Summary

In the past 48 hours, the cryptocurrency market has experienced a significant and rapid decline in asset prices. Both ETH and BTC saw substantial drops, with ETH plummeting by 17% and BTC by 12% from their recent peaks. Particularly noteworthy is the occurrence of 10% and 8.3% drops within just 30 minutes, reflecting the market’s volatility and the speed at which prices can fluctuate. This swift downturn also affected more volatile crypto assets, with many experiencing drops exceeding 20%. As a result, we summarize the recent liquidation events on Venus to analyze the impact of this downturn on the protocol.

Liquidations

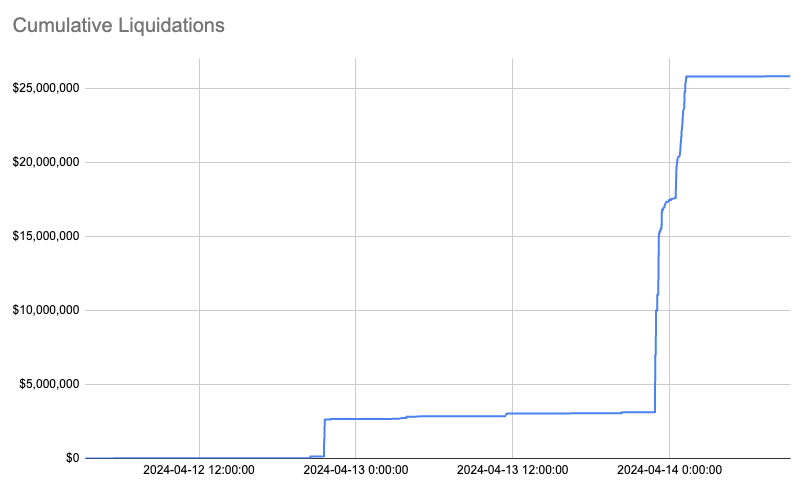

In the past 48 hours, liquidations totaling over $26 million took place, with a significant portion of $22.7 million, representing 87%, occurring within the last 24 hours alone. These liquidations involved 765 events across 268 unique accounts and were executed by 2 distinct liquidators.

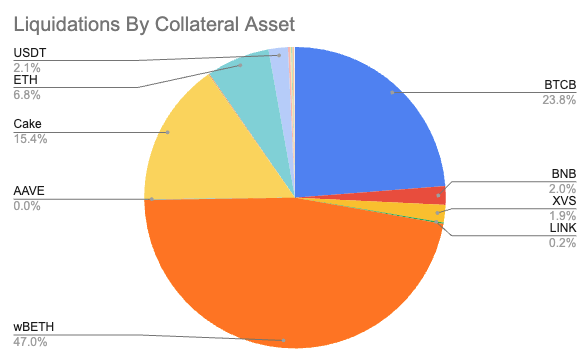

All liquidations took place on Binance Chain. 53.8% of all liquidations involved wbETH or WETH as collateral assets. Additionally, assets like BTCB and CAKE saw a relatively high number of liquidations, accounting for 23.8% ($6.13 million) and 15.4% ($3.97 million) respectively.

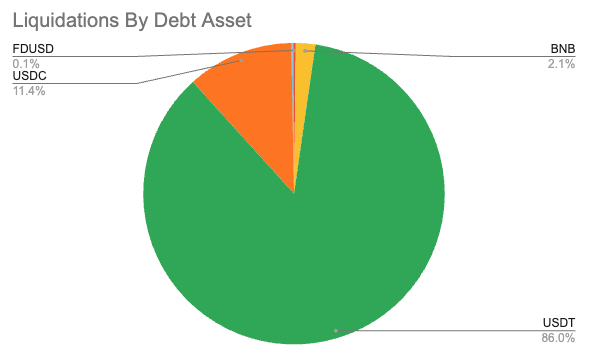

As expected, 97.9% of debt assets were represented by various stablecoin iterations.

Account Size Distribution

Below, we present the distribution of liquidated accounts over the past 48 hours, segmented by the size of the positions involved. Notably, the largest account totaled $17.8 million, representing a wbETH-collateralized USDC debt position. This position saw its health factor dip to near 0.9 for several hours, primarily due to limited on-chain liquidity for wbETH. However, almost half of this position was subsequently liquidated, resulting in a current health factor of 1.04.

| Minimum Size of Collateral Seized | Number of Accounts | Sum of Liquidated | % of Total |

|---|---|---|---|

| 100K | 12 | 24.6M | 95.3% |

| 500K | 6 | 23M | 89.14% |

| 1M | 3 | 21M | 81.3% |

| 2.5M | 1 | 17.8M | 69% |

Bad Debt

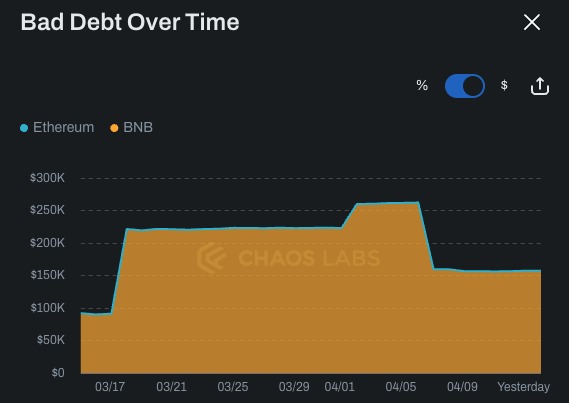

The Venus Protocol demonstrated relative efficiency over the last 48 hours, with minimal bad debt (<$500) incurred, as evidenced in the chart below.

Conclusion

Overall, the Venus protocol demonstrated robust performance over the past 48 hours, with the current parameterization proving effective during this stress test. We’ll remain vigilant and make necessary adjustments if faced with further extreme conditions.