Overview

Chaos Labs recommends an update to BNB’s interest rate curve and collateral factor within the BNB Core pool.

BNB IR Curve

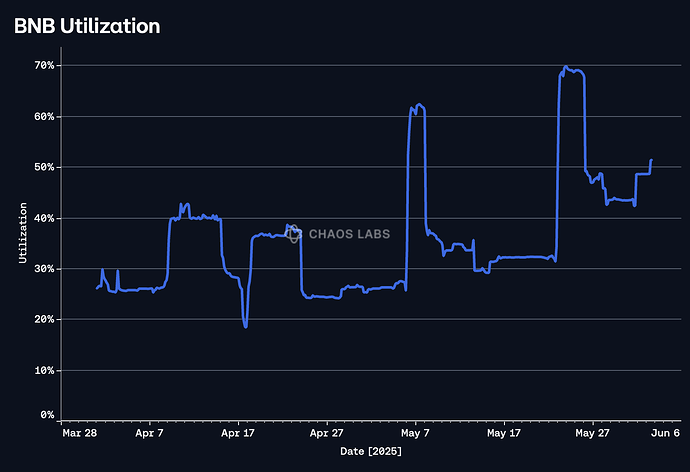

Following recent adjustments to BNB’s interest rate curve, we have observed consistent increasing utilization of the market. In previous market regimes, utilization would fall below 30% outside of Launchpool events. Now, however, the baseline for utilization has risen, with utilization dropping to just under 45% after the most recent Launchpool.

Additionally, the implementation of an IR curve designed to boost utilization has led to three successive Launchpools each with higher utilization than the last. The most recent Launchpool (shown above around May 27) reached a peak utilization of 70%.

Maintaining higher levels of utilization — rather than sharp increases and decreases — is beneficial for both the protocol and suppliers, both of whom benefit from more consistent yield. Additionally, allowing for greater utilization during Launchpools is beneficial for Venus, BNB suppliers, and borrowers who have access to greater liquidity.

As a result, we propose increasing the Kink 1 parameter to account for this new market structure, allowing more borrowing before the market enters the rate discovery zone between Kink 1 and Kink 2.

Recommendation

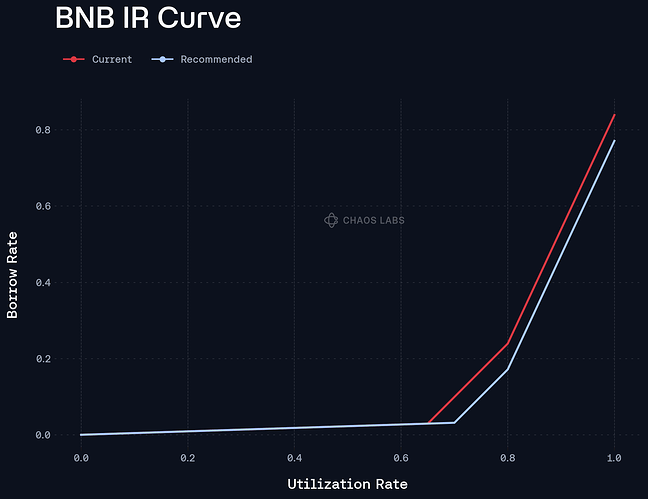

We recommend increasing Kink 1 by 5 percentage points, creating a curve that facilitates greater utilization. The chart below displays the current borrow curve compared to the recommended curve.

As displayed, this is a simpler change than previous proposals — increasing Kink 1 pushes back the rate discovery zone and thus creates a lower borrow APY at all points past Kink 1.

BNB Collateral Factor

BNB’s current collateral factor (CF) is set at 78%. Given the evolving risk profile of the asset a reassessment of this parameter is warranted. Increasing BNB’s CF will enhance capital efficiency and ensure Venus remains the protocol of choice in the BNB lending market.

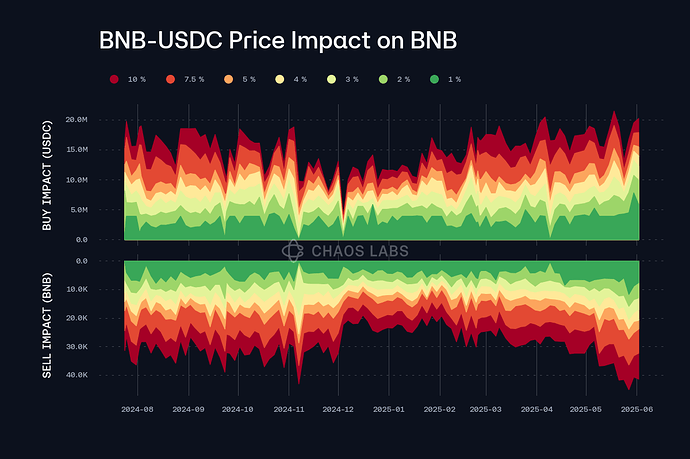

Liquidity Profile

BNB exhibits strong and stable on-chain liquidity. Over the past quarter, spot and on-chain depth has grown, with large trade sizes incurring minimal price impact. In particular, slippage for a sale of 20K WBNB result in less than 4% price slippage. Additionally, the primary borrow activity against BNB is concentrated in high-liquidity assets, predominantly stablecoins such as USDC and USDT.

Volatility and Drawdown Characteristics

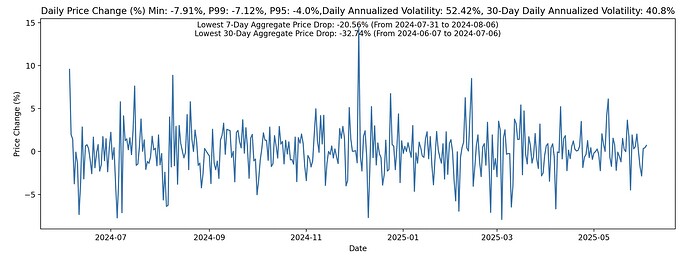

Recent volatility assessments indicate that BNB’s volatility has decreased significantly over the last year. Moreover, historical BNB’s drawdowns have been in line with other major assets, contributing to a favorable liquidation profile.

Recommendation

Thanks to the improved risk profile of the asset, and after careful consideration through Chaos Labs’ simulations, we support a moderate increase in CF. Our simulations show that under current liquidity and volatility regimes, raising BNB’s collateral factor from 78% to 80% does not materially increase the likelihood of large-scale protocol liquidations or bad debt generation. It also supports Venus’ positioning by enabling protocol parameters to be highly competitive, helping retain market share in the BNB lending ecosystem.

Specification

| Parameter | Current | Recommended |

|---|---|---|

| Kink 1 | 65% | 70% |

| CF | 78% | 80% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.