Summary

- Increase USDT (GameFi) supply and borrow caps

- Increase crvUSD (Curve) supply and borrow caps

- Increase UNI (Core) supply cap

- Increase CAKE (Core) supply cap

Analysis

The following recommendations where made utilizing Chaos Labs’ supply and borrow cap methodology and after analyzing user positions and market conditions for each asset.

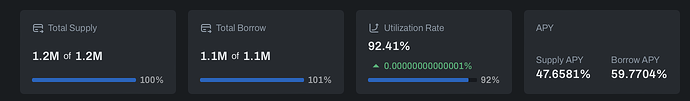

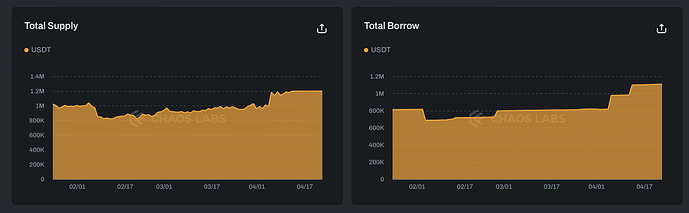

USDT (GameFi)

USDT has reached its supply and borrow caps.

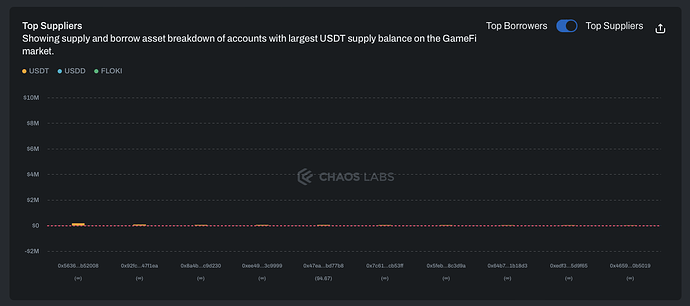

All but one of the top 10 suppliers is not borrowing against their USDT collateral, putting these positions at little risk of liquidation.

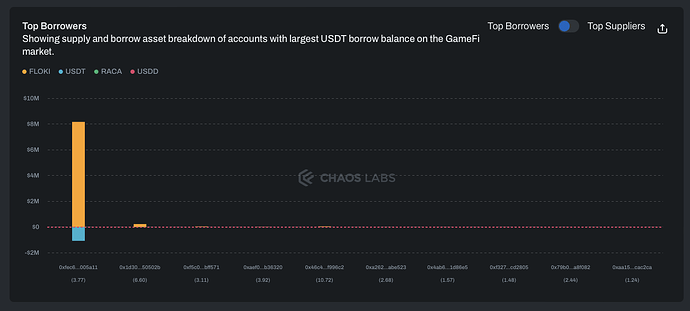

The top borrower is borrowing $1M USDT against $8.6M FLOKI.

Given this, and the token’s on-chain liquidity, we recommend increasing the supply and borrow caps to 2M and 1.9M, respectively.

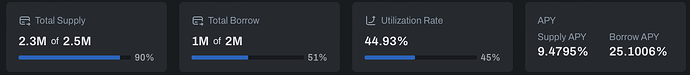

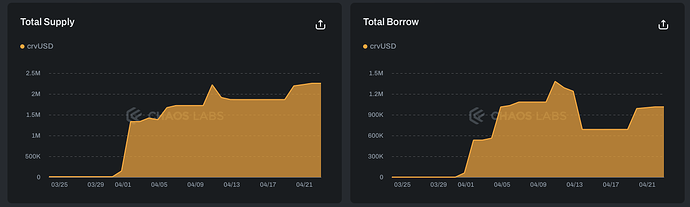

crvUSD (Curve)

90% of crvUSD’s supply cap has been utilized following new deposits; the borrow utilization rate is 51%.

The top supplier represents 55% of supply, while the second largest accounts for 26%.

Both of these accounts are borrowing and supplying a mixture of crvUSD and CRV, minimizing their risk of liquidation even as their health scores is relatively low.

Given this and crvUSD liquidity onchain, we recommend doubling the supply and borrow caps to 5M and 4M.

