Summary

A proposal to:

- Increase weETHs’ supply cap on the Ethereum Core pool.

- Increase WETH’s supply cap on the Unichain deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

weETHs (Ethereum Core)

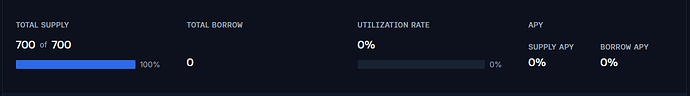

weETHs has reached 100% supply cap utilization; it is currently enabled as non-borrowable; hence, its borrow cap has not been utilized. The supply cap was reached after a single user made a deposit shortly after the pool deployment.

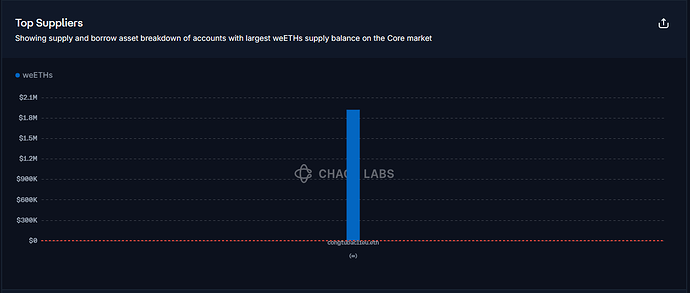

Supply Distribution

The supply of weETHs is concentrated on one user and is not currently being used as collateral. Hence, the position does not pose any liquidation risk.

Furthermore the depositor into weETHs pool maintains significant deposits into multiple Venus instances where it mantains healthy and actively managed positions.

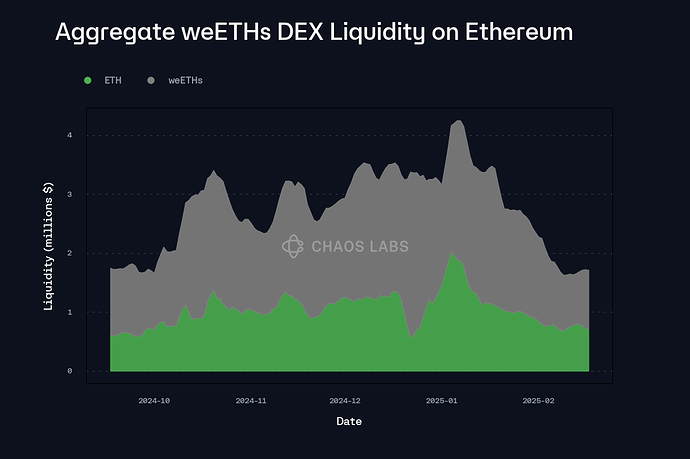

Liquidity

weETHs’ on-chain liquidity buy liquidity has remained fairly stable over the last 3 months, with its current value being $800K of WETH correlated assets.

Recommendation

Given on-chain liquidity and user positions, we recommend doubling the supply cap.

WETH (Unichain)

Following the launch of Unichain, the supply of WETH on Unichain’s Venus instance quickly reached the initial supply cap of 350 WETH. Given the demand demonstrated, we recommend updating the asset’s parameters.

Supply

The on-chain supply of WETH on Unichain grew to 2,800 WETH, with similar growth in the number of asset holders reaching 2,140. This fast growth shortly after the chain deployment suggests bridging demand, and as such, Venus can capitalize on it.

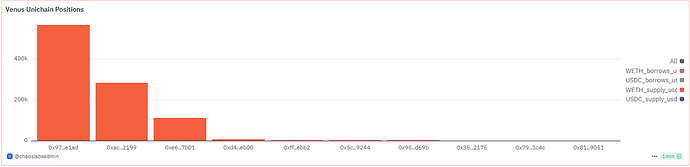

Supply Distribution

While fairly concentrated, the current suppliers of WETH on Unichain do not borrow assets against their positions, keeping the liquidation risk very limited.

Liquidity

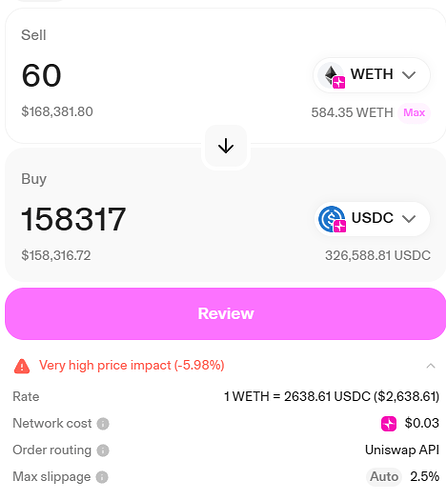

The DEX liquidity of the assets is still fairly limited, with the price impact caused by a sell of 65 WETH to surpass the 10% liquidation bonus of the vault. Additionally, Uniswap X solvers do not appear to be active for cross-chain arbitrages on the chain yet, effectively limiting the available liquidity to the pools deployed on the chain itself. We expect this to change soon, and we will continue monitoring the liquidity to update our recommendation accordingly.

Recommendation

Given the growth in supply and the safe positioning of current WETH suppliers, we recommend increasing WETH’s Supply Cap to 700 WETH.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | weETHs | 700 | 1,400 | - | - |

| Unichain | WETH | 350 | 700 | 300 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.