Summary

- Increase USDT’s (BNB GameFi) supply and borrow caps

- Increase weETH’s (Ethereum Staked ETH) borrow capI

- Increase XVS (BNB Core) supply cap

- Increase FDUSD’s (BNB Core) supply and borrow cap

Analysis

The following recommendations were made utilizing Chaos Labs’ supply and borrow cap methodologies after analyzing each asset’s user positions and market conditions.

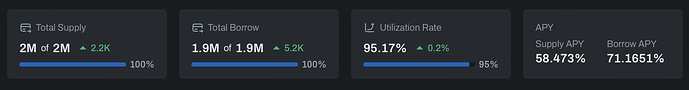

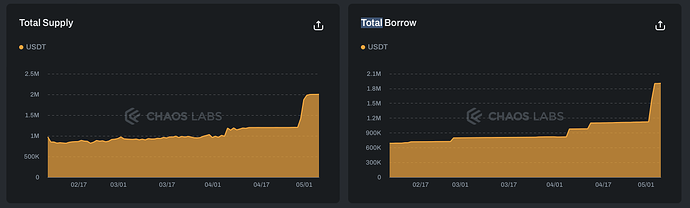

USDT (GameFi)

USDT’s supply and borrow cap utilization is at 100% following a surge in new deposits and borrowing.

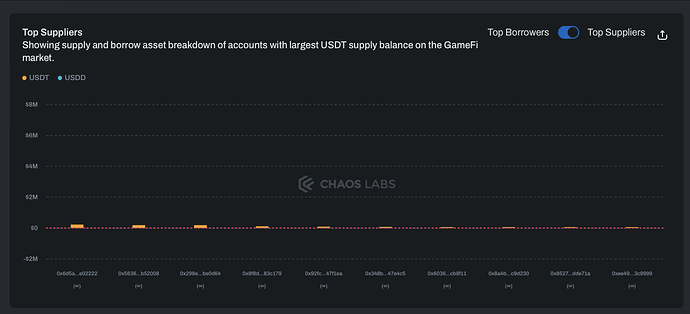

Supply is well distributed amongst wallets, with none of the top 10 suppliers borrowing against their USDT deposits.

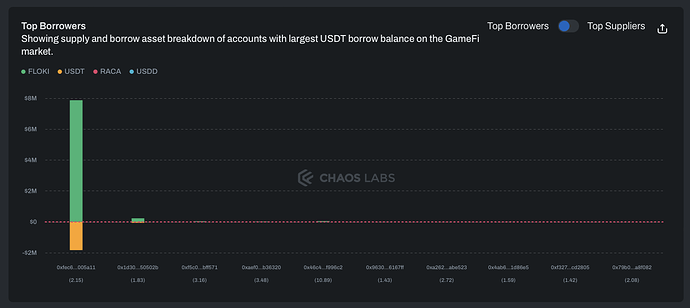

The largest borrow is $1.8M against $7.9M of FLOKI, for a health score of 2.15. This user has been actively managing their position in recent days, likely reducing the risk of liquidation.

Given the on-chain liquidity and user distribution, we recommend increasing the supply and borrow caps.

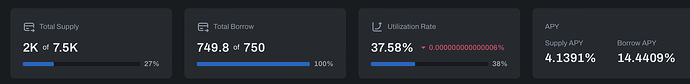

weETH (Liquid Staked ETH)

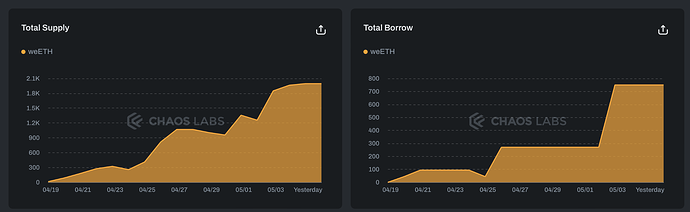

weETH has reached its borrow cap following a surge of new borrows in April. Unlike other LST/LRTs, we have observed significant borrowing demand for weETH, likely related to external incentives.

