Summary

A proposal to adjust stablecoin Interest Rate parameters across all Venus stablecoin markets.

Motivation

Following anticipated upcoming changes to Venus’s stablecoin interest rates and MakerDAO’s Dai Savings Rate (from 7% to 6%), we review stablecoin rates to ensure they are optimized.

Interest Rate Analysis

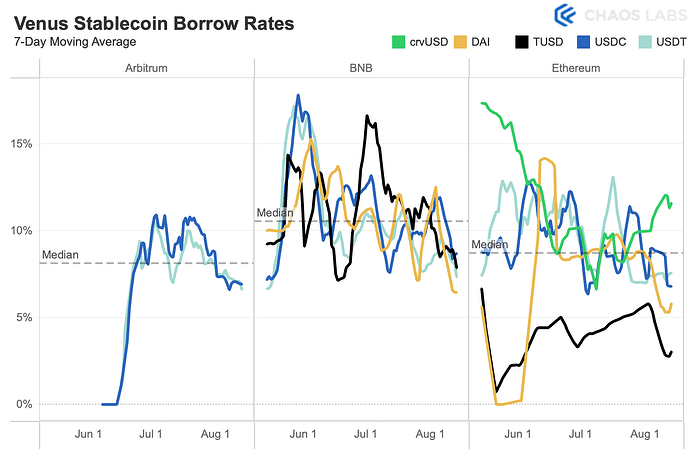

Overall, we find that rates have remained higher on BNB than on Arbitrum and Ethereum, both of which appear to be more reactive to changes in the DSR.

BNB

Rates on BNB Core have remained elevated, with occasional periods of over-utilization since the previous recommended change. However, we have observed a decrease in rates in recent days towards the target APY at the Kink. Even still, we recommend a slight increase in the multiplier for USDT, USDC, and DAI to reduce rate volatility, ideally reducing the time each spends above the Kink. We recommend reducing FDUSD’s multiplier given its relatively low utilization while leaving TUSD’s multiplier the same, aligning it with USDT, USDC, and DAI.

In the stablecoins pool, we observe very low utilization for USDT. As such, we recommend reducing its multiplier to the equilibrium we have observed in recent months.

USDT in the DeFi and GameFi pools has been slightly underutilized. Thus, we recommend a small decrease to their respective multipliers.

Ethereum

Rates on Ethereum have been stable, though with occasional spikes above the Kink; they have decreased slightly following the DSR announcement. As a result we do not recommend changing USDC and USDT rates at this time, though we recommend aligning DAI and TUSD’s multipliers. Additionally, we recommend increasing crvUSD’s multiplier given its frequent over-utilization.

Arbitrum

Rates on Arbitrum have been quite steady, and markets have occasionally been under-utilized. Thus, we recommend a slight decrease to stablecoin multipliers.

Specification:

| Asset | Chain | Pool | Current Multiplier (Annualized) | Recommended Multiplier (Annualized) |

|---|---|---|---|---|

| USDT | BNB Chain | Core Pool | 0.0875 (7.0% APY at Kink) | 0.1000 (8.0% APY at Kink) |

| USDC | BNB Chain | Core Pool | 0.0875 (7.0% APY at Kink) | 0.1000 (8.0% APY at Kink) |

| DAI | BNB Chain | Core Pool | 0.0875 (7.0% APY at Kink) | 0.1000 (8.0% APY at Kink) |

| FDUSD | BNB Chain | Core Pool | 0.0875 (7.0% APY at Kink) | 0.0750 (6.0% APY at Kink) |

| TUSD | BNB Chain | Core Pool | 0.1000 (8.0% APY at Kink) | - |

| USDT | BNB Chain | Stablecoins | 0.1000 (8.0% APY at Kink) | 0.0375 (3.0% APY at Kink) |

| USDT | BNB Chain | GameFi | 0.1500 (12.0% APY at Kink) | 0.1350 (10.8% APY at Kink) |

| USDT | BNB Chain | DeFi | 0.1500 (12.0% APY at Kink) | 0.1350 (10.8% APY at Kink) |

| USDC | Ethereum | Core Pool | 0.0875 (7.0% APY at Kink) | - |

| USDT | Ethereum | Core Pool | 0.0875 (7.0% APY at Kink) | - |

| DAI | Ethereum | Core Pool | 0.1500 (12.0% APY at Kink) | 0.0875 (7.0% APY at Kink) |

| crvUSD | Ethereum | Core Pool | 0.1250 (10.0% APY at Kink) | 0.1500 (12% APY at Kink) |

| TUSD | Ethereum | Core Pool | 0.1500 (12.0% APY at Kink) | 0.0875 (7.0% APY at Kink) |

| USDC | Arbitrum | Core Pool | 0.0875 (7.0% APY at Kink) | .0800 (6.4% APY at Kink) |

| USDT | Arbitrum | Core Pool | 0.0875 (7.0% APY at Kink) | .0800 (6.4% APY at Kink) |