Summary

In October 2024, we proposed adding GM: BTC/USD [WBTC-WBTC] as a collateral asset to the money market Venus Protocol on its Arbitrum network deployment. Following community feedback, a vote was initiated on Snapshot, which successfully passed with a 100% quorum. The asset was subsequently added to Venus Protocol on Arbitrum.

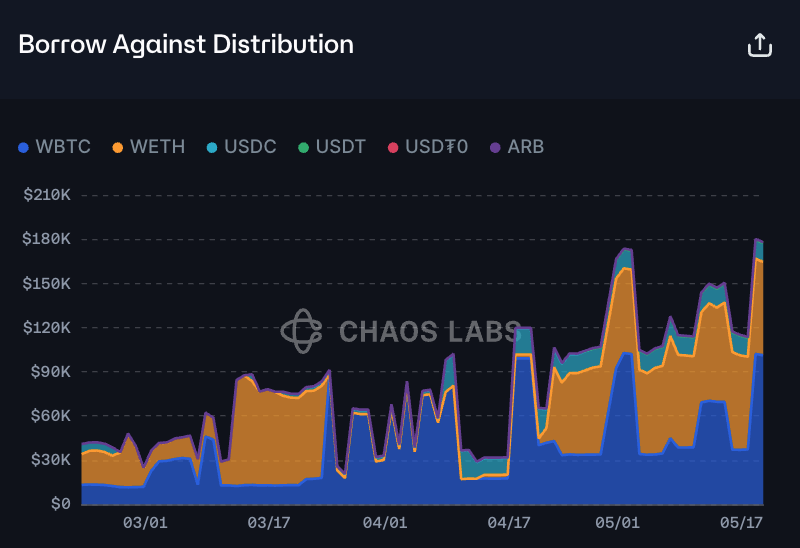

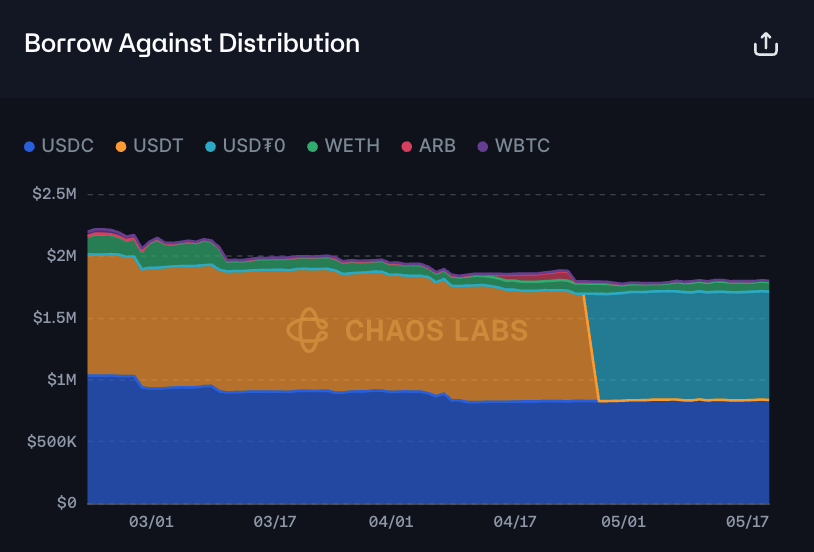

Now, GMX Contributors would like to propose the addition of the GM: BTC/USD [WBTC-WBTC] liquidity asset to Venus Protocol on the Arbitrum Network. This addition would allow this GM liquidity token for the GM: BTC/USD [WBTC-WBTC] pool to be used as collateral on Venus as well, enabling LPs to borrow against it, and thereby expanding Venus’ offerings, TVL, and central role on Arbitrum.

Benefits of Adding GM: BTC/USD [WBTC-WBTC] to Venus Protocol

- Increased demand for borrowable assets on Venus Protocol due to GM: BTC/USD [WBTC-WBTC] popularity and low-volatility nature.

- GM: BTC/USD [WBTC-WBTC] low beta properties make it an ideal asset to borrow against.

- Integration with Chainlink Data Streams in GMX V2 reduces the risks of front-running and price manipulation.

- $294.58 million of GM: BTC/USD [WBTC-WBTC] has already been minted on Arbitrum. This demonstrates the asset’s popularity.

- The APR of this GM: BTC/USD [WBTC-WBTC] pool stands at 9.17% (as of the time of writing); a very respectable yield

- More than 975 Liquidity Providers are holding the GM: BTC/USD [WBTC-WBTC] token: a healthy, decentralised distribution

- GMX V2 and its GM tokens are highly composable, and were designed with that functionality in mind.

The GM: BTC/USD [WBTC-WBTC] token is already being integrated into various DeFi protocols and used as collateral in multiple money markets: Dolomite, Abracadabra, Vaultka, and Deltaprime come to mind. This is evidence of significant community demand for the asset.

