Summary

- Increase USDT’s (BNB GameFi) supply and borrow caps

- Increase UNI’s (BNB Core) supply cap

- Increase weETH’s (Ethereum Liquid Staked ETH) supply and borrow caps

- Decrease supply and borrow caps for:

- DAI, FRAX, crvUSD (Ethereum Core)

- CRV (Ethereum Curve)

- TUSD (BNB Core)

- ankrBNB, USDD, BSW, PLANET, ANKR, TWT, ALPACA, FLOKI (BNB DeFi)

- RACA, USDD (BNB GameFi)

- USDD, lisUSD, USDT (Stablecoins)

- USDD, USDT, BTT, TRX, WIN (Tron)

Cap Increase Analysis

The following recommendations were made utilizing Chaos Labs’ supply and borrow cap methodologies after analyzing each asset’s user positions and market conditions.

USDT (GameFi)

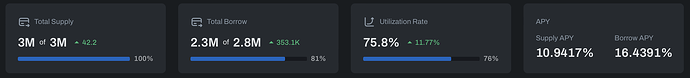

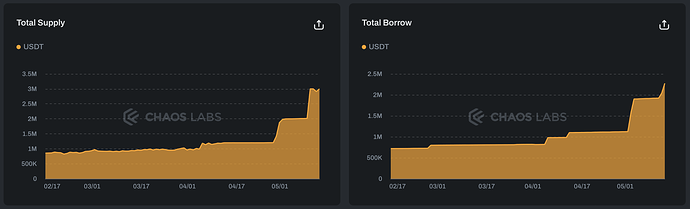

USDT’s supply and borrow cap utilization are 100% and 81%, respectively, following a surge in new deposits and borrowing.

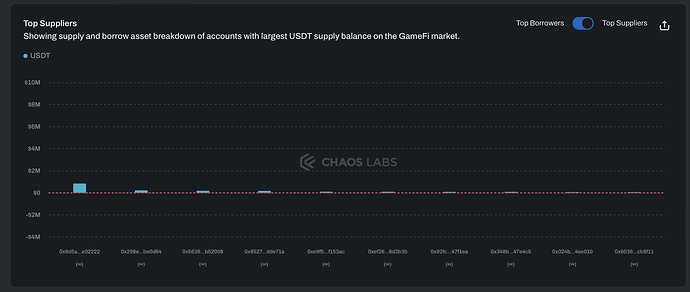

Supply is well distributed amongst wallets, with none of the top 10 suppliers borrowing against their USDT deposits.

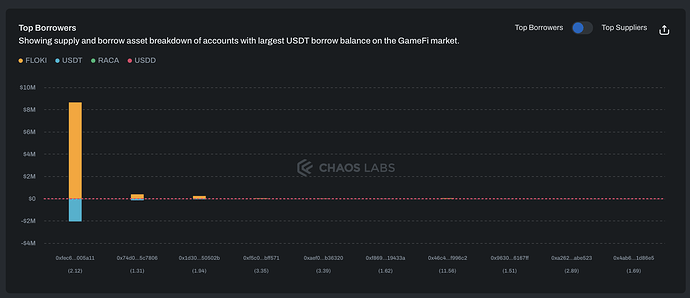

The largest borrow is $2.0M against $8.65M of FLOKI, for a health score of 2.12. This user has been actively managing their position in recent days, likely reducing the risk of liquidation.

Given the on-chain liquidity and user distribution, we recommend increasing the supply and borrow caps.

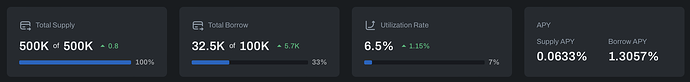

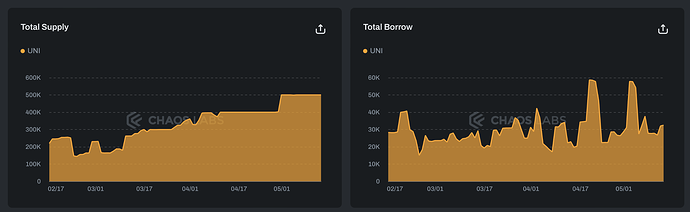

UNI (Core Pool)

UNI has reached its supply cap after new deposits, while borrow demand remains low.

