Summary

A proposal to:

- Increase UNI’s supply cap on the BNB Core pool.

- Increase TWT’s supply cap on the BNB Core pool.

- Increase WETH’s supply and borrow cap on the Unichain pool

- Increase USDC’s supply and borrow cap on the Unichain pool

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

UNI (BNB Core)

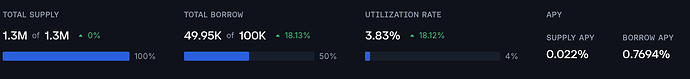

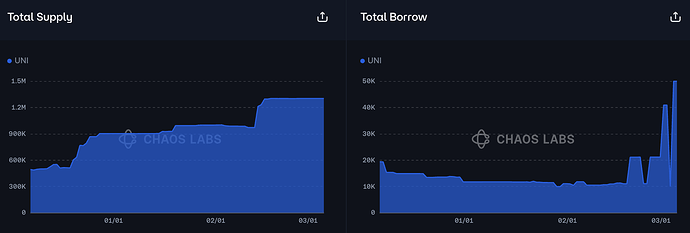

UNI’s supply cap utilization has reached 100%, while its borrow cap utilization stands at 50%.

Supply Distribution

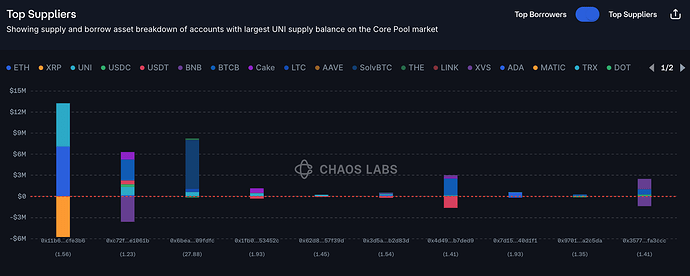

The supply distribution of UNI is somewhat concentrated, with the largest supplier accounting for 64% of the total supply. This user is borrowing XRP against ETH and UNI collateral, maintaining a relatively strong health score.

This position does not present a risk to the Venus Protocol in its current composition.

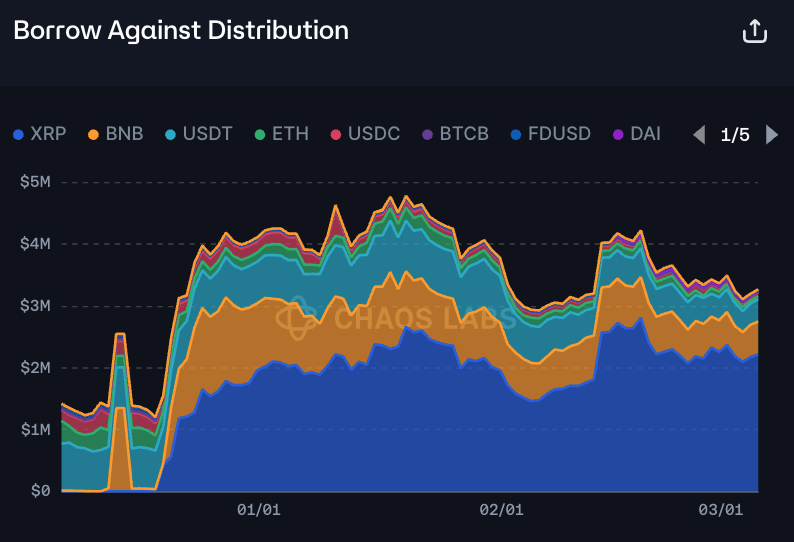

XRP has been the most popular asset borrowed against UNI over the last few months, the result of this user opening their position.

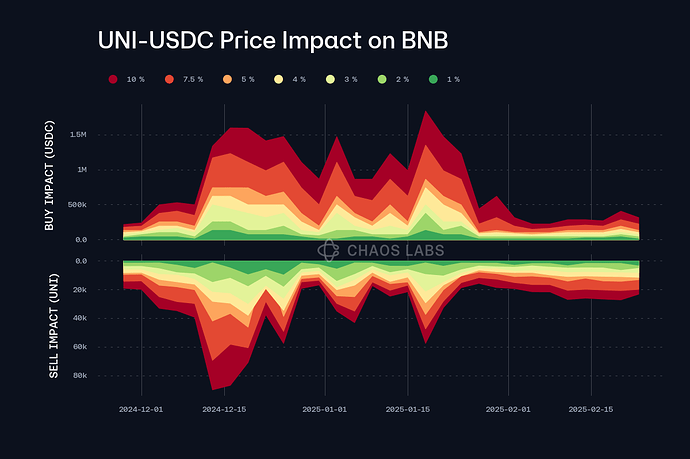

Liquidity

UNI’s liquidity has been volatile in recent months, though it has maintained a baseline of about 20K UNI able to be swapped for less than 10% price impact.

Recommendation

Given the on-chain liquidity and current user positions, we support a 20% supply cap increase.

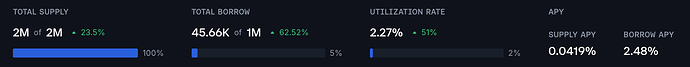

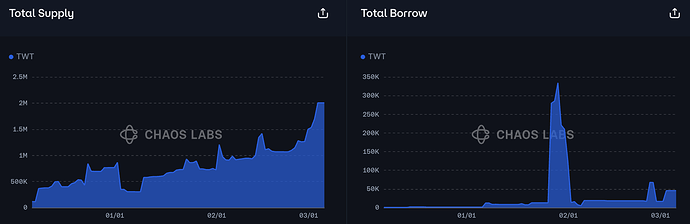

TWT (BNB Core)

TWT has reached 100% supply cap utilization while its borrow cap is currently 5% utilized.