Performance of the GM: BTC/USD [WBTC-WBTC] token

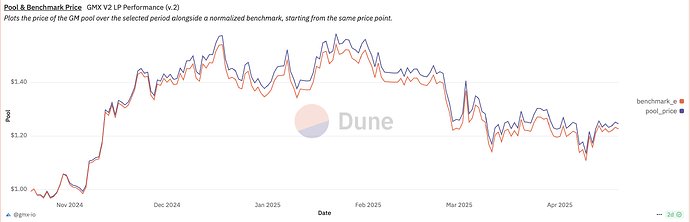

When comparing GM: BTC/USD [WBTC-WBTC] to a traditional Uniswap V2-style 50/50 rebalancing pool composed of equivalent long and short tokens, the GM: BTC/USD [WBTC-WBTC] pool outperforms by 3.71% over the last 6 months.

This highlights the advantages of GMX’s GM: BTC/USD [WBTC-WBTC] pool for liquidity providers, and its potential value as a collateral asset in money markets like Venus.

Motivation

GMX is a leading,battle-tested decentralised finance application, allowing users to buy spot crypto and trade perpetuals on 70+ top crypto assets. The introduction of several new features in GMX V2, including the integration with Chainlink Data Streams, has significantly reduced the risks of front-running and price manipulation and further bolstered protocol security. .

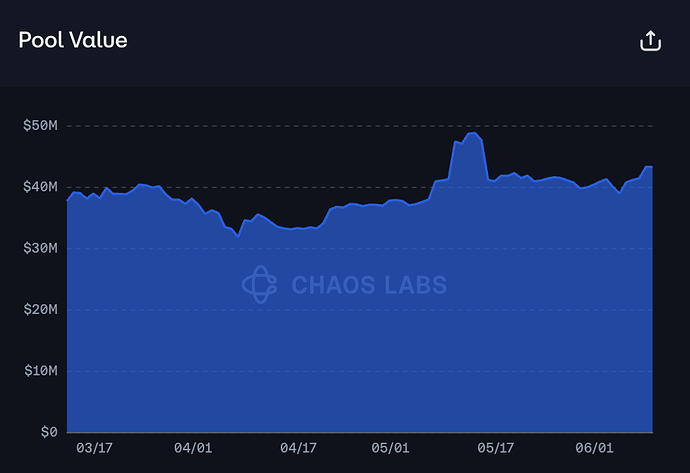

GM: BTC/USD [WBTC-WBTC] is a single sided Liquidity Token on the GMX V2 platform and earns fees from leveraged trading, borrowing fees, and swaps. More than $35 million in liquidity has been committed to GM: BTC/USD [WBTC-WBTC] by DeFi users, underlining the asset’s significant popularity.