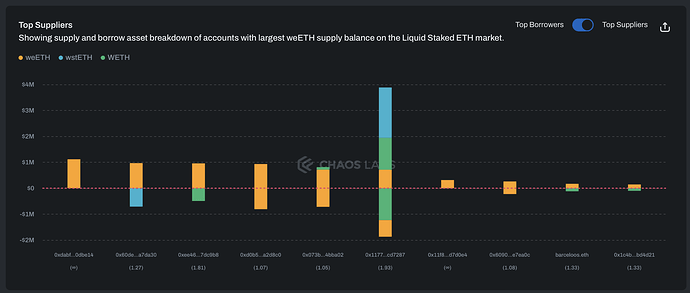

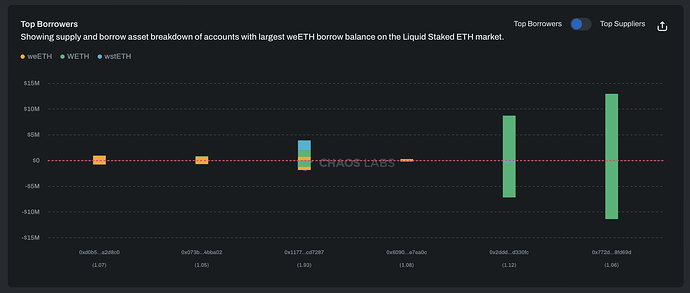

All of the top suppliers are looping or not borrowing against their weETH; borrows similarly show users are only looping, putting this market at lower risk of liquidations.

Given the on-chain liquidity and user distribution, the borrow cap can be increased; there is no need to increase the supply cap at this time.

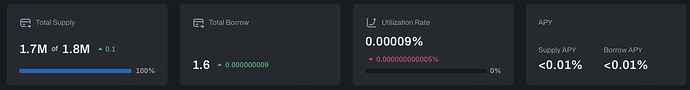

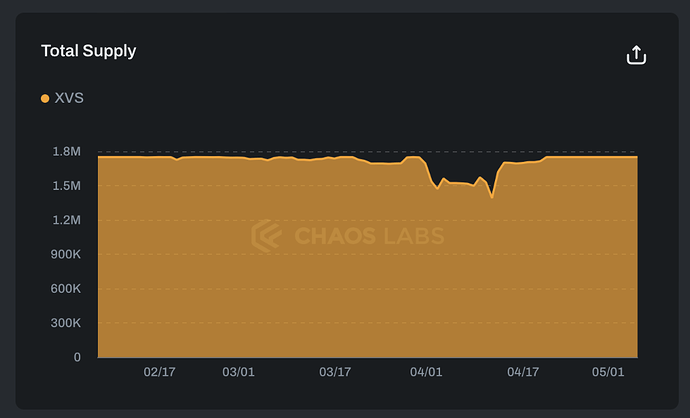

XVS (Core)

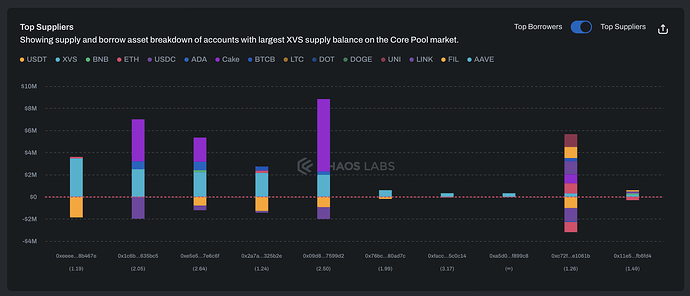

XVS is at full supply cap utilization; it has previously not been given supply cap increases because of low on-chain liquidity, though there is significant demand to deposit.

The largest supplier accounts for 14% of the total and maintains a health score of 1.19. They are borrowing USDT against XVS collateral. Other top suppliers have better health scores and do not present an immediate risk of liquidation.

Given the user distribution, we recommend a modest increase in the supply cap. The enhancements to liquidity conditions outlined in this proposal could facilitate further increases going forward.

