This proposal outlines the allocation of Prime Rewards on BNB for November 2025, based on available funds. The allocation is retroactive, redistributing revenue generated through October 2025.

Allocation Strategy

In October 2025, Venus generated $588.5k in reserves revenue. Of this amount, $117.7k* (20%) is allocated to Prime and will be distributed as rewards in November.

Proposed allocation strategy:

- Allocate $110K in Prime rewards, maintaining a small buffer to safeguard against price fluctuations and prevent full depletion.

- Continue rewarding stablecoin markets (USDT and USDC) only, adjusting speeds to allocate $55k attributed this month to each market.

- Distribute rewards exclusively to suppliers. October data indicates that borrowing activity was only marginally affected by the pause in borrower incentives. Focusing rewards on the supply side helps strengthen liquidity and create conditions for lower borrow rates. In contrast, rewarding both sides tends to create arbitrage opportunities, artificially inflating activity and driving up borrow rates for other users.

- Going forward, adjust the rewards distribution from 50/50 to 75% USDT and 25% USDC, doubling down on the stronger-performing market (USDT) while continuing to support USDC adoption through targeted incentives.

*This allocation is an estimate based on token prices at the time the reserves were collected. Actual allocations may vary due to price changes between collection and conversion into Prime reward tokens. The current Prime budget stands at $127k.

Analysis

All the data presented below can be found in the Venus Prime dashboard.

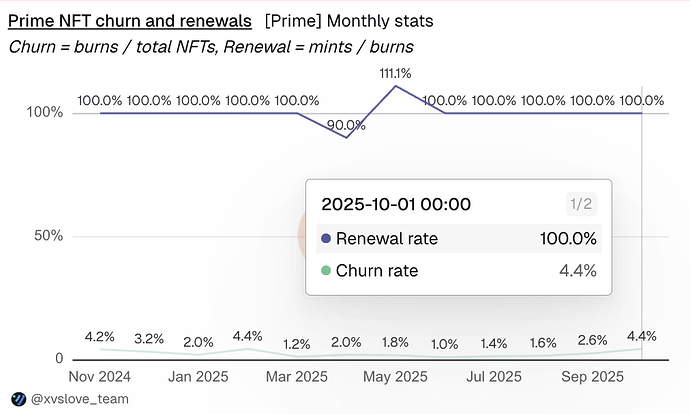

Churn and User Activity Overview

In October, churn was slightly higher than usual, but new entrants were more active than the users who left.

- Prime NFTs recorded a 4.4% churn rate with 22 NFTs burned, while maintaining a 100% renewal rate, showing that demand for the program remains strong despite reduced rewards in September.

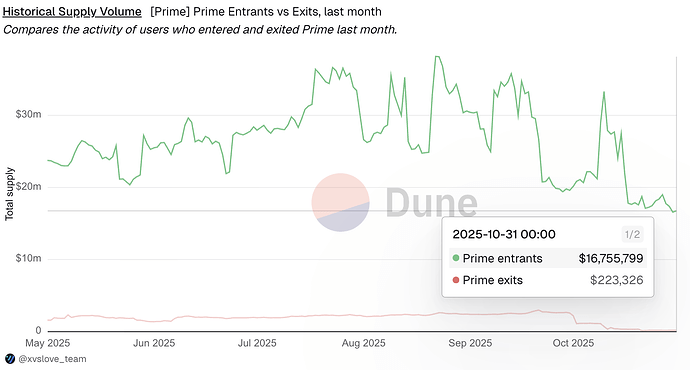

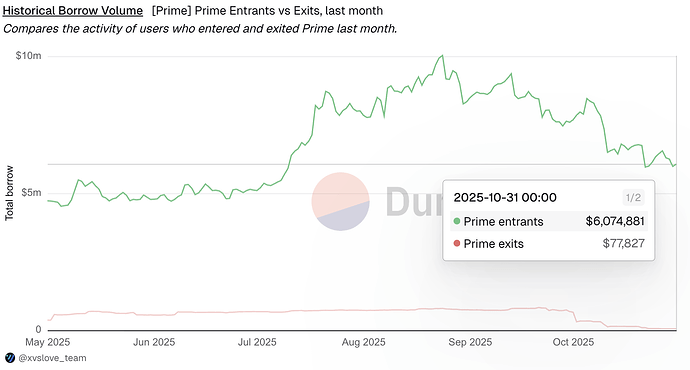

- After leaving Prime, former users reduced supply from $2.6M to $0.2M and borrow volume from $700K to $78K. In contrast, the new October Prime users have historically been much more active, with their October supply ranging between $16.6M–$33.3M and borrow volumes between $6.1M–$8.5M.

Prime markets - Activity, reserves and rewards

In October, the Prime rewards allocation strategy was adjusted to align incentive levels with current revenue and direct rewards exclusively to USDT and USDC suppliers, while pausing all borrower, BTCB, and ETH incentives.