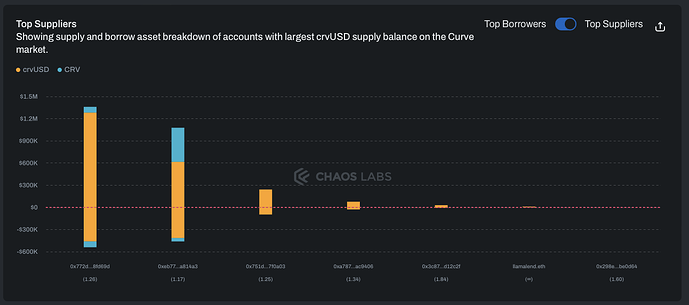

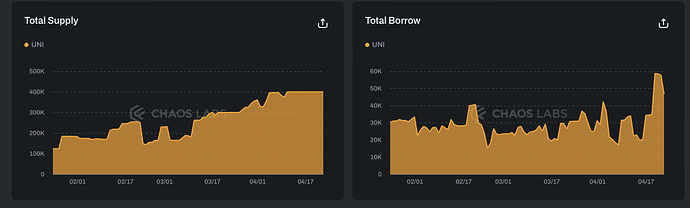

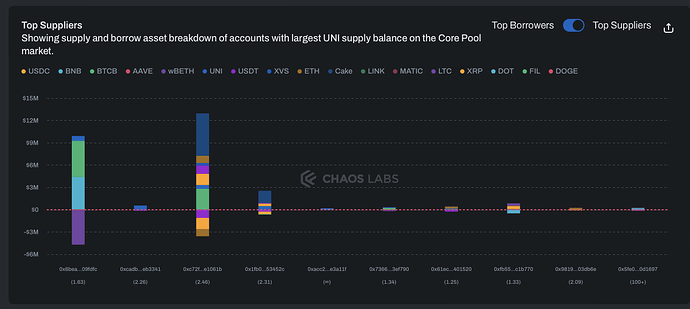

UNI (Core Pool)

The UNI supply and borrow caps have reached 100% and 47% utilization, respectively.

Supply is well distributed, with the largest supplier representing 20% of the total.

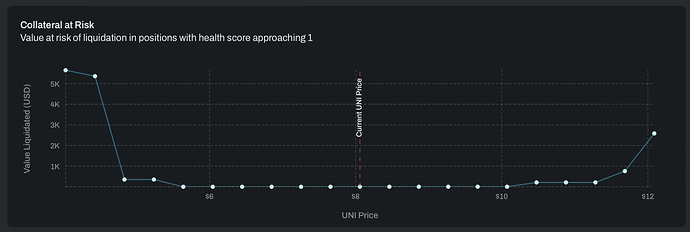

Overall, there is little collateral at risk until UNI’s price falls to $4.5.

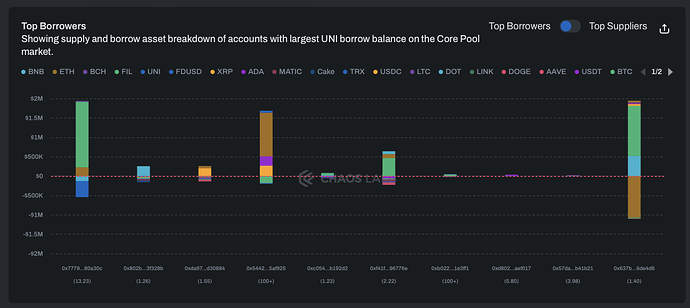

64% of total borrows are accounted for by a single user; in general, demand for borrows is low.

Our simulations show that it is possible to increase supply caps slightly without dramatically increasing VAR. As a result, we recommend a 25% increase in supply cap, to 500K UNI. Given the current borrow cap utilization, we do not recommend increasing the borrow cap.

