Summary

A proposal to:

- Increase USDC’s supply and borrow caps on Venus’s Unichain Core deployment.

- Increase WETH’s supply and borrow caps on Venus’s Unichain Core deployment.

All increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Motivation

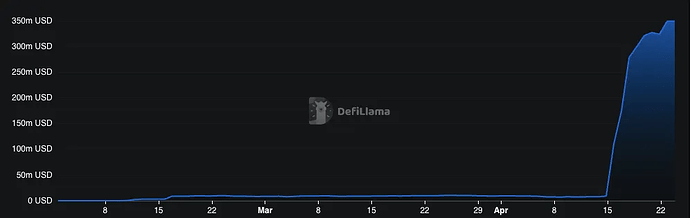

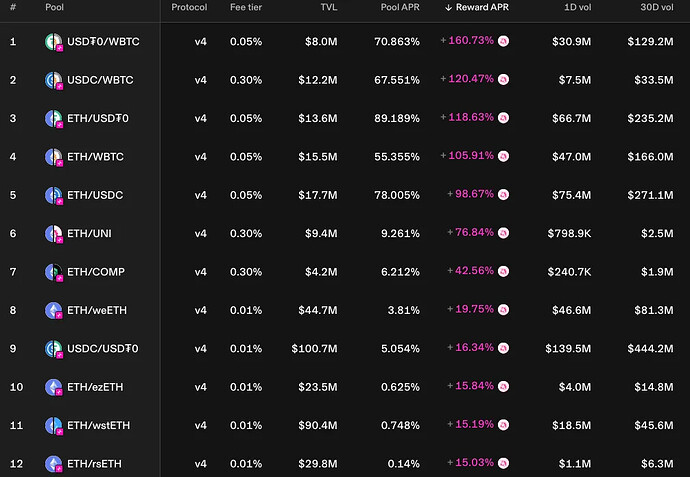

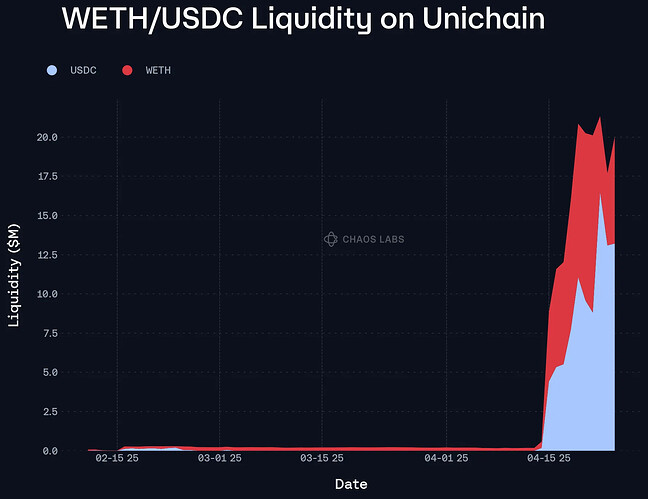

Uniswap recently launched Unichain liquidity incentives, which are structured as a dynamic program aimed at rapidly bootstrapping liquidity following sluggish growth on the chain.

Incentives are deployed in two-week tranches, allowing for adjustments based on market conditions. The incentive program is intended to target specific pools that provide a return to the DAO.

uniswap.org/explore/pools/unichain

As noted by governance participants, the criteria for selecting which pools to incentivize are somewhat opaque, as a post states that service providers will “prioritize ‘blue-chip assets’… stablecoins, and LST/LRT pairs.” However, a low-volume ETH/COMP pool is currently being incentivized despite COMP not falling into any of the three stated categories. Additionally, the initial proposal recommends a “front-loaded incentive approach”, indicating that rewards will likely tail off as TVL increases, potentially leading to a drop in liquidity.

As expected, the start of rewards has led to a large increase in on-chain liquidity, allowing us to recommend cap increases. However, the two factors discussed above — a lack of predictability and a front-loading approach — call for some caution when increasing caps, as we have previously observed chains like ZkSync and Scroll lose the majority of their TVL in weeks following incentives ending.

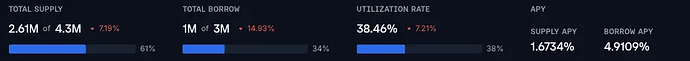

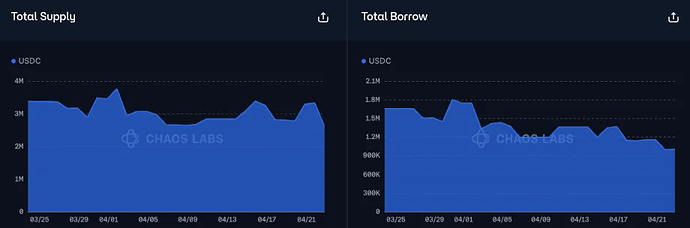

USDC (Unichain)

USDC has reached 61% supply and 34% borrow cap utilization, though we expect an increase in utilization of both in the coming days because of incentives.

