Summary

A proposal to:

- Increase weETHs’ supply cap on Ethereum Core.

- Increase USDT’s supply cap on BNB Core.

- Increase UNI’s supply and borrow caps on BNB Core.

- Increase RACA’s supply cap on BNB GameFi.

- Increase SOL’s supply cap on BNB Core.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

weETHs (Ethereum Core)

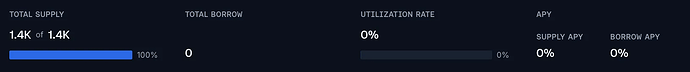

weETHs’ supply cap has reached 100% utilization.

Supply Distribution

There is a single user supplying in the market; however, they are not currently at high risk of liquidation because of a high health score.

This user’s borrow position has been relatively static, as they borrowed more USDC at the end of February but have not significantly altered it since.

Recommendation

Given the user behavior in this market, we recommend doubling its supply cap.

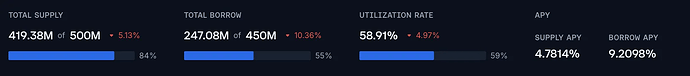

USDT (BNB Core)

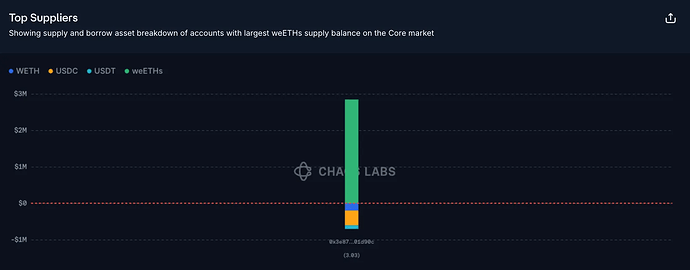

USDT’s supply cap is 84% utilized while its borrow cap is 55% utilized.

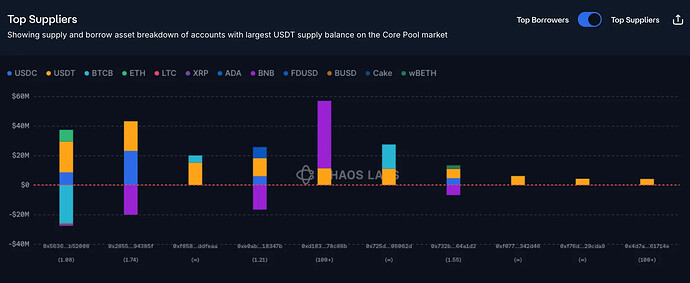

Supply Distribution

Supply is not highly concentrated, decreasing the risk profile of this market. However, the largest supplier is borrowing BTCB against USDT with a low health score of 1.08. However, on-chain liquidity is sufficient to liquidate this position, as both assets are highly liquid.

The most popular borrowed asset against USDT is BNB, followed by BTCB.

Recommendation

Based on user behavior and deep on-chain liquidity, we recommend increasing USDT’s supply cap; there is no need to increase its borrow cap at this time.

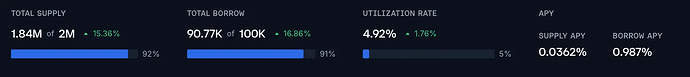

UNI (BNB Core)

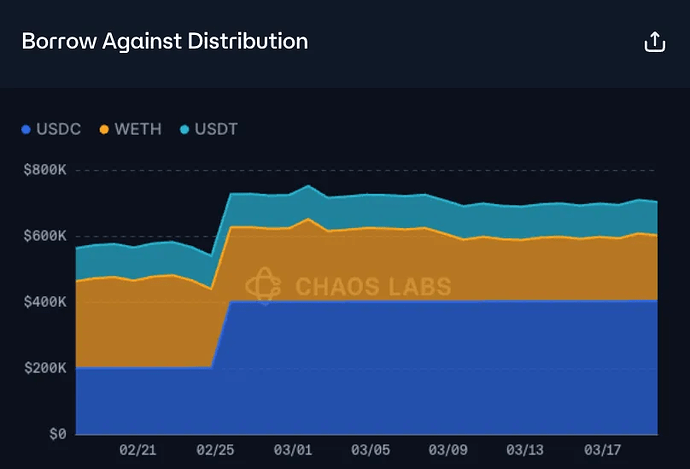

UNI’s supply and borrow caps are 92% and 91% utilized, respectively.

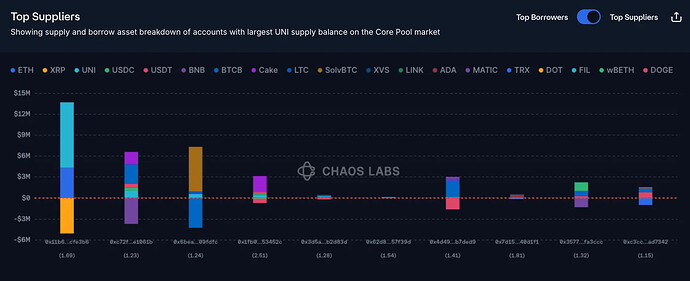

Supply Distribution

Its supply is heavily concentrated, with one user supplying 1.4M of the 1.84M UNI tokens in the market. This user is borrowing XRP against UNI, with a relatively strong health score of 1.69.

