Summary

A proposal to:

- Increase SolvBTC’s supply cap on Venus’s BNB Core deployment.

Motivation

SolvBTC (BNB Core)

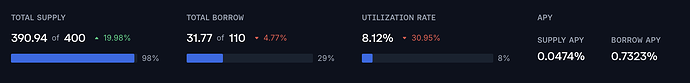

SolvBTC has reached 98% supply cap utilization and 29% borrow cap utilization.

Supply Distribution

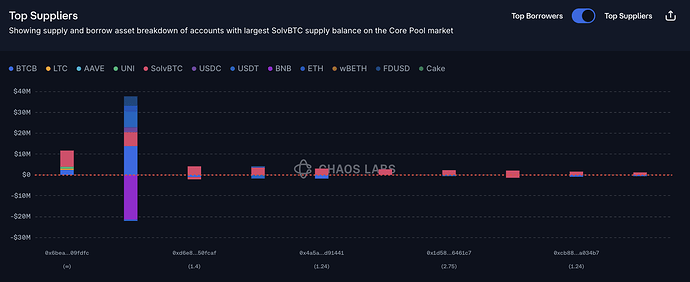

SolvBTC’s is not highly concentrated and the top supplier is not borrowing against their position.

The most popular asset borrowed against SolvBTC is BTC.B, reducing the risk of liquidations. The next most popular is BNB.

Liquidity

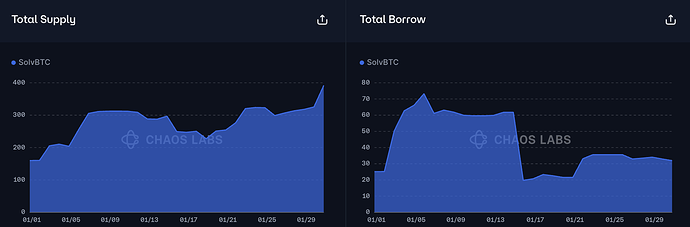

SolvBTC’s on-chain liquidity has remained stable over the last three months, allowing us to increase the asset’s supply cap.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the asset’s supply cap.

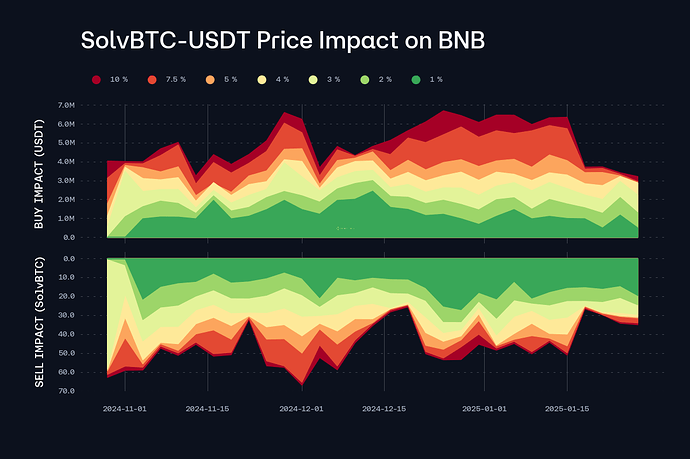

This increase is backed by Chaos Labs’ risk simulations, which consider the user’s behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap |

|---|---|---|---|

| BNB Core Pool | SolvBTC | 400 | 480 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.