Summary

A proposal to:

- Increase FLOKI’s borrow cap on the BNB GameFi pool.

- Increase pufETH’s borrow cap on the Ethereum Liquid Staked ETH pool.

- Increase BAL’s supply cap on the Ethereum Core pool.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

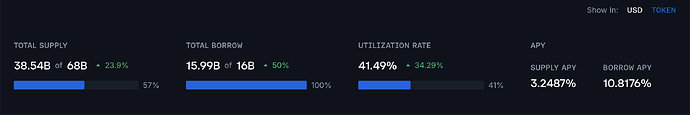

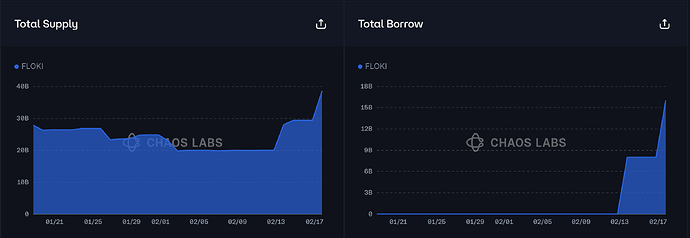

FLOKI (BNB GameFi)

FLOKI has reached 57% supply cap utilization and its borrow cap is 100% utilized.

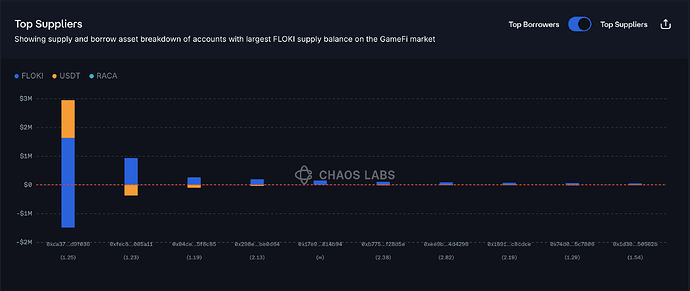

Supply Distribution

The top supplier of FLOKI holds 43% of the total supply, presenting a concentration risk. However, since this position is borrowing FLOKI itself, the risk of liquidation is largely reduced. The remaining top suppliers maintain healthy health scores, further minimizing liquidation risk.

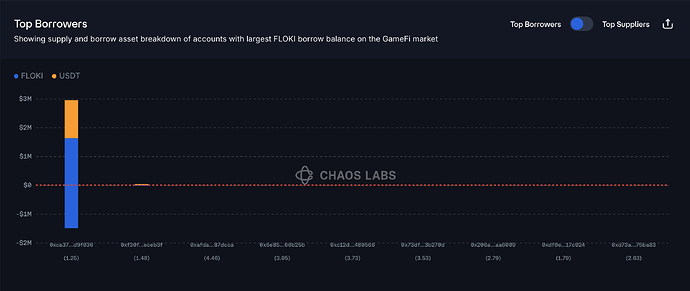

Borrow Distribution

The borrow distribution is highly concentrated, with a single position accounting for 93% of the total borrowed assets. However, since this position is borrowing FLOKI against FLOKI and USDT, the risk of liquidation is significantly reduced.

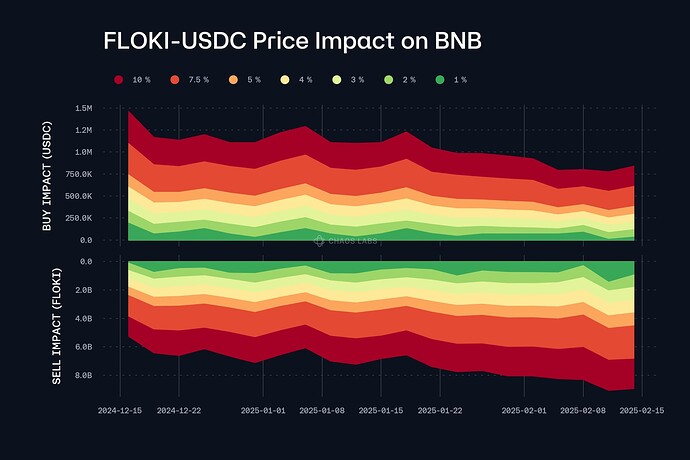

Liquidity

FLOKI’s liquidity has remained stable over the past month, supporting an increase in its borrow cap.

