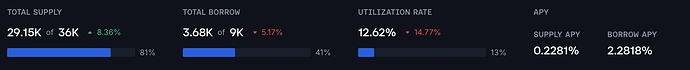

SOL’s supply cap utilization has reached 81%, while its borrow cap is just 41% utilized.

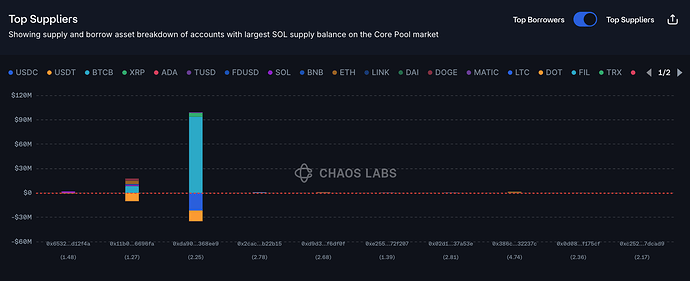

Supply Distribution

The supply of SOL is not highly concentrated, with the top supplier representing 32% of the total; the top four suppliers represent 70% of the total. The largest supplier uses a mix of SOL, ADA, and BTCB as collateral to borrow mostly USDT and FDUSD.

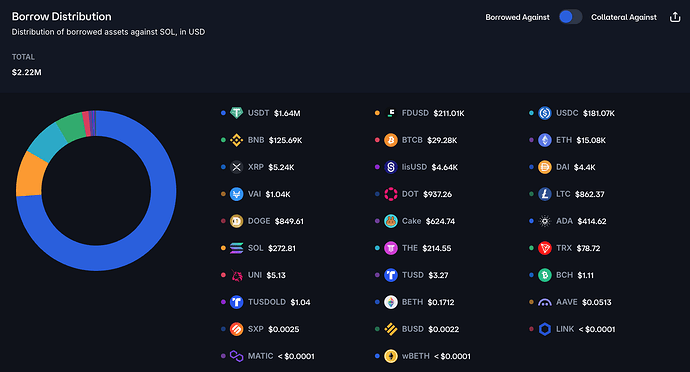

The majority of debt against SOL collateral is USDT, followed by FDUSD, USDC, and BNB. These assets are all highly liquid, reducing the risk in this market.

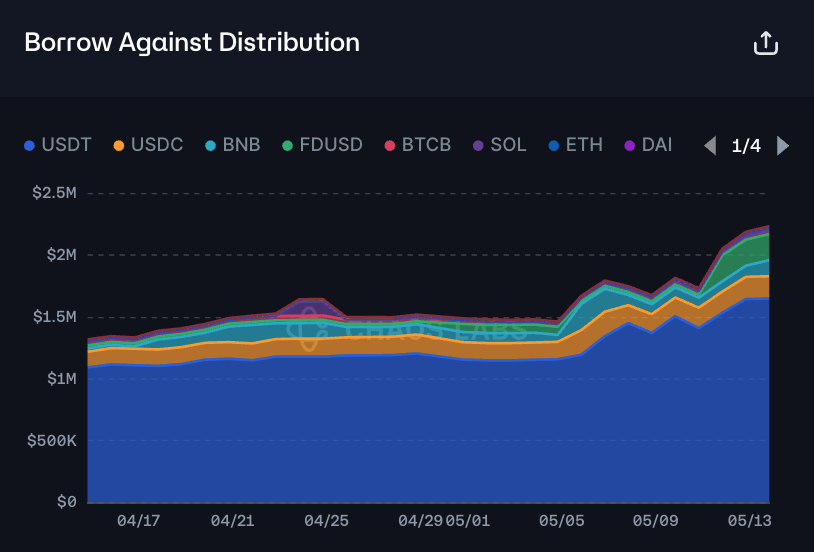

New borrowing activity against SOL has primarily come in the form of USDT and FDUSD.

Liquidity

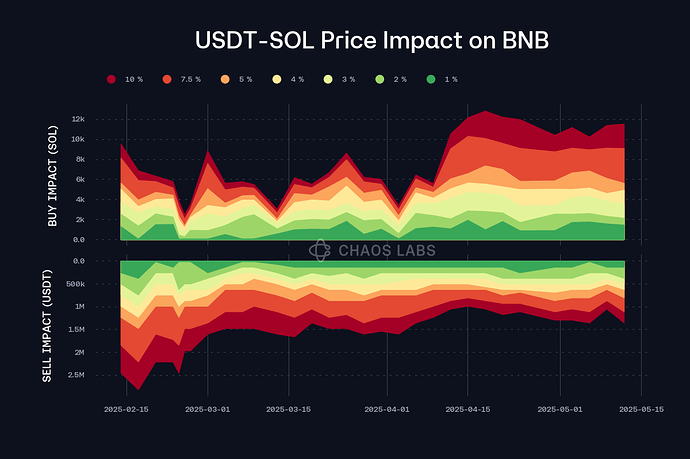

SOL’s on-chain liquidity has been relatively stable and has improved since the start of April, with a 10K SOL for USDT swap able to be completed at less than 10% price slippage.

Recommendation

Given the distribution and behavior of suppliers, as well as relatively strong on-chain liquidity, we recommend doubling the supply cap while leaving the borrow cap unchanged.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | SOL | 36,000 | 72,000 | 9,000 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.