Summary

A proposal to:

- Increase WBTC’s supply and borrow caps on Venus’s ZkSync deployment.

- Increase USDC’s supply cap on Venus’s ZkSync deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

WBTC (ZkSync)

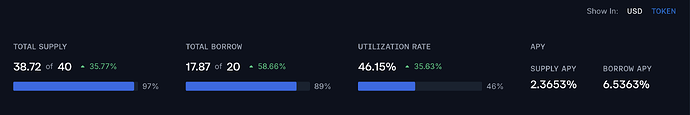

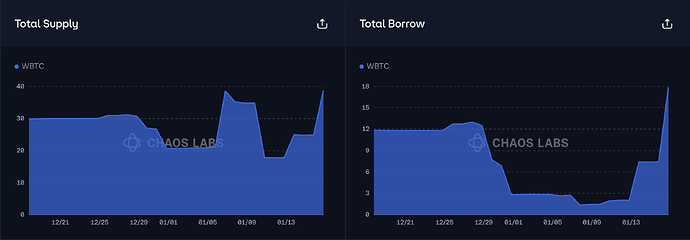

WBTC has reached 97% supply cap utilization and its borrow cap is 89% utilized.

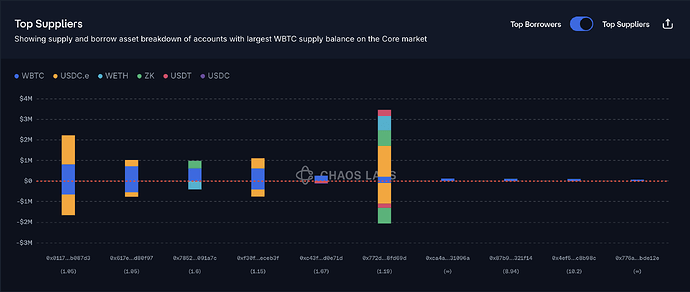

Supply Distribution

The top WBTC supplier accounts for 20% of the total supply, indicating some concentration risk. However, since this user is collateralizing and borrowing the same assets, it does not pose significant liquidation risk at this time. The remaining positions are either staking and borrowing the same asset or maintaining a high health score, reducing the risk of liquidation.

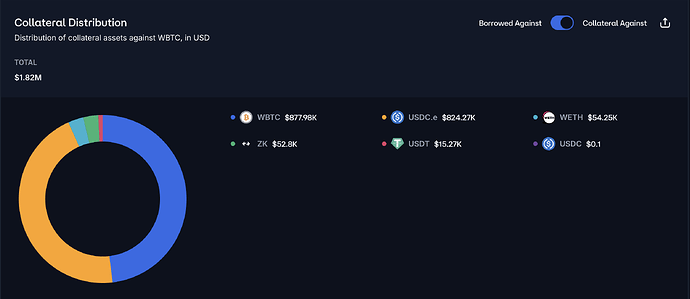

The largest borrowed asset against WBTC is USDC.e, closely followed by WBTC itself, comprising 39% and 38% of the total borrowed asset distribution, respectively.

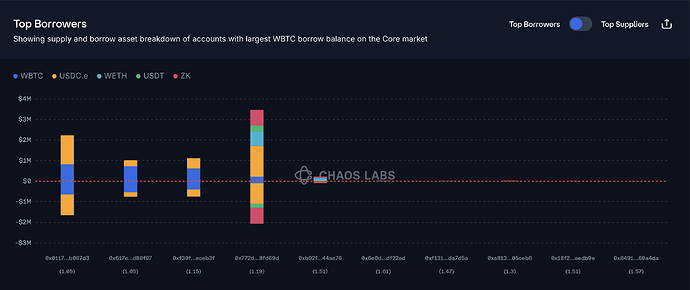

Borrow Distribution

The borrow distribution of WBTC is fairly balanced, with three largest borrowers borrowing WBTC and USDC.e by collateralizing against the same assets. The remaining top borrowers maintain high health scores, further reducing liquidation risks.

The largest collateral asset against WBTC is WBTC itself, accounting for 48% of the total distribution, which significantly reduces liquidation risks.