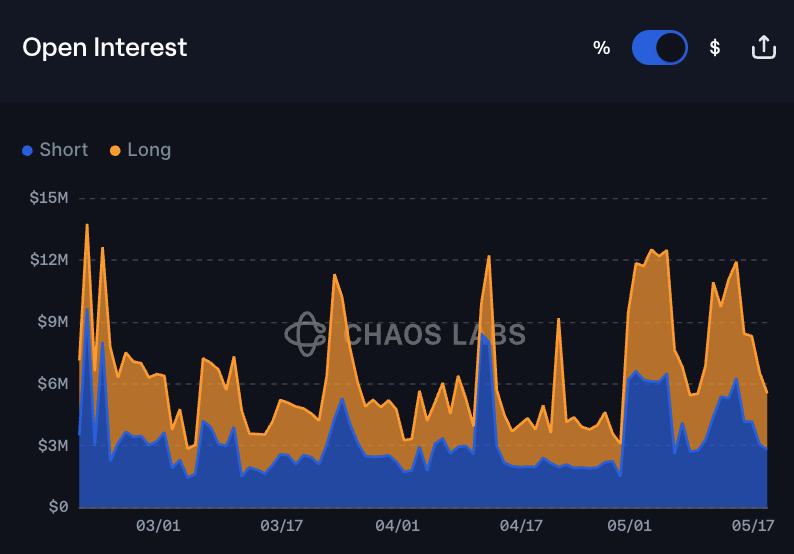

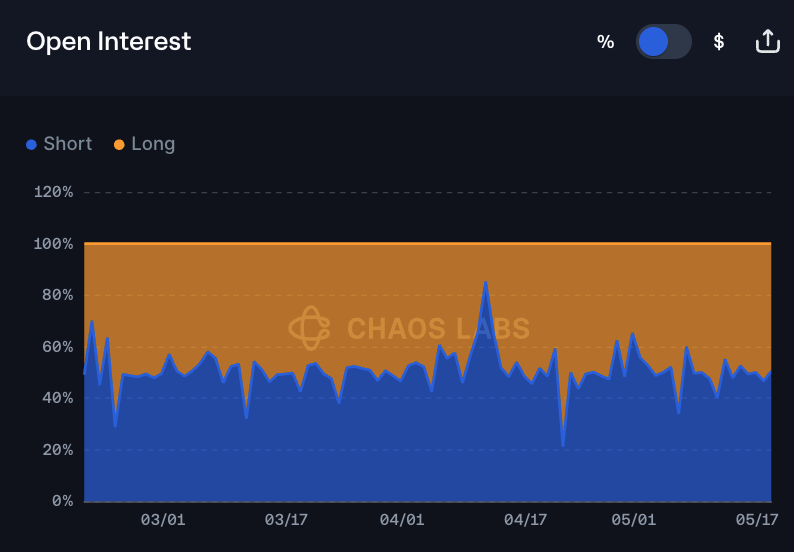

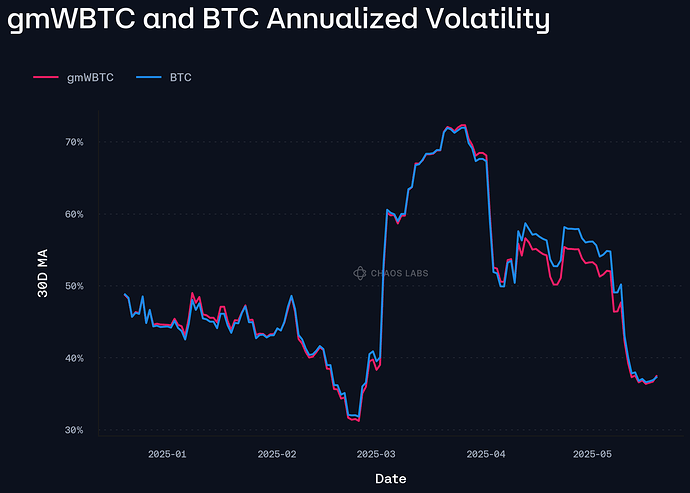

Integrating single-sided GM: BTC/USD [WBTC-WBTC] as a collateral asset in Venus on Arbitrum has the potential to create new demand for borrowable assets on Venus. GM: BTC/USD [WBTC-WBTC] has a proven track record of being a low-volatility asset whose value does not fluctuate heavily compared to the broader market. The low beta properties of gm WBTC make it an ideal asset to borrow against.

Background: GMX V2

GMX V2 was launched following discussions on the GMX forums in mid-2022. The limitations of GLP (the GMX V1 Liquidity Pool Token), designed for specific assets and sizes, restricted its potential scalability.

V2 builds on the successes and challenges of the GMX V1 model, aiming to enhance the experience for both traders and liquidity providers. V1 demonstrated a community demand for ownership of liquidity, creating a solid foundation for an on-chain perpetual market without relying on professional market makers. GMX simultaneously pioneered the use of Oracles for effective price discovery, providing liquidity providers with more equitable returns, and minimizing value extraction.

GMX’s performance over the years highlights traders’ need for control over assets, transparent pricing, guaranteed protocol solvency (100% backed and verifiable on-chain), and isolated risk.

Arbitrum supports the best of Ethereum DeFi, with multiple protocols integrating with GMX to meet the demand for yield-generating assets and capital-efficient trading.

GMX V2 builds upon these rock-solid foundations. It utilizes new sub-second data Oracles developed together with Chainlink, enabling real-time price updates and faster on-chain execution, thereby improving performance and reducing frontrunning risks. Liquidity pools in V2 are isolated to each market, enhancing flexibility for providers and allowing the emergence of new markets as trader interest grows. In addition to lower trading fees, GMX V2 features robust market parameters that promote balanced open interest, including variable fees and opportunities to earn funding fees. This results in more liquid markets, making GMX a preferred venue for trading, hedging, and earning.

Specification

Ticker: GM: BTC/USD [WBTC-WBTC]

Contract Address: 0x7C11F78Ce78768518D743E81Fdfa2F860C6b9A77

Chainlink Oracle: 0x19eCDd6DDc12597ec4A522fB1E25b1A580B605B7

Reference

Project: https://gmx.io/#/

GitHub: gmx-io · GitHub

Docs: GMX | GMX Docs

Audit: gmx-synthetics/audits at main · gmx-io/gmx-synthetics · GitHub

Twitter: https://twitter.com/GMX_IO

Telegram: @GMX_IO

Discord: GMX

Next Steps

We invite the community to consider this application for listing the gmWBTC market, and welcome suggestions in this direction and any related feedback.

Disclaimer

This proposal is provided for informational purposes only and does not constitute any form of legal commitment or agreement between GMX, Venus Protocol, or any other parties. The listing and parameters for such allocation are subject to the approval and discretion of Venus Protocol. GMX or any other parties make no warranties or representations regarding the accuracy, completeness, or suitability of the information presented, and will not be liable for any losses, damages, or adverse consequences that may arise in relation to this proposal. All parties are advised to conduct their own due diligence and seek independent legal advice before making any decisions or commitments based on this proposal.

GMX DAO is supported by Labs as voted on in Snapshot: (Snapshot 7)