Summary

A proposal to:

- Increase BAL’s supply cap on the Ethereum Core deployment.

- Increase USDC’s supply cap on the ZKSync deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

BAL (Ethereum)

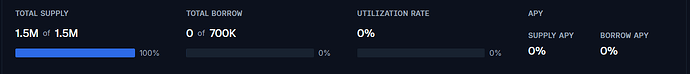

BAL has reached 100% supply cap utilization and its borrow cap is 0% utilized.

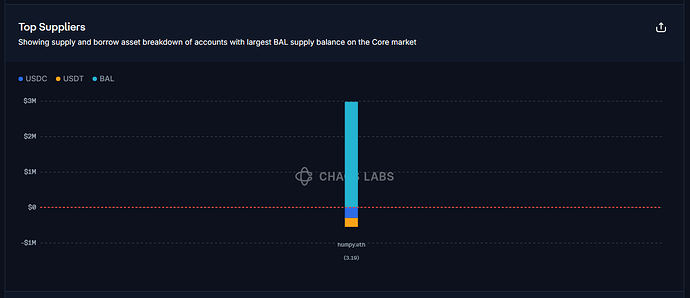

Supply Distribution

BAL’s supply is highly concentrated, with a single user accounting for 100% of the total supply. This user borrows USDC and USDT against BAL collateral and maintains a safe health score of 3.19, putting them at a low of liquidation.

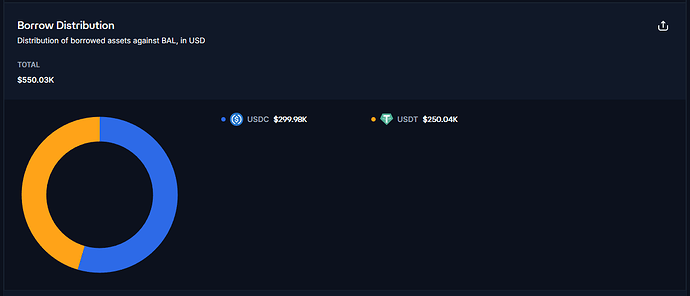

As a result of the only position, USDC is the most popular debt asset against BAL, closely followed by USDT.

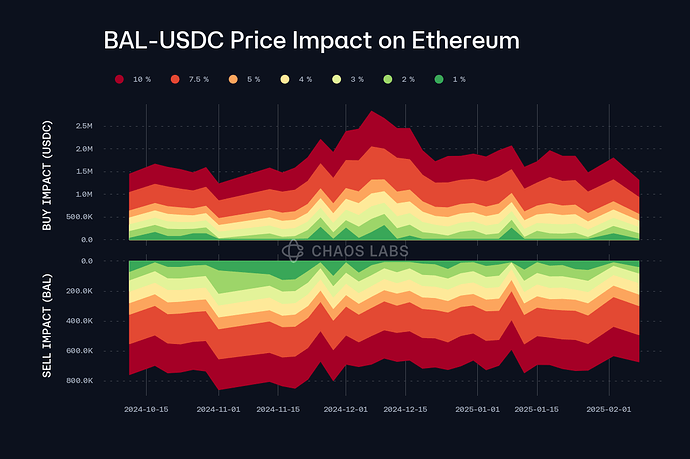

Liquidity

BAL’s liquidity on Ethereum has remained stable over the last 90 days with a sell of 700K BAL needed to cause a slippage of 10%.

Recommendation

While the current supply is highly concentrated, the safe positioning of the user combined with stable liquidity is sufficient to recommend increasing the supply cap to 2,000,000 BAL.

USDC (ZKSync)

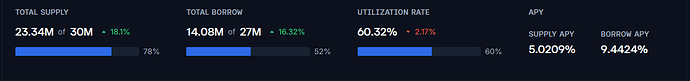

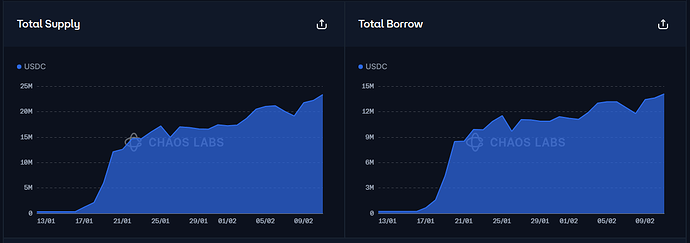

USDC has reached 78% supply cap utilization, and its borrow cap is 52% utilized.

Supply Distribution

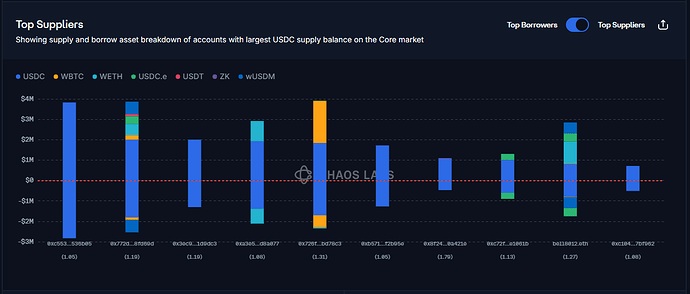

USDC’s supply is evenly distributed among top suppliers, with all of the top positions looping the asset over itself to accumulate ZK Ignite rewards. Given the 1:1 correlation between the supplied and borrowed assets, the top positions pose no liquidation risk.

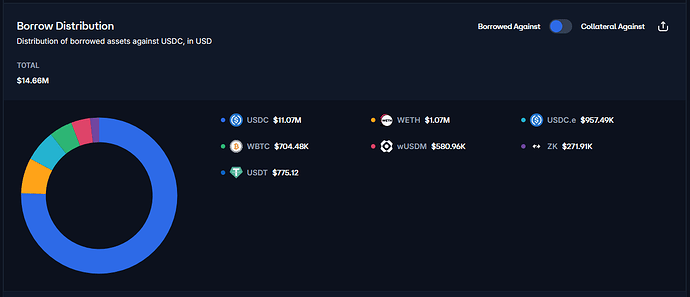

As a result of the looping, USDC is the most popular debt asset against USDC, representing 75% of the borrow demand.

Recommendation

Thanks to the limited risk posed by the looping positions, we recommend increasing the supply of USDC to 35M.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum | BAL | 1,500,000 | 2,000,000 | 700,000 | - |

| ZKSync | USDC | 30,000,000 | 35,000,000 | 27,000,000 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.