Other top suppliers utilize UNI as one of multiple collateral assets, reducing the chance of large-scale liquidations.

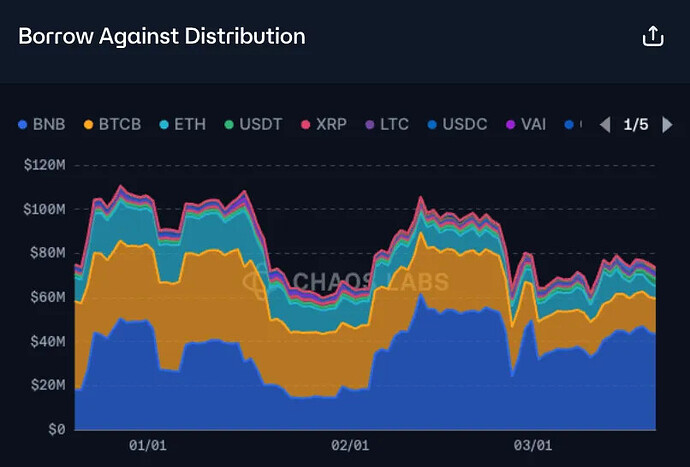

Borrow Distribution

Borrowing is also highly concentrated, with a single user representing virtually all UNI borrows.

This user is borrowing the asset against BTCB and USDT, both highly liquid assets, which reduces the risk of the position.

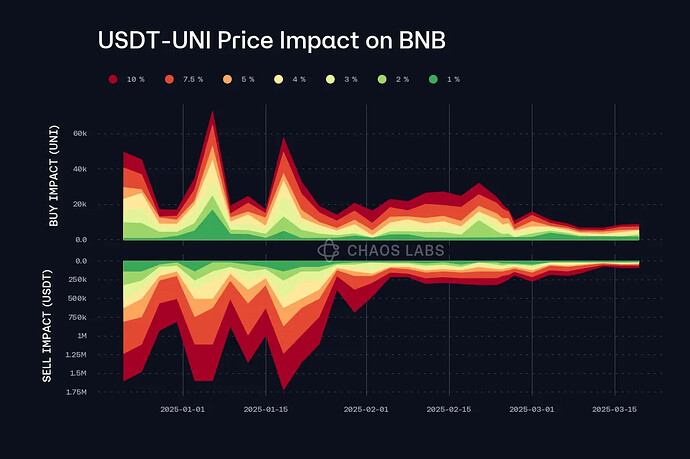

Liquidity

UNI’s liquidity on BNB Chain has deteriorated in recent months, though our simulations indicate it is still sufficient to allow for a supply and borrow cap increase.

Recommendation

Given the factors discussed above, we recommend increasing UNI’s supply and borrow caps.

RACA (BNB GameFi)

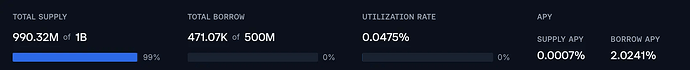

RACA has nearly reached its supply cap while its borrow cap is less than 1% utilized.

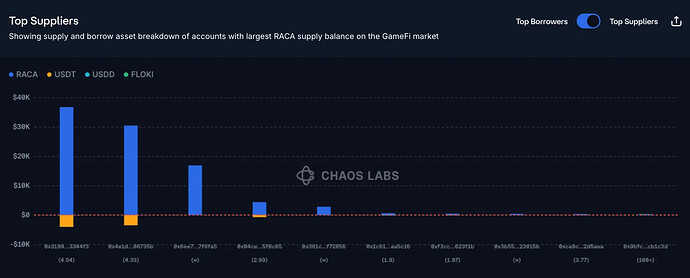

Supply Distribution

Supply is somewhat concentrated, but the largest suppliers maintain strong health scores that reduce their liquidation risk.

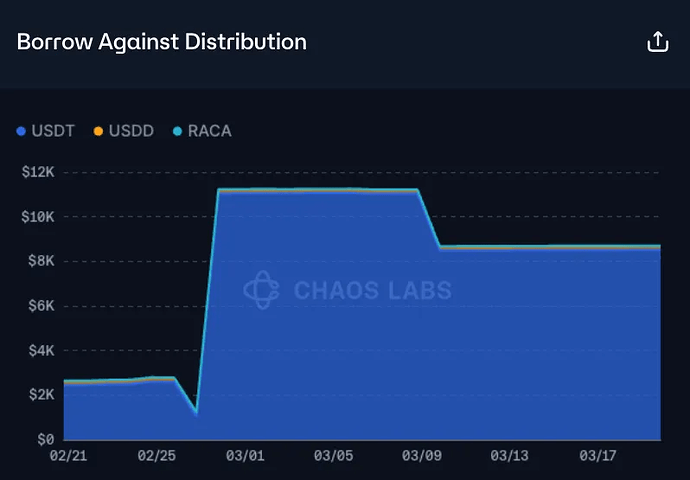

The most popular asset borrowed against RACA is USDT.

