Summary

- BNB (Core Pool) - increase CF to 78%

- FDUSD (Core Pool) - Increase supply cap to 10M and borrow cap to 8M

Analysis

BNB

Overview

To assist in the efforts of repaying the insolvent account utilizing the BNB exploiter’s debt in this proposal, we analyzed an increase of BNB CF in the Venus Core Pool.

Chaos Labs’ Parameter Recommendation Platform runs hundreds of thousands of agent-based blockchain simulations to examine how different Venus risk parameter configurations would behave under adverse market conditions - and find the optimal values to maximize protocol borrow usage while minimizing losses from liquidations and bad debt. Following these simulations, we recommend an increase to the BNB CF on the Venus Core Pool.

Simulation Outputs

The output of our simulations reveals an opportunity to increase the collateral factor for BNB to 78%, with an increase of ~$20K in projected VaR (95th percentile of the protocol losses that will be accrued due to bad debt from under-collateralized accounts over 24 hours).

Following are our additional analyses and recommendations.

Liquidity Analysis

- BNB/USDT - liquidity seems stable with 100,000 WBNB available subject to a 10% price impact.

Positions Analysis

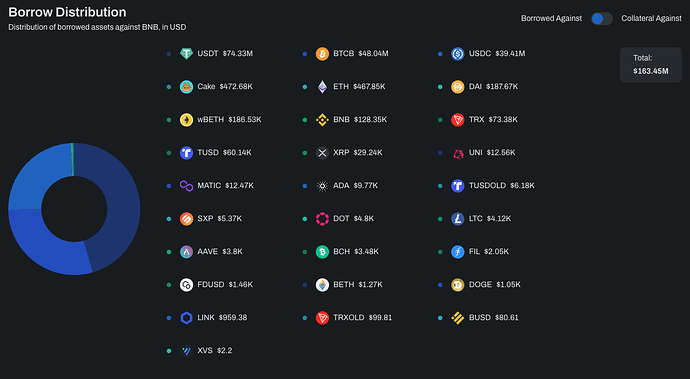

The aggregate WBNB utilized as collateral on Venus amounts to around $163.45 million. This includes borrowings of $75 million in USDT, $39.4 million in USDC, and $48 million in BTCB against it.

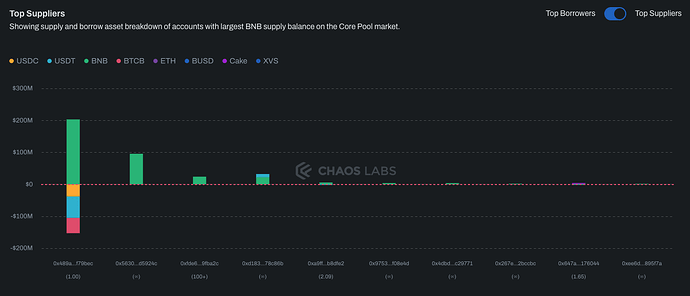

The largest wallet, the exploiter wallet, accounts for nearly 50% of the total supply of BNB. This account is currently borrowing over $153 million against BNB from the overall total of $163.45 million, amounting to over 93%. This account and liquidations are actively managed, reducing insolvency risk to the protocol.

Recommendation

Following the above analysis, based on the historical volatility, liquidity, position analysis, and risk assessment, we recommend increasing the CF of WBNB from 75% to 78%.

Continuous monitoring and risk assessment are essential in ensuring that the adjusted CF remains viable and sustainable, aligning with the Venus protocol’s overarching risk tolerance and strategic objectives.

FDUSD

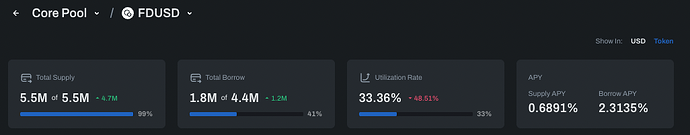

The supply cap for FDUSD on the Venus core pool is currently at 99% utilization.

The recent increase in supply is due to a single user supplying ~4.4M FDUSD, amounting to around 80% of the total supply. The user is currently borrowing 500K FDUSD and $1.42M in WBETH against this collateral.

Utilizing our supply cap methodology, and considering the current usage on Venus and liquidity conditions, we recommend increasing the supply cap to 10M and the borrow cap to 8M

Borrow Distribution

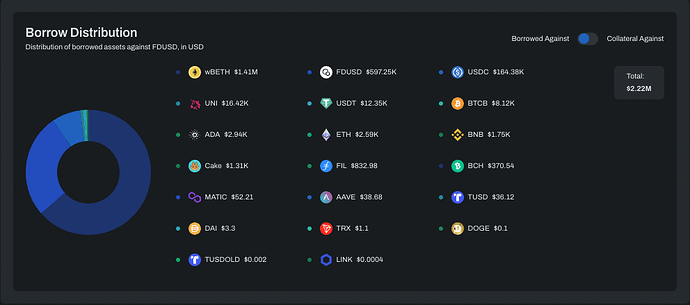

There are currently $2.22M of assets borrowed against FDUSD on Venus core pool, primarily WBETH and FDUSD borrowed by the user highlighted above.

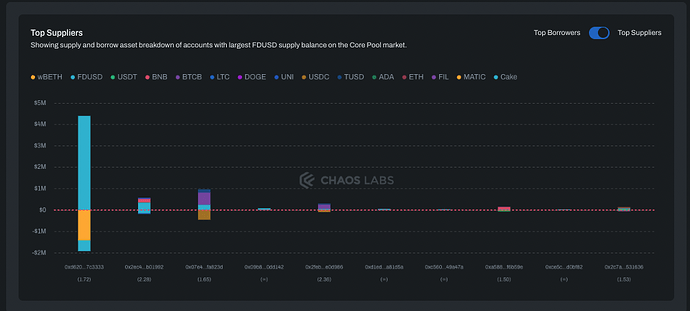

Top Suppliers

The top three users collectively contribute approximately 92% of the overall FDUSD supply. Despite this concentration, the current market conditions in addition to the borrow distribution against FDUSD permit an increase of the cap.