Recommendation

Given on-chain liquidity and user positions, we recommend doubling the borrow cap; there is no need to increase the supply cap at this time.

pufETH (Ethereum Liquid Staked ETH)

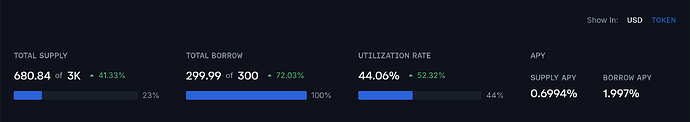

pufETH has reached 23% supply cap utilization and its borrow cap is 100% utilized.

Supply Distribution

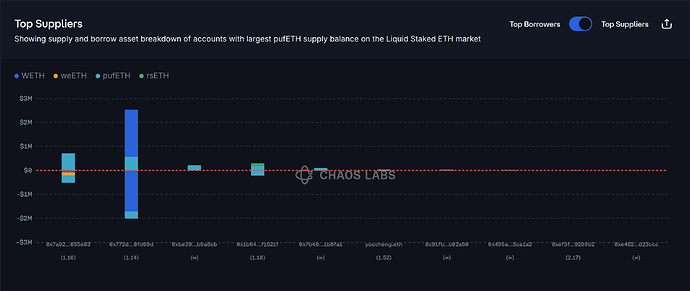

The supply of pufETH is moderately concentrated, with the top supplier holding approximately 36% of the total supply. However, since this supplier is borrowing pufETH itself and correlated assets (WETH and weETH), the risk of liquidation is significantly reduced.

The remaining top suppliers are either borrowing correlated assets or have no borrowing activity, significantly reducing liquidation risk and minimizing the likelihood of a spike in utilization due to liquidations.

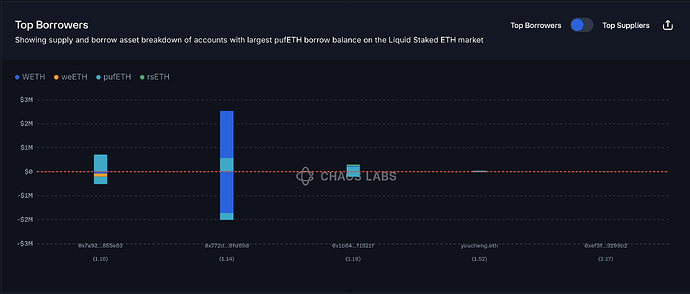

Borrow Distribution

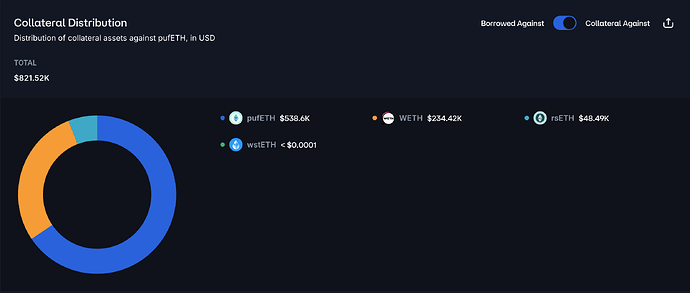

None of the top pufETH borrowers present significant liquidation risk, as their collateral consists of pufETH itself or assets correlated with pufETH, such as WETH or rsETH.

The top collateral asset against pufETH is pufETH itself, accounting for 65% of the total collateral distribution, significantly reducing the likelihood of large-scale liquidations.

