Summary

A proposal to:

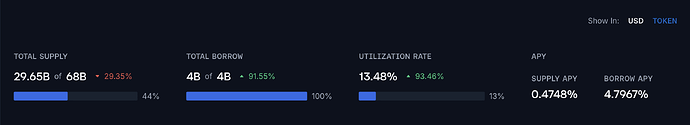

- Increase FLOKI’s borrow caps on Venus’s BNB GameFi deployment.

FLOKI(BNB-GameFi)

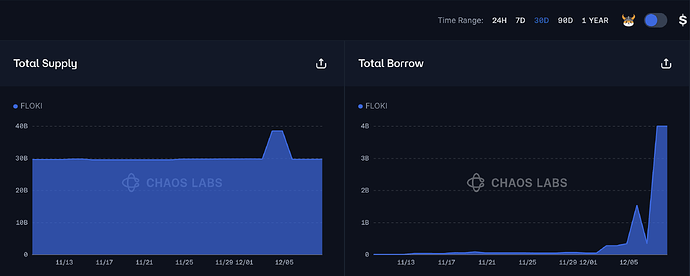

FLOKI has reached 100% borrow cap utilization and can no longer be borrowed.

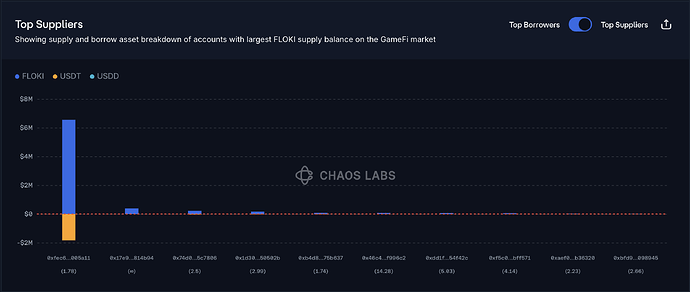

Supply Distribution

The supply distribution of FLOKI presents limited liquidation risk. The top supplier has provided $6.55 million worth of FLOKI, representing 85.28% of the total market supply of $7.68 million. While this indicates concentration risk, the position’s high health score (1.78) and active management suggest it does present limited liquidation risks.

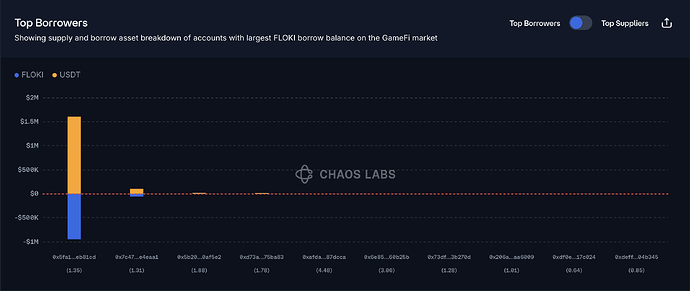

Borrow Distribution

The borrow side of FLOKI also does not present any significant liquidation risks. The largest borrower has a health score of 1.35, and this position is being actively managed, minimizing the risk of liquidation. The remaining borrower positions do not present noticeable liquidation risks, as each maintains a high health score.

Additionally, USDT composes 99.98% of the collateral assets against FLOKI. Given USDT’s high liquidity on BNB, this ensures that even in the event of severe market volatility, the liquidation process can still proceed smoothly.

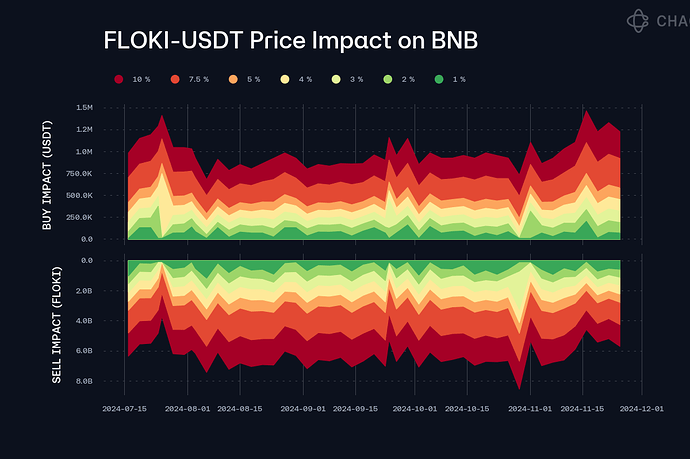

Liquidity

The liquidity of FLOKI has remained stable, with a 2 billion FLOKI for USDT swap incurring less than 3% price slippage.

Recommendation

We recommend increasing the borrow cap to 8,000,000,000 FLOKI. This increase is backed by Chaos Labs’ risk simulations, which consider the user’s behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB GameFi Pool | FLOKI | 68,000,000,000 | - | 4,000,000,000 | 8,000,000,000 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0