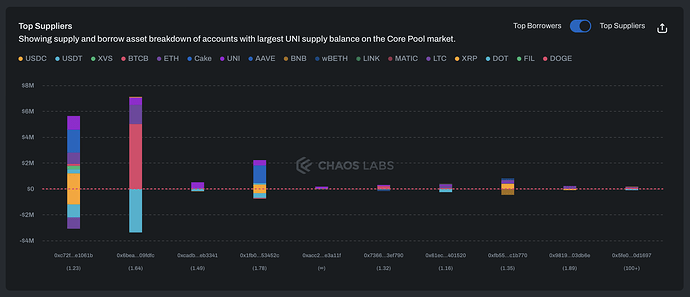

The top supplier is responsible for 30% of total supply, while the second largest is responsible for 16%. They carry health scores of 1.23 and 1.64, respectively, and both are actively managing their positions, reducing the risk of liquidation.

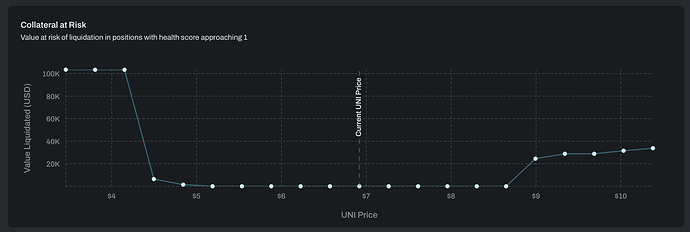

There is limited collateral at risk until UNI drops to $4.15, a 40% drop from current price levels.

Additionally, our simulations find that there is a limited increase in VAR and liquidations at risk when increasing the supply cap by 20%, thus this is our recommendation.

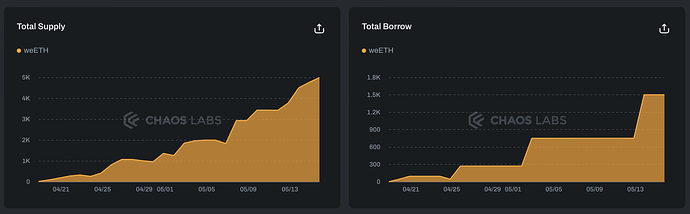

weETH (Liquid Staked ETH)

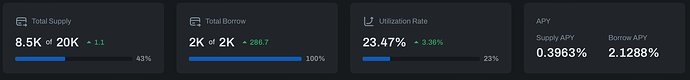

weETH’s supply cap and borrow cap utilization are at 67% and 100%, respectively, following new borrows over the past three days.

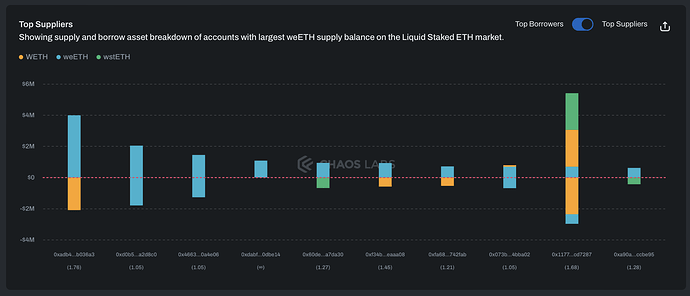

Supply is well distributed amongst wallets, with all top suppliers borrowing ETH-correlated assets against their weETH collateral; those with the lowest health scores are borrowing weETH against itself. This behavior puts the market at lower risk for large scale liquidations.

