Overview

After President Trump announced new tariffs on Chinese imports, financial markets experienced one of the most abrupt and severe downturns in recent memory. In just 30 minutes, Bitcoin’s price dropped over 12%, falling from $116,500 to $102,700. Ether suffered an even sharper decline of around 20%, while several other assets lost more than 50% of their value within a 10-minute span during the same period. This sudden market disruption set off a chain reaction of liquidations across both DeFi and CeFi platforms. While the protocol has accrued approximately $1.38M of bad debt, the bonuses from the liquidations outpaced the deficit, resulting in net positive revenue.

Liquidation Volume

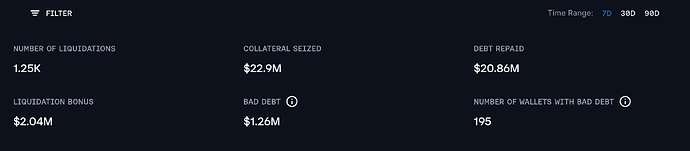

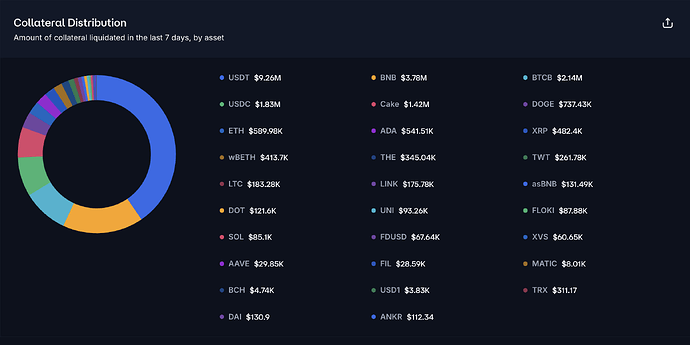

The rapid price action within the broader market has triggered a substantial wave of liquidations within the BNB Core Pool of Venus, primarily concentrated in USDT, BNB, BTCB, and USDC. The total number of liquidations reached 1.6K, while collateral seized exceeded $24M.

While the protocol, largely due to an oracle price deviation, has accrued approximately $1.38M of bad debt, the conservative estimate the aggregate liquidation bonuses and interest rate paid towards the protocol amounted to over $2.6M, creating a net surplus of $1.2M.

Oracle Deviation

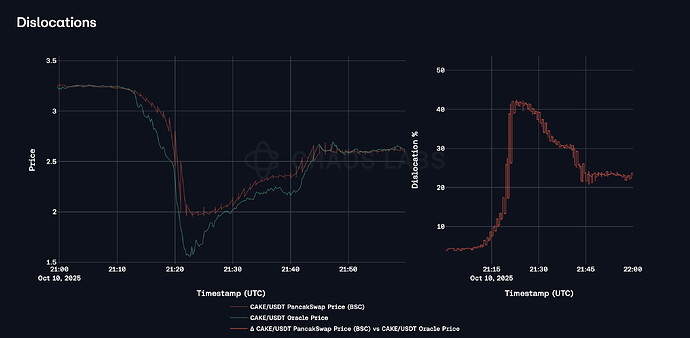

Venus experienced an oracle deviation of CAKE in this incident and, as a result, incurred around $1.1 worth of bad debt. Currently, Venus uses the Chainlink CAKE/USD oracle to determine the price of CAKE. However, between 8:30 PM and 10:00 PM UTC, the price reported by the Chainlink oracle significantly depegged from the effective market price of CAKE in the secondary market, specifically in the CAKE/USDT PancakeSwap liquidity pool.

As shown in the chart below, the oracle price consistently traded below the market price, with an average dislocation of around 30% and a maximum dislocation of up to 40%. After 10:00 PM UTC, the oracle price and the secondary market price gradually returned to peg and stabilized.

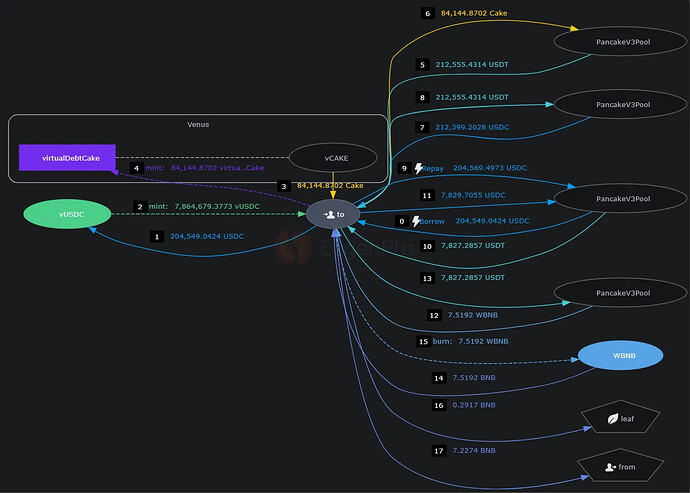

Due to the significant divergence between CAKE’s oracle-reported price and its actual market price on PancakeSwap, a user was able to exploit the price discrepancy. By borrowing CAKE against the artificially low oracle valuation and subsequently selling it on the open market at a higher price, the user effectively conducted an arbitrage against the Venus protocol. As a result, Venus incurred approximately $1.1M in bad debt as the oracle’s mechanics were taken advantage of.

Summary

Overall, during this flash crash, Venus resulted in approximately $1.38M in bad debt, primarily driven by the CAKE and EIGEN oracle deviation attack. While this was a negative outcome, it was offset by liquidation activity and other revenue, which generated approximately $2.6M in fees. As a result, the protocol remained net positive overall, with an estimated profit of $1.2M following the event.