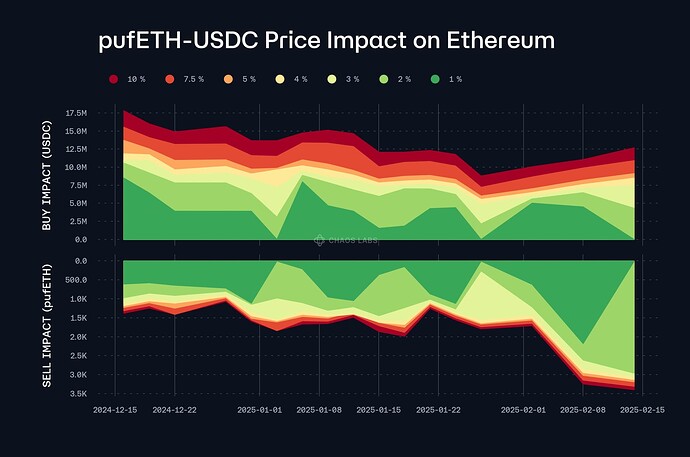

Liquidity

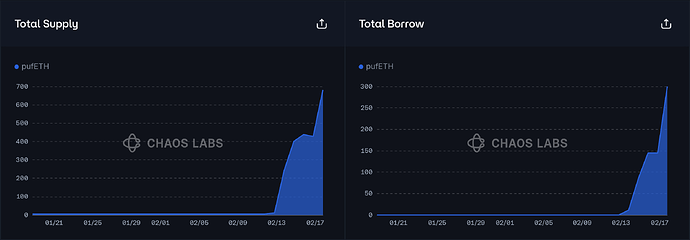

pufETH’s liquidity has been growing over the past month, supporting an increase in its borrow cap.

Recommendation

Given on-chain liquidity and user positions, we recommend doubling the borrow cap; there is no need to increase the supply cap at this time.

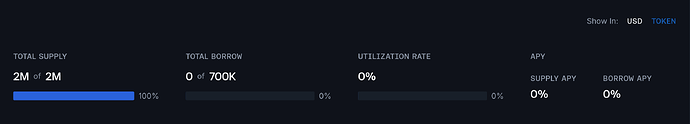

BAL (Ethereum Core)

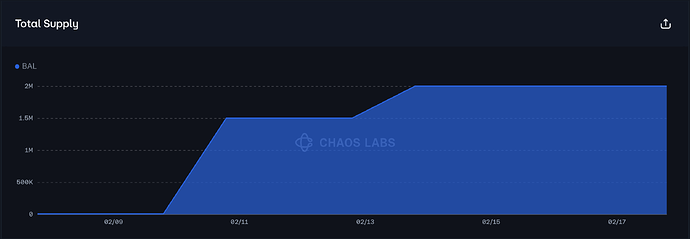

BAL’s supply cap utilization has reached 100%.

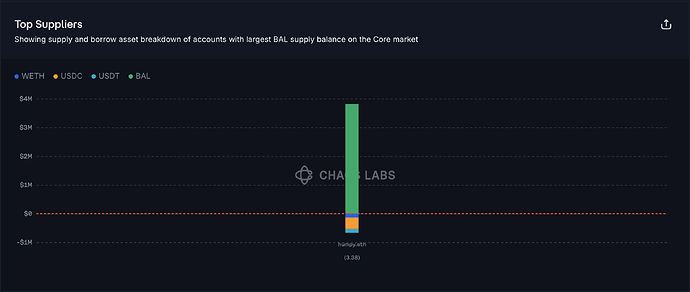

Supply Distribution

BAL’s supply is highly concentrated in a single address, however, since this user maintains a strong health score of 3.38 and is actively managing their position, it does not present a significant risk at this time.

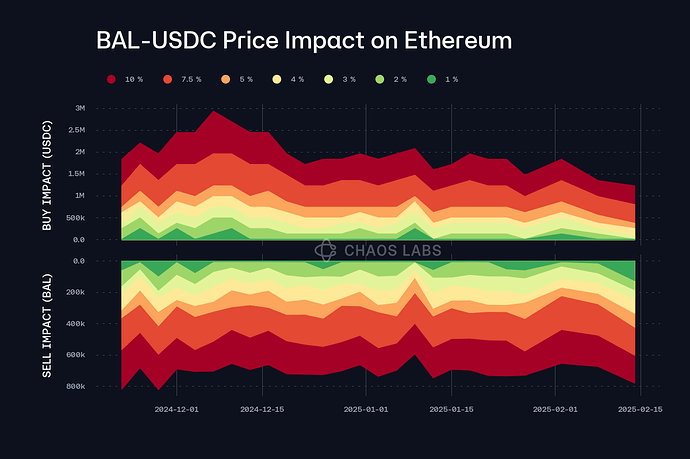

Liquidity

BAL’s liquidity has remained stable over the past three months, currently allowing a 200K BAL sell with less than 3% price slippage, supporting a supply cap increase.

Recommendation

Given on-chain liquidity and user positions, we recommend increasing the supply cap to 3,000,000.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB GameFi | FLOKI | 68,000,000,000 | - | 16,000,000,000 | 32,000,000,000 |

| Ethereum Liquid Staked ETH | pufETH | 3,000 | - | 300 | 600 |

| Ethereum Core | BAL | 2,000,000 | 3,000,000 | 700,000 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.