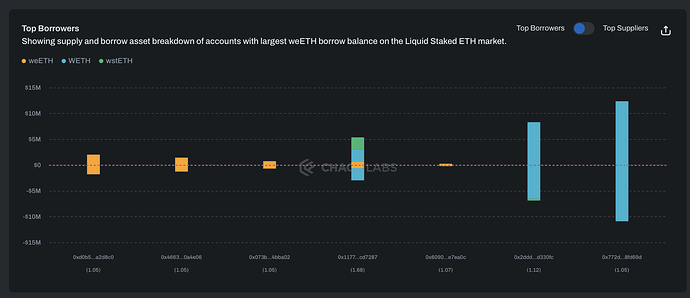

Similar to supply, the three top borrowers are all borrowing weETH against itself, putting these positions at low risk of liquidation.

We have observed higher-than-usual demand for weETH borrowing, and thus recommend increase the borrow cap more than the supply cap so that utilization is able to reach the Kink at 45%.

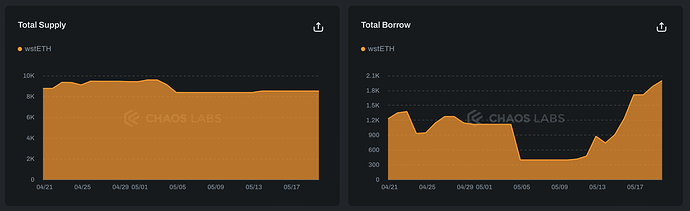

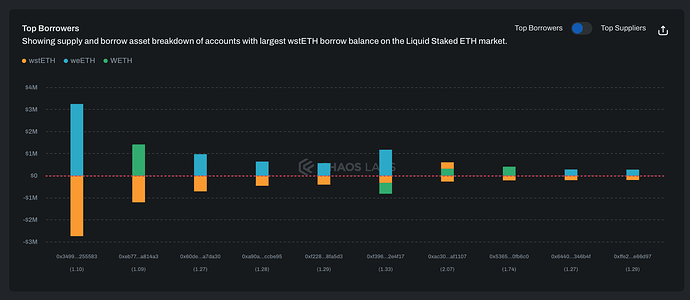

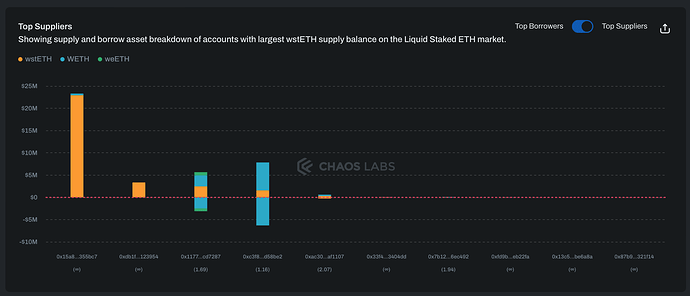

wstETH (Liquid Staked ETH)

Following a rapid increase in borrowing, wstETH has reached its borrow cap while its supply cap is at 43% utilization.

The increase in borrowing has come as a result of looping strategies using weETH as collateral and wstETH as debt. The correlation of these assets puts the positions at low risk of liquidation.

The top borrower is responsible for 38% of the total wstETH borrowed; supply is more concentrated, with the largest user responsible for 75% of deposits; they are not borrowing against their wstETH.

Given on-chain liquidity and user distribution, we recommend increasing the borrow cap to 4,000 wstETH.

Cap Decrease Analysis

We recommend reductions in the caps for various assets due to consistently low supply and borrow demand over an extended period. All assets targeted for cap reductions have demonstrated supply and borrow cap utilization below 25%. We aim to maintain tighter caps relative to current demand as a precaution against abnormal and unforeseen events. Should demand for these assets increase, we are ready to offer further recommendations based on our supply and borrow cap methodology.