Despite these changes, activity across Prime-eligible markets remained relatively stable. Borrow volumes declined slightly across all markets (except ETH), in part following the industry-wide liquidations on October 10. Overall, all markets recorded an increase in net revenue (reserves minus rewards).

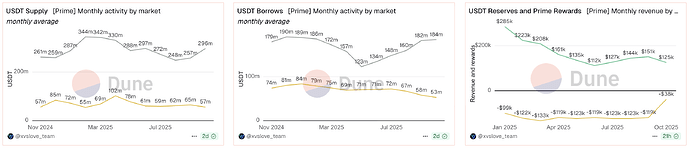

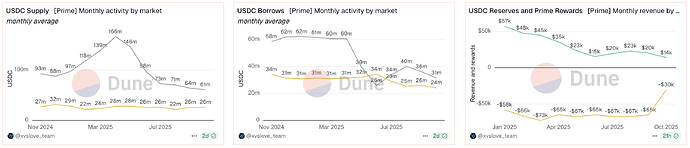

Stablecoin Markets (USDT, USDC)

- USDT supply increased (+9.3%), while USDC supply declined slightly (-2.8%).

- Average borrow volumes decreased across both markets following the industry-wide liquidations on October 10.

- This resulted in lower reserves revenue (USDT -17%, USDC -31.8%).

- However, reduced Prime rewards distribution led to higher overall net revenue (reserves minus rewards) for both markets:

- USDT net revenue increased from $31.3K → $87.4K.

- USDC net loss narrowed from -$44.8K → -$16.6K.

- Both markets continued to perform well without incentives.

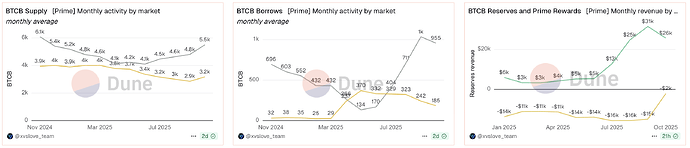

- BTCB supply increased (+13.2%) and maintained solid borrowing levels.

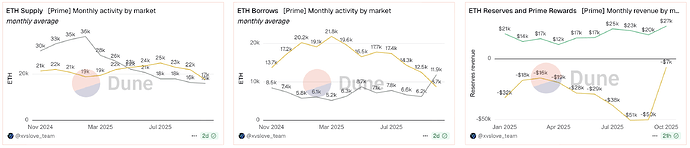

- ETH borrowing rose (+10.2%) despite a decline in supply (-12.4%).

- Net revenue improved:

- ETH reserves increased by 36.2%, with net revenue shifting from a -$30K loss to a +$20K gain.

- BTCB net revenue grew by 41.6%.

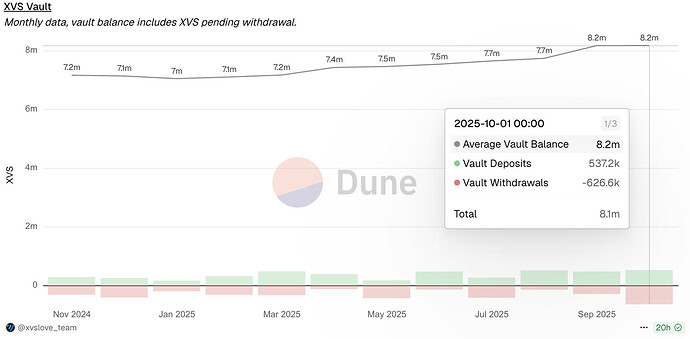

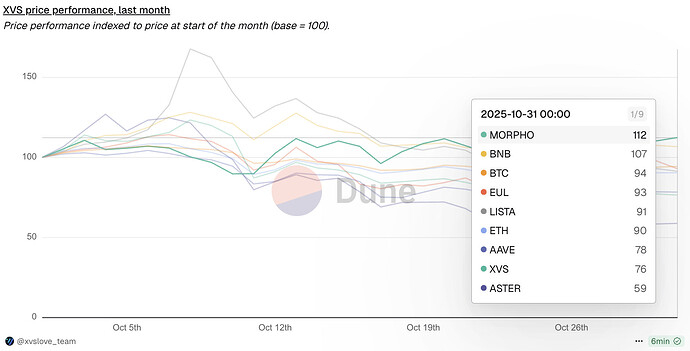

XVS - Vault and price

-

Withdrawals (-627K XVS) exceeded new deposits (+537K XVS) in October. Despite this, the average staked balance remained stable at around 8.2M XVS, including tokens pending withdrawal.

-

XVS underperformed relative to the broader market, falling 24% over the month, comparable to Aave (-22%). Other lending protocols saw mixed results: Lista (-9%), Euler (-7%), and Morpho (+12%), which notably outperformed peers. Within BNB DeFi, Venus outperformed Aster (-59%).