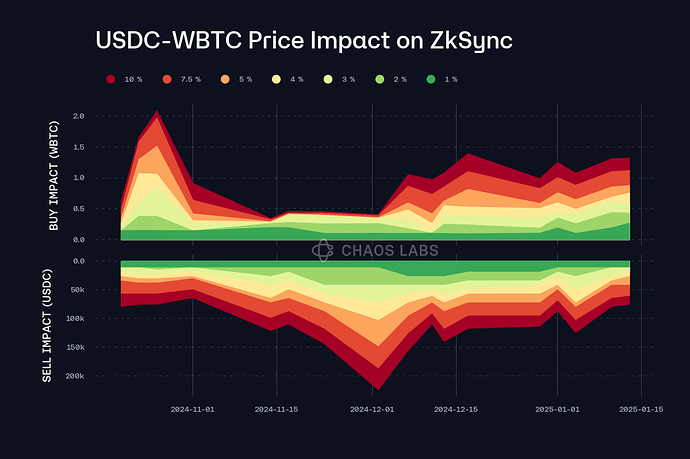

Liquidity

WBTC’s liquidity on ZkSync is low compared to its total supply. However, based on our observations of the current top suppliers and borrowers, we do not see this as a significant concern. Nonetheless, we will take liquidity into account in our considerations when offering cap recommendations.

Recommendation

Given the user-behavior and on-chain liquidity, we recommend increasing the supply cap to 62 WBTC and borrow cap to 31 WBTC.

USDC (ZkSync)

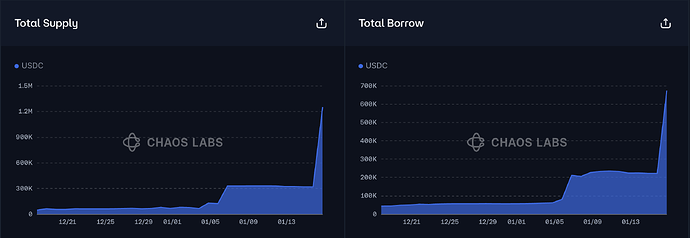

USDC’s supply cap has reached 100% utilization, while it borrow cap utilization stands at 67%.

Supply Distribution

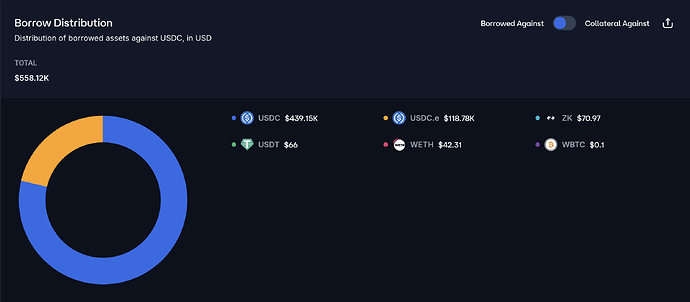

The supply distribution of USDC presents limited liquidation risks. Among the top 10 suppliers, 8 have no borrowing activities, presenting no liquidation risk at this time. The remaining two positions are collateralizing and borrowing correlated assets, reducing liquidation risks.

The largest borrowed asset against USDC is USDC itself, accounting for approximately 80% of the borrowed asset distribution, which significantly reduces liquidation risks.

Liquidity

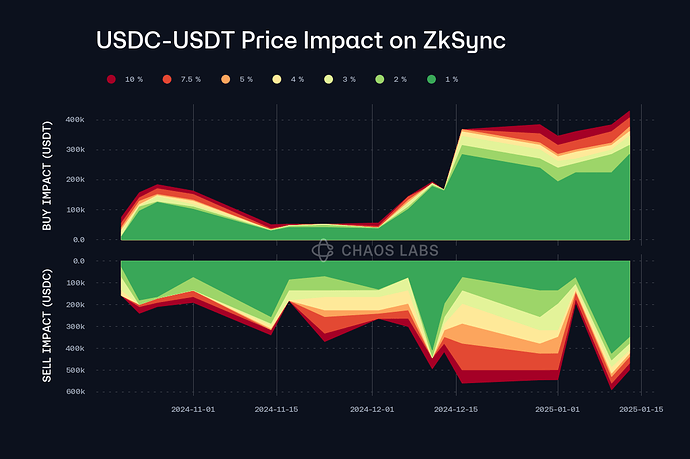

USDC’s liquidity has been increasing over the past two weeks, with a 400K USDC sell currently incurring less than 4% slippage.

Recommendation

Given the user-behavior and on-chain liquidity, we recommend increasing the supply cap to 6M and the borrow cap to 5.4M.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| ZkSync | WBTC | 40 | 62 | 20 | 31 |

| ZkSync | USDC | 1,250,000 | 6,000,000 | 1,000,000 | 5,400,000 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.