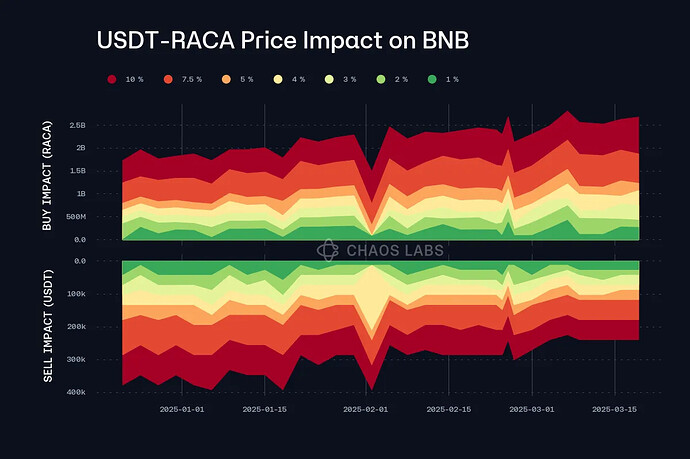

Liquidity

RACA’s on-chain liquidity has been stable in recent months.

Recommendation

Given the relatively small size of the market, sufficient on-chain liquidity, and user behavior, we recommend doubling RACA’s supply cap.

SOL (BNB Core)

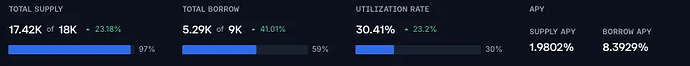

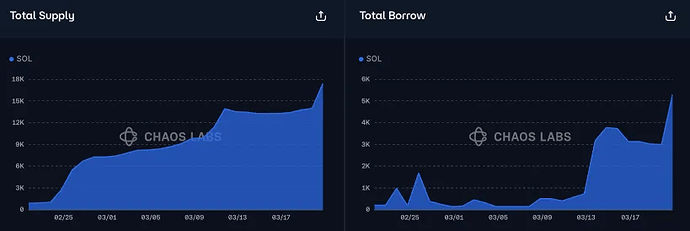

SOL has reached 97% and 59% supply and borrow cap utilization, respectively.

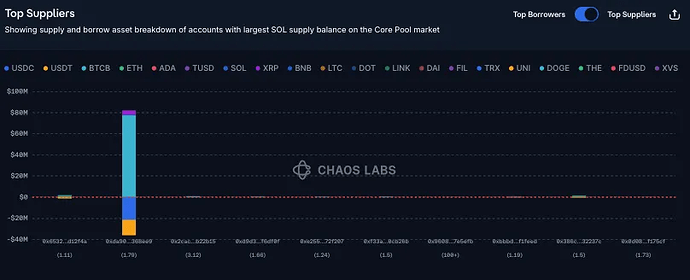

Supply Distribution

Supply is highly distributed, with no user depositing more than 3.52K SOL.

This distribution reduces the risk of the market, as does the borrow against distribution, which indicates that most users are borrowing USDT.

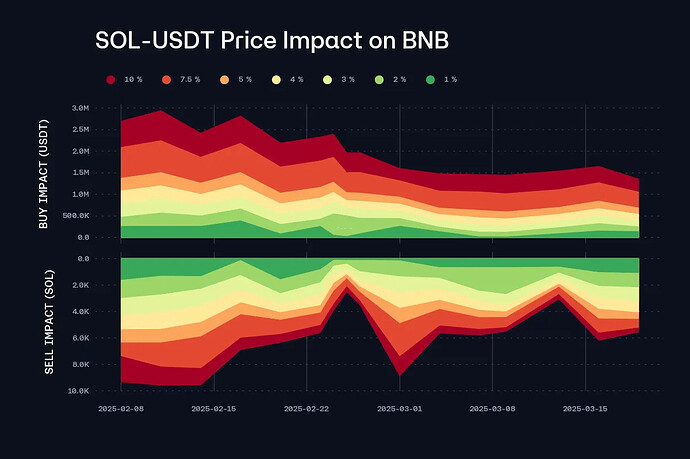

Liquidity

SOL’s liquidity on BNB has decreased since February but remains sufficient to support a supply cap increase.

Recommendation

Given user behavior and on-chain liquidity, we recommend doubling the supply cap.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | weETHs | 1,400 | 2,800 | - | - |

| BNB Core | USDT | 500,000,000 | 600,000,000 | 450,000,000 | - |

| BNB Core | UNI | 2,000,000 | 2,200,000 | 100,000 | 200,000 |

| BNB GameFi | RACA | 1,000,000,000 | 2,000,000,000 | 500,000,000 | - |

| BNB Core | SOL | 18,000 | 36,000 | 9,000 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.