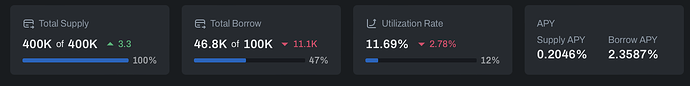

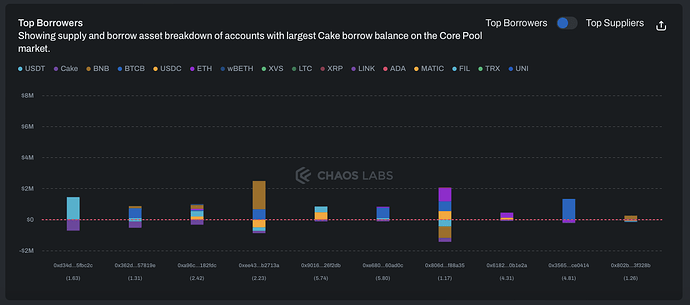

CAKE (Core Pool)

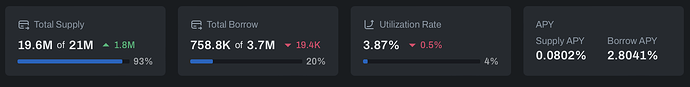

The CAKE supply and borrow caps have reached 93% and 20% utilization, respectively.

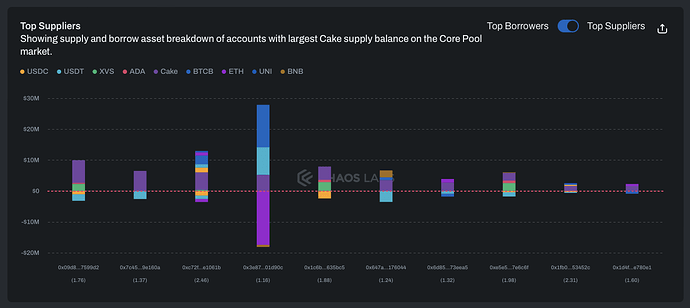

Supply is well distributed, with the largest supplier accounting for 12.5% of the total.

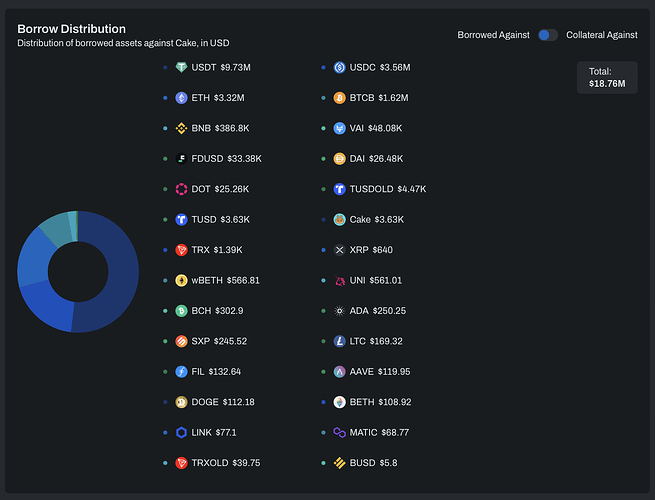

Stablecoins represent the majority of value borrowed against CAKE collateral, putting these positions at risk of liquidation should CAKE’s price fall.

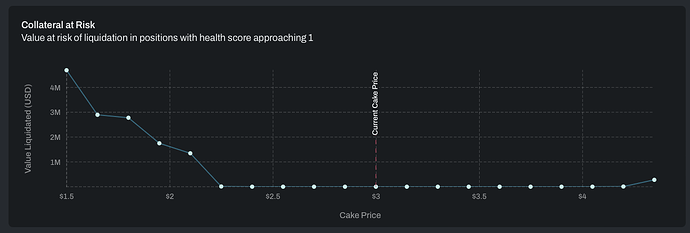

There is little collateral at risk until CAKE falls below $2.25.

Borrowing demand is relatively small and well distributed.

Utilizing our supply cap methodology and current on-chain liquidity, we recommend a modest increase in supply cap to 24M.

Specification

| Pool | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| GameFi | USDT | 1,200,000 | 2,000,000 | 1,100,000 | 1,900,000 |

| Curve | crvUSD | 2,500,000 | 5,000,000 | 2,000,000 | 4,000,000 |

| Core | UNI | 400,000 | 500,000 | 100,000 | No Change |

| Core | CAKE | 21,000,000 | 24,000,000 | 3,700,000 | No Change |