Summary

A proposal to:

- Increase UNI’s supply cap on the BNB Core pool

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

UNI (BNB Core)

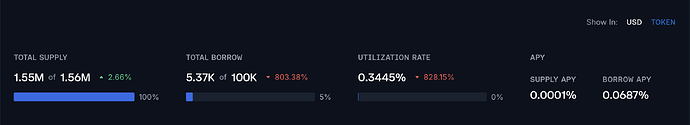

UNI’s supply cap utilization has reached 100%, while its borrow cap stands at 5%.

Supply Distribution

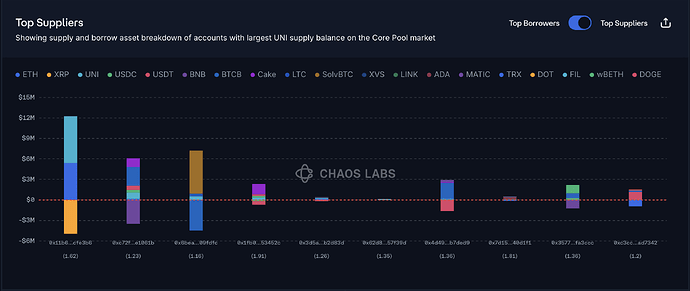

The largest UNI supplier accounts for 73% of the total supply distribution, presenting a high concentration risk. However, since this user maintains a high health score and is actively managing their position, the risk of liquidation is currently low.

The rest of the top suppliers all maintain robust health scores, minimizing liquidation risks.

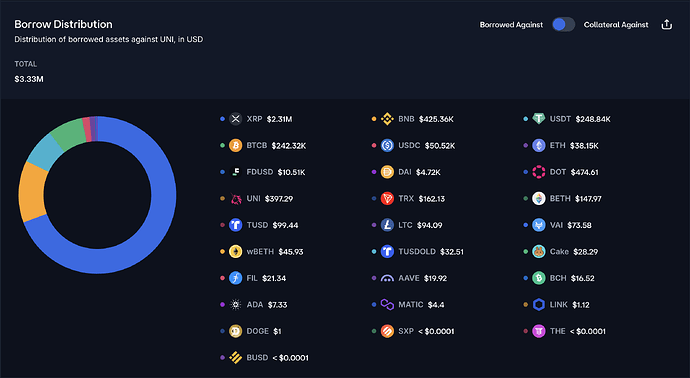

The top borrowed asset against UNI is XRP, accounting for 70% of the total distribution, with BNB as the second most borrowed asset.

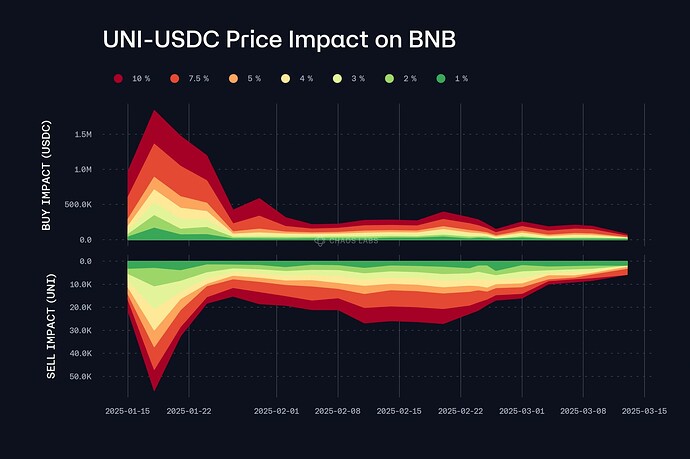

Liquidity

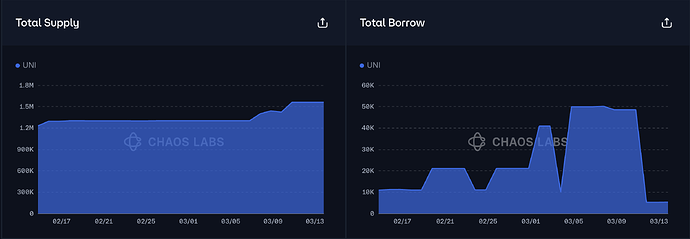

UNI’s liquidity has been relatively low over the past three months, with a 9K UNI sell currently incurring less than 10% price slippage. However, considering user behavior, it remains reasonable to consider an increase in its supply cap, though conservative approaches are necessary.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 2M.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | UNI | 1,560,000 | 2,000,000 | 100,000 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.