Summary

Chaos Labs has completed a comprehensive analysis to provide informed recommendations for the launch parameters for a Floki-centered pool on Venus BNB. These initial recommendations aim to ensure a safe and efficient launch and are the basis for future optimization post-launch after observing usage on each pool.

FLOKI, USDT/USDC, and WETH

Collateral Factor

- We recommend starting with Collateral Factor and Liquidation Threshold parameters slightly less conservative than those of the same assets in the GameFi isolated pool.

- TOKEN’s CF and LT are set according to its volatility.

- These parameters may be further optimized utilizing our simulation platform after launch.

Supply and Borrow Caps

- Initial supply caps are set according to our Supply Methodology. This methodology determines how much of a particular asset can be liquidated with less slippage than the Liquidation Incentive (10%). We recommend setting supply caps at two times this value.

- Borrow caps are set to allow utilization over the Kink while preventing borrowing of all available supply if both caps are reached.

- This is a conservative approach to listing, and we will recommend increasing caps if and when we observe high utilization.

Interest Rates

- Recommendations are derived from observed historical rates and IR settings on other deployments.

- Stablecoin parameters are aligned with those on other isolated pools, with higher multipliers to compensate suppliers for greater risk.

Additional Parameters

- Close Factor: 50%

- Liquidation Incentive: 10%

- minLiquidatableCollateral: 100 USD

TOKEN

Collateral Factor

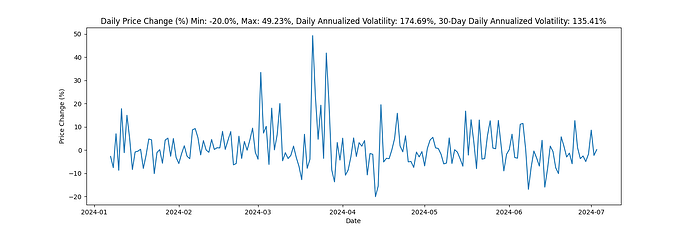

TOKEN has an average market cap of $120M over the last 180 days, with an average daily volume of $23M over that timeframe. Its 30-day daily annualized volatility is 135.41%, and its largest daily price drop was 20%.

Given these factors, we recommend a collateral factor of 40% and a liquidation threshold of 50%.

Supply and Borrow Caps

Following the methodology described above, we recommend a supply cap of 10M and a borrow cap of 5M.

Interest Rates

We recommend aligning TOKEN’s interest rates with FLOKI’s.

XVS

Given the large supply cap of XVS in the BNB Core Pool relative to on-chain liquidity, as well as the volatility of FLOKI and TOKEN, we do not recommend listing XVS in this pool.

Specification

| Asset | FLOKI | TOKEN | ETH | USDC | USDT |

|---|---|---|---|---|---|

| Collateral Factor | 50% | 40% | 75% | 78% | 78% |

| Liquidation Threshold | 55% | 50% | 80% | 80% | 80% |

| Supply Cap | 12,000,000,000 | 10,000,000 | 600 | 2,000,000 | 2,000,000 |

| Borrow Cap | 6,000,000,000 | 5,000,000 | 540 | 1,800,000 | 1,800,000 |

| Kink | 45% | 45% | 80% | 80% | 80% |

| Base | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Multiplier | 0.2 | 0.2 | .035 | 0.15 | 0.15 |

| Jump Multiplier | 3.0 | 3.0 | 2.5 | 2.5 | 2.5 |

| Reserve Factor | 25% | 25% | 20% | 10% | 10% |