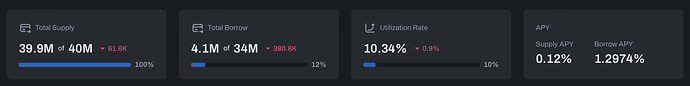

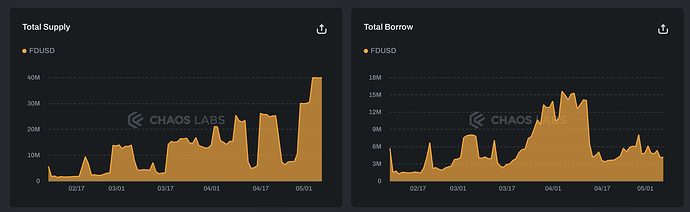

FDUSD (Core)

FDUSD remains at its supply cap despite there being no ongoing Binance Launchpool, which in the past has caused supply and borrows to fluctuate.

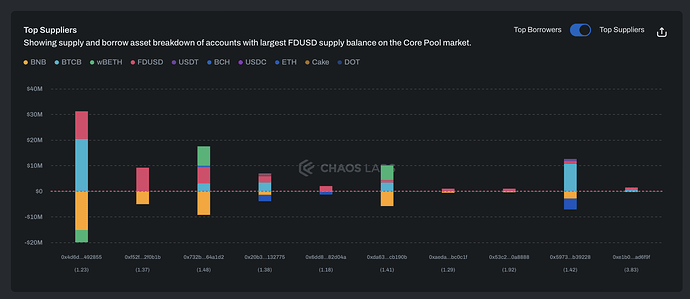

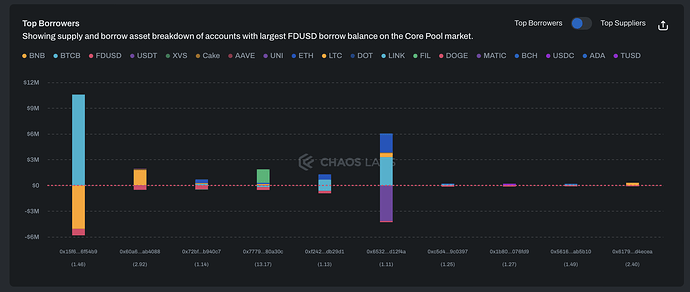

The largest FDUSD supplier represents 27% of the total supplied; they are also supplying $20.42M worth of BTCB and borrowing $4.76M WBETH and $15.16M BNB, for a health score of 1.23. This user has been actively managing their position, most recently depositing $200K FDUSD and $40K BTCB.

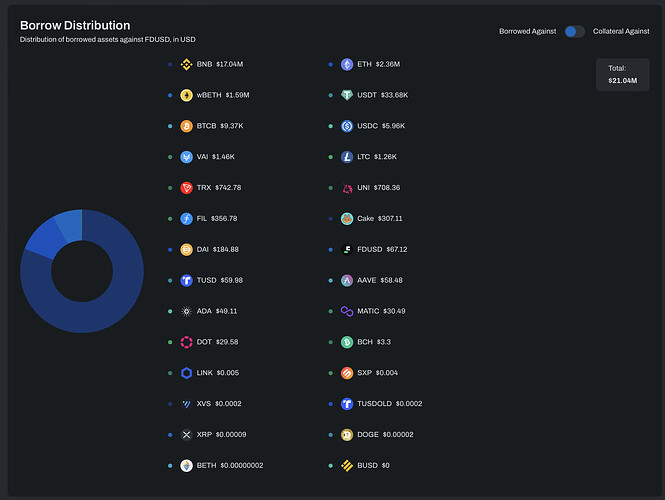

BNB, ETH, and WBETH are the most popular borrowed assets against FDUSD collateral, putting these positions at risk of liquidation should BNB and ETH rally.

Demand for borrows is relatively limited given the absence of Binance Launchpool events; however, this would likely change quickly should Binance announce a new event. Currently, the largest borrow is $758K FDUSD and $5M BNB borrowed against $10.6M BTCB.

Given the on-chain liquidity and user distribution, we recommend increasing the supply and borrow caps.

Specification

| Pool | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| GameFi | USDT | 2,000,000 | 3,000,000 | 1,900,000 | 2,800,000 |

| Core | weETH | 7,500 | No Change | 750 | 1,500 |

| Core | XVS | 1,750,000 | 1,850,000 | NA | NA |

| Core | FDUSD | 40,000,000 | 45,000,000 | 34,000,000 | 40,000,000 |