Summary

A proposal to reduce BNB’s Kink in the BNB Core Pool

Motivation

Following a change to interest rates in March, we have observed changes in the market and present them here. In March, the kink was increased from 0.6 to 0.8, the multiplier from 0.15 to 0.225, and the jump multiplier from 4 to 6.8.

The stated goal of this change was to offer equivalent borrowing rates at higher utilization levels, while ensuring an ample buffer in case of liquidations.

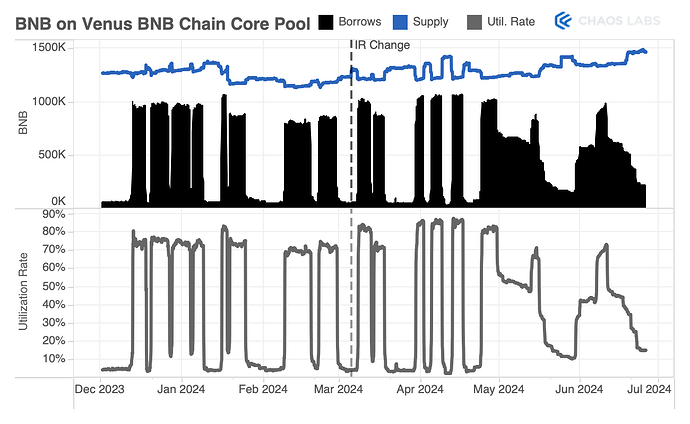

The chart below shows the overall supply in the BNB Chain Core Pool, along with borrows in black and utilization rate in the bottom half.

There are three key takeaways from this chart:

- Notional borrows are relatively predictable, and increased slightly following interest rate changes.

- Notional borrows are more correlated to Launchpool event length than to utilization or interest rates, indicating that users do have some sensitivity to accruing interest.

- Borrowers have been slower to repay since events beginning in late April, generating more protocol revenue.

The Launchpad that led to the highest borrow demand was Manta (January), which lasted just two days. ENA had the second-highest notional borrowing demand, lasting just three days. Borrowers are naturally more rate sensitive as Launchpool duration increases and less sensitive as it decreases.

Below, we explore two different cases to simulate outcomes under the old and new IR curves, the first with the assumption that utilization would have remained the same, the second assuming that interest rates would have remained the same.

Case 1: Holding Utilization Equal

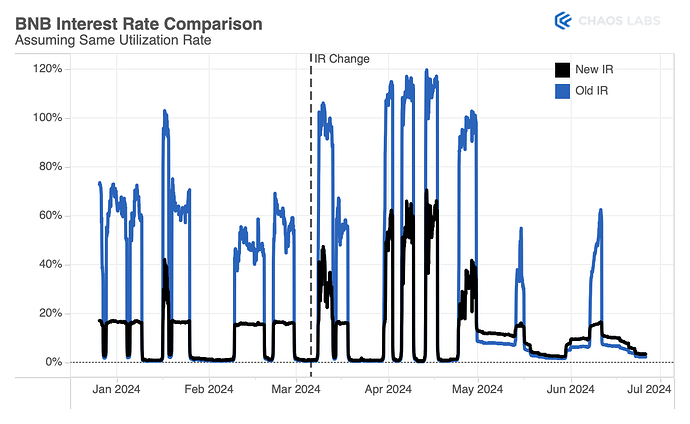

The chart below shows observed borrowing rates following the previously discussed adjustment, as well as hypothetical borrowing rates under the previous IR curve, assuming utilization was equal.

We find that the previous curve would have led to significantly higher rates during Launchpool events, again assuming that utilization was equal, as the utilization would have been above the Kink.

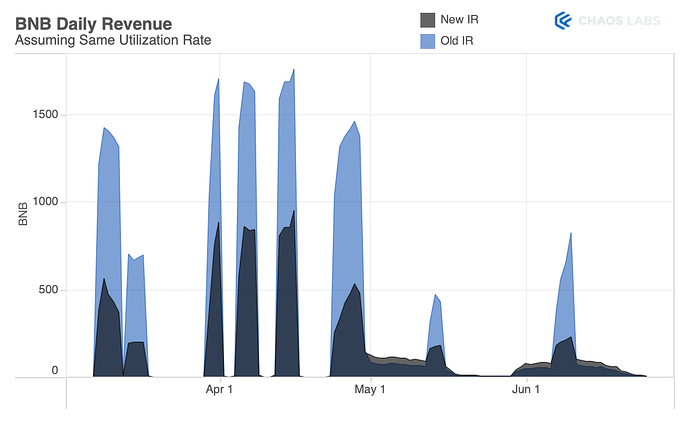

However, we also note that since May, the updated curve has generated more income outside of Launchpool events, while the old curve would have theoretically generated more during Launchpools, peaking at over 1,700 BNB per day instead of just under 1,000 per day.

Case 2: Holding Interest Rates Equal

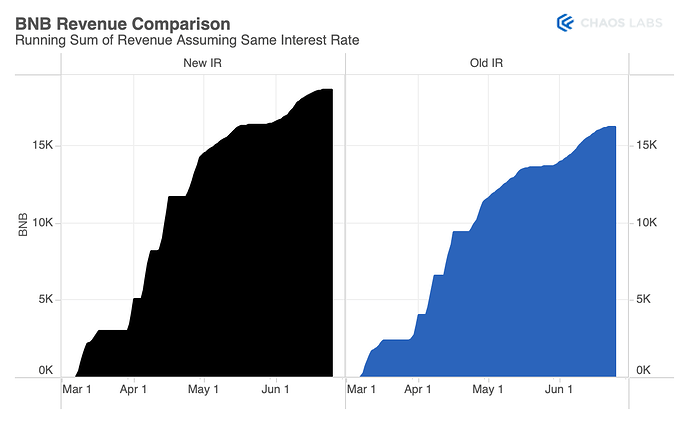

Given the finding that the amount borrowed varies based on the length of an event — indicating that borrowers are somewhat rate sensitive — we do not find it likely that utilization would have been the same under the previous IR curve, as higher borrowing rates likely would have reduced the notional amount borrowed. Holding interest rates even to simulate rate-sensitive borrowers, we find that the old IR curve would have produced less revenue by reducing the amount of BNB borrowed.

Since March, under these theoretical circumstances, the BNB market would have generated 3K BNB less than what was actually generated.

However, the true outcome likely lies somewhere in the middle of Case 1 and 2, and is especially difficult to discern given confounding factors related to Launchpools: demand, market conditions, etc. It is likely that, under the old IR curve, utilization would have been lower while interest rates would have been slightly higher.

Recommendation

Should the community wish to optimize for protocol reserves, we recommend decreasing the Kink to 0.7 from 0.8. This change would provide valuable insights into the elasticity of borrowing demand — helping to determine the sensitivity of Launchpool borrowers to borrow rates — and help to further optimize this market.

Specification

| Chain | Pool | Asset | Current Kink | Rec. Kink |

|---|---|---|---|---|

| BNB Chain | Core | BNB | 0.8 | 0.7 |