Specification

Cap Increases:

| Pool | Asset | Current Supply Cap | Current Supply Utilization | Recommended Supply Cap | Current Borrow Cap | Current Borrow Utilization | Recommended Borrow Cap |

|---|---|---|---|---|---|---|---|

| GameFi | USDT | 3,000,000 | 100% | 4,000,000 | 2,800,000 | 81% | 3,800,000 |

| Core | UNI | 500,000 | 100% | 600,000 | 100,000 | 33% | No Change |

| Liquid Staked ETH | weETH | 7,500 | 67% | 15,000 | 1,500 | 100% | 7,500 |

| Liquid Staked ETH | wstETH | 20,000 | 43% | No Change | 2,000 | 100% | 4,000 |

Cap Decreases:

| Pool | Asset | Current Supply Cap | Current Supply Utilization | Recommended Supply Cap | Current Borrow Cap | Current Borrow Utilization | Recommended Borrow Cap |

|---|---|---|---|---|---|---|---|

| Ethereum Core | DAI | 50,000,000 | 0% | 5,000,000 | 45,000,000 | 0% | 4,500,000 |

| Ethereum Core | FRAX | 10,000,000 | 8% | 2,000,000 | 8,000,000 | 8% | 1,600,000 |

| Ethereum Core | crvUSD | 50,000,000 | 8% | 10,000,000 | 45,000,000 | 8% | 9,000,000 |

| Ethereum Curve | CRV | 6,000,000 | 22% | 3,000,000 | 3,000,000 | 8% | 1,500,000 |

| BNB Core | TUSD | 1,500,00 | 8% | 750,000 | 1,200,000 | 7% | 600,000 |

| BNB DeFi | ankrBNB | 10,000 | 1% | 500 | 4,000 | 1% | 250 |

| BNB DeFi | USDD | 450,000 | 2% | 100,000 | 300,000 | 1% | 90,000 |

| BNB DeFi | BSW | 11,600,000 | 11% | 3,000,000 | 5,800,000 | 6% | 1,500,000 |

| BNB DeFi | TWT | 3,000,000 | 69% | No Change | 500,000 | 0% | 100,000 |

| BNB DeFi | ALPACA | 1,500,000 | 51% | No Change | 750,000 | 1% | 100,000 |

| BNB DeFi | PLANET | 4,000,000,000 | 21% | 2,000,000,000 | 1,500,000,000 | 0% | 750,000,000 |

| BNB DeFi | ANKR | 17,700,000 | 5% | 2,000,000 | 8,850,000 | 0% | 1,000,000 |

| BNB GameFi | USDD | 450,000 | 5% | 100,000 | 300,000 | 6% | 90,000 |

| BNB GameFi | RACA | 4,200,000,000 | 8% | 1,000,000,000 | 2,100,000,000 | 0% | 500,000,000 |

| BNB GameFi | FLOKI | 68,000,000,000 | 72% | No Change | 22,000,000,000 | 0% | 2,000,000,000 |

| Stablecoins | USDD | 240,000 | 5% | 100,000 | 160,000 | 0% | 90,000 |

| Stablecoins | lisUSD | 1,000,000 | 5% | 200,000 | 250,000 | 1% | 100,000 |

| Stablecoins | USDT | 960,000 | 7% | 500,000 | 640,000 | 7% | 400,000 |

| Tron | USDD | 2,700,000 | 1% | 500,000 | 1,800,000 | 0% | 400,000 |

| Tron | USDT | 1,380,000 | 1% | 500,000 | 920,000 | 1% | 400,000 |

| Tron | BTT | 1,130,000,000,000 | 2% | 100,000,000,000 | 565,000,000,000 | 0% | 50,000,000,000 |

| Tron | TRX | 6,300,000 | 5% | 2,000,000 | 3,150,000 | 0% | 1,000,000 |

| Tron | WIN | 2,300,000,000 | 6% | 500,000,000 | 1,150,000,000 | 0% | 250,000,000 |