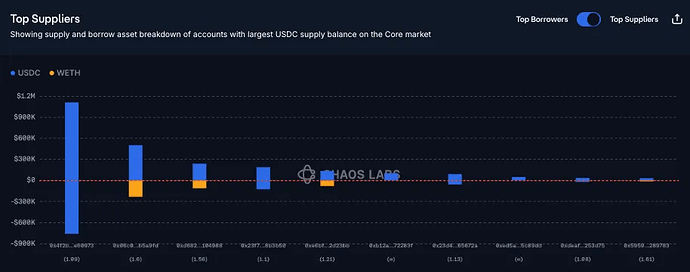

Supply Distribution

Supply is relatively well distributed, with the largest two suppliers accounting for 58% of the total.

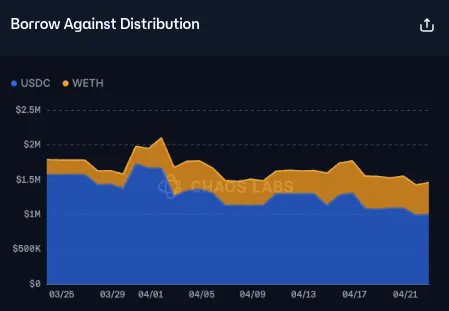

The largest supplier is looping the asset with itself, significantly reducing the liquidation risk. Other users are borrowing WETH, putting them at risk of liquidation should WETH’s price increase significantly. USDC is the primary asset borrowed against USDC.

Borrow Distribution

Borrows are somewhat concentrated but dominated by looping, significantly reducing the risk in this market.

Liquidity

As discussed above, liquidity has improved significantly, allowing us to recommend an aggressive cap increase.

Recommendation

Given user behavior, especially looping, we can recommend significant increases in the supply and borrow caps.

WETH (Unichain)

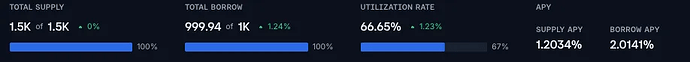

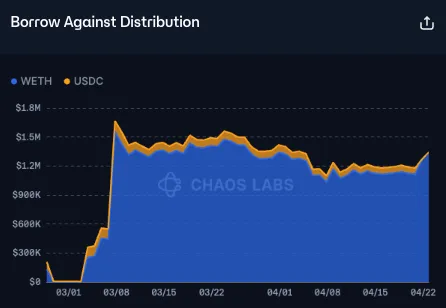

WETH has reached 100% supply and 100% borrow cap utilization following new activity in the market.

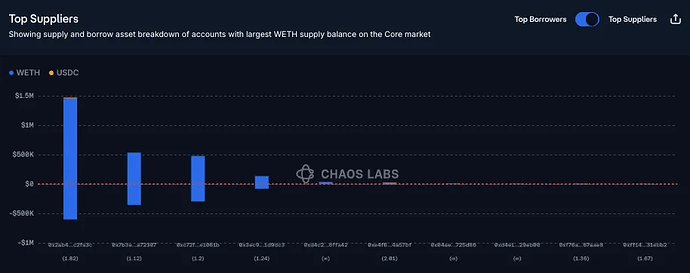

Supply Distribution

Supply is concentrated, but all top suppliers are looping the asset with itself, significantly reducing the risk in this market.

Looping represents the vast majority of WETH collateralization in this market; this is expected to continue as Unichain gains traction.

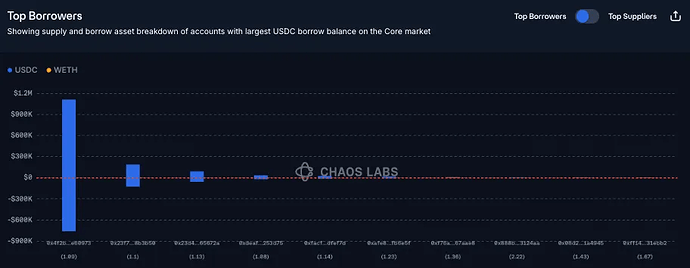

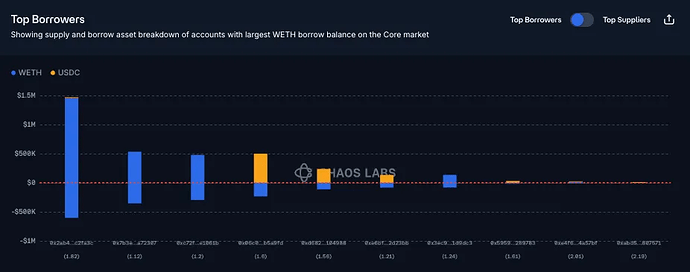

Borrow Distribution

As expected, borrowing is also dominated by loopers, with the top three users all looping WETH.

Recommendation

Given user behavior and liquidity (shown above), we recommend a large increase to WETH’s supply and borrow caps.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Unichain | USDC | 4,300,000 | 10,000,000 | 3,000,000 | 8,000,000 |

| Unichain | WETH | 1,500 | 6,000 | 1,000 | 4,000 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.