Overview

Following observations of Launchpool behavior, Chaos Labs recommends a refinement to Venus’s BNB Core pool BNB IR curve.

Motivation

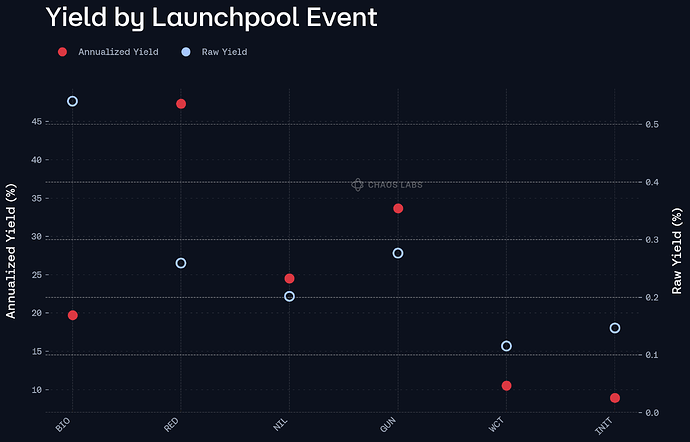

We continue to observe changing dynamics in the Launchpool market. The most significant of these is the decreasing value of Launchpool rewards. By tracking the exchange rate of asBNB, we are able to infer the value of these events, finding that they have decreased significantly since January.

Additionally, the existence of assets like asBNB and clisBNB makes accessing Launchpool rewards easier than ever, not requiring users to lock up funds on Binance. Instead, they are able to hold the tokens and accrue rewards automatically.

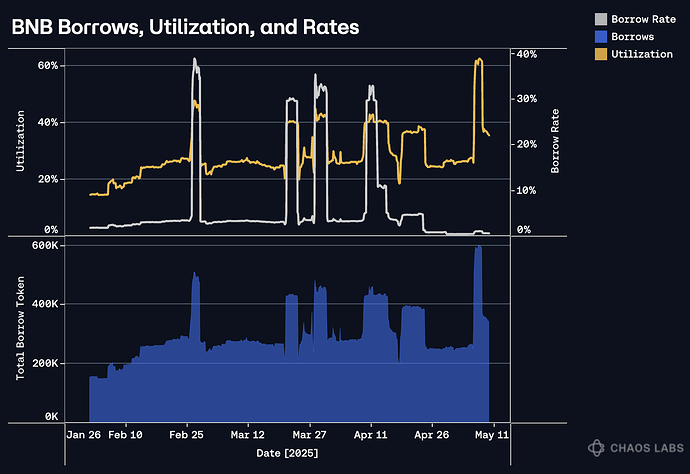

Finally, as previously discussed, the entrance of Lista DAO has reshaped the market, creating an influx of borrowable BNB. As of this writing, their target borrow rate is 0.91% at 90% utilization and 3.75% at 100% utilization. There is a total supply of 358K BNB, or about $230M, that is subject to this IR. This continues to be a significant underpricing of BNB debt, creating a situation in which there is more cheap BNB that can be borrowed on BNB Chain than there is demand. This has been manifest on Venus, where a recent decrease in the IR curve led to significantly lower borrow rates while driving an in increase in 400-450K BNB borrowed to 600K BNB borrowed, despite the borrow rate reaching a max of under 1.1%.

This indicates that the market has a glut of BNB supply, as well as a notional limit in the amount of BNB that will be borrowed, regardless of borrow rate. Thus, further reductions to the IR curve would not be productive. Instead, we recommend optimizing the parameters around the currently observed equilibrium, in which utilization reached a maximum of 63%.

Recommendation

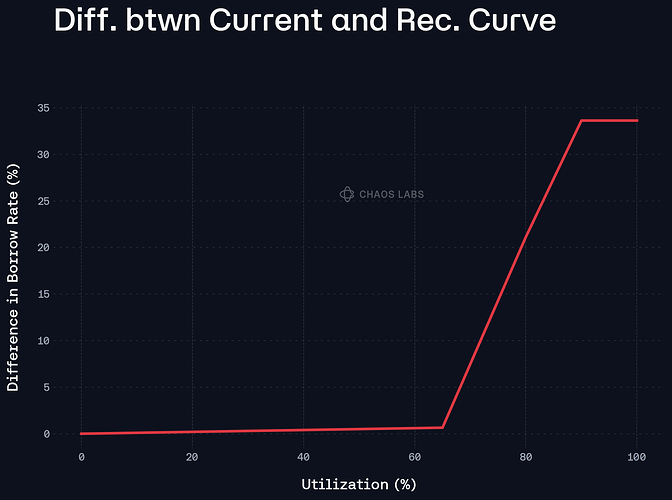

Our recommendation is to:

- Lower Kink 1 to 65%: this aligns with the max utilization during the last Launchpool.

- Slightly increase Multiplier 1: Increasing Multiplier 1 still ensures that the borrow rate at Kink 1 is lower than the borrow rate at full utilization on Lista. It will provide a boost to supplier yield.

- Lower Kink 2 to 80%: Given potentially increasing speculation in the market, this increases the buffer between Kink 2 and 100% utilization.

- Lower Multiplier 2 to 1.4: This makes the slope between Kink 1 and 2 less aggressive, improving the borrower experience should the market exceed Kink 1.

The combined effects of these changes is displayed below.

The target rate at the new Kink 1 would be 2.925%, just 0.65 pp higher than the current rate of 2.275% at 65% utilization.

Specification

| Parameter | Current | Recommended |

|---|---|---|

| Kink 1 | 0.8 | 0.65 |

| Base Rate 1 | 0 | 0 |

| Multiplier 1 | 0.035 | 0.045 |

| Kink 2 | 0.9 | 0.8 |

| Base Rate 2 | 0.0 | 0 |

| Multiplier 2 | 1.75 | 1.4 |

| JumpMultiplier | 3.0 | 3.0 |

| Reserve Factor | 10% | 10% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.