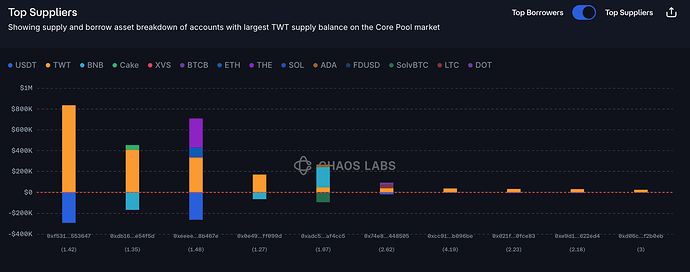

Supply Distribution

The asset’s supply is not highly concentrated, with the largest supplier depositing 806K TWT; this user borrows USDT with a moderate health score of 1.42.

USDT is the most popular asset borrowed against TWT, followed by BNB.

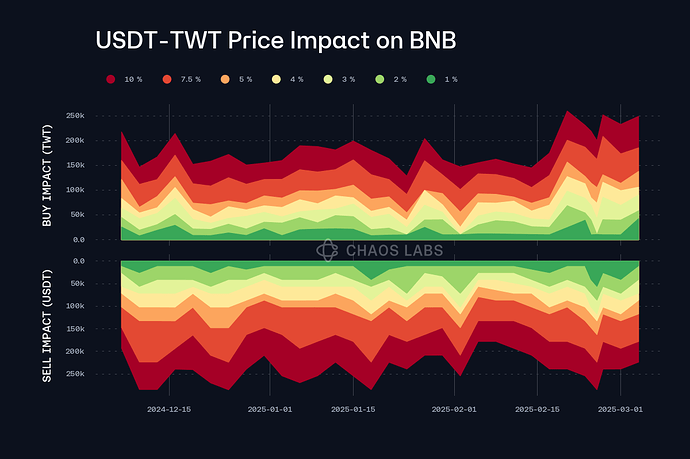

Liquidity

The asset’s liquidity has remained stable in recent months and is sufficient to support a supply cap increase.

Recommendation

Given on-chain liquidity, we recommend doubling the supply cap.

WETH and USDC (Unichain Core)

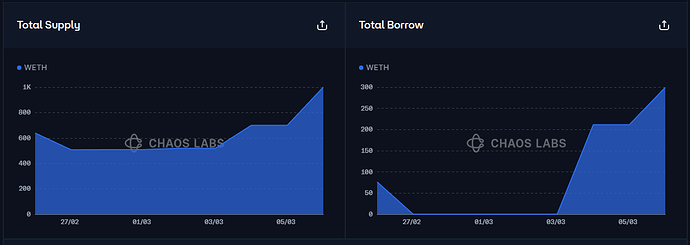

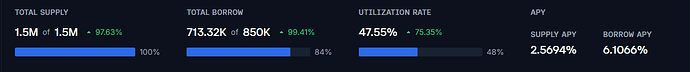

WETH

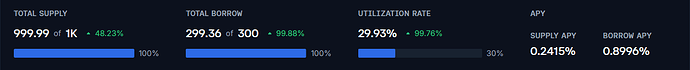

WETH’s supply cap utilization has reached 100%, while its borrow cap utilization stands at 100%.

Supply Distribution

The supply distribution of WETH presents minimal liquidation risk, as all WETH suppliers are borrowing WETH itself, significantly reducing the likelihood of liquidations.

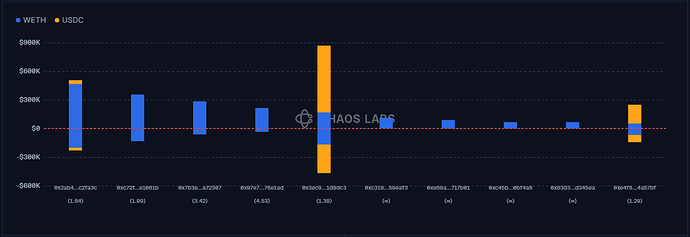

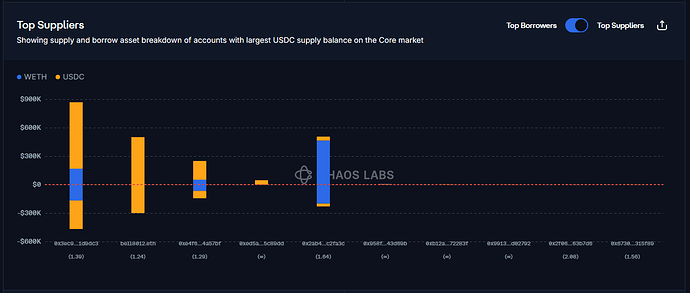

USDC

USDC’s supply cap utilization has reached 100%, while its borrow cap utilization stands at 5084.

Supply Distribution

The supply of USDC is well-distributed, with all top USDC suppliers borrowing USDC itself, significantly minimizing the risk of liquidations.

Liquidity

Currently, WETH liquidity allows a 10 ETH sell with less than 4.5% price slippage. Although the assets have relatively limited liquidity compared to their total supply, our analysis of user behavior suggests that this does not pose significant concerns at this time.

Recommendation

Given the safe utilization of the users in the WETH and USDC’s market, likely driven by the Venus token incentives, we support increasing WETH’s supply cap to 1,500 and USDC’s supply cap to 3M and adjusting their borrow caps in respect to their Kink.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | UNI | 1,300,000 | 1,560,000 | 100,000 | - |

| BNB Core | TWT | 2,000,000 | 4,000,000 | 1,000,000 | - |

| Unichain | WETH | 1,000 | 1,500 | 300 | 1000 |

| Unichain | USDC | 1,500,000 | 3,000,000 | 850,000 | 1,500,000 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.