Overview

Chaos Labs supports listing weETHs on Venus Protocol’s Ethereum Core Pool. Below is our analysis and recommendations for initial risk parameters.

Technical Overview

weETHs is an LRT facilitated by Ether.fi that restakes on Symbiotic. Users have numerous deposit options including WETH, eETH, weETH, wstETH, cbETH, bETH, rETH, mETH, swETH, etc. Users that deposit into weETHs earn Symbiotic points, ether.fi points and Veda points. At the same time, users earn the composite staking rate of all yield bearing assets in the vault.

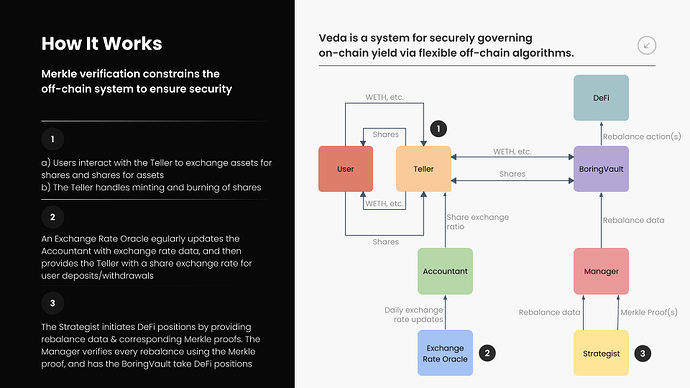

The vault is built using the Veda architecture. At a high level, the BoringVault serves as a barebones contract rebalanced by the Manager contract. The account responsible for using the Manager to rebalance is referred to as the strategist. Every rebalance call made by a strategist must include a Merkle proof to verify that the actions comply with the vault’s permitted logic. This functionality is implemented through the ManagerWithMerkleVerification contract.

Veda Architecture

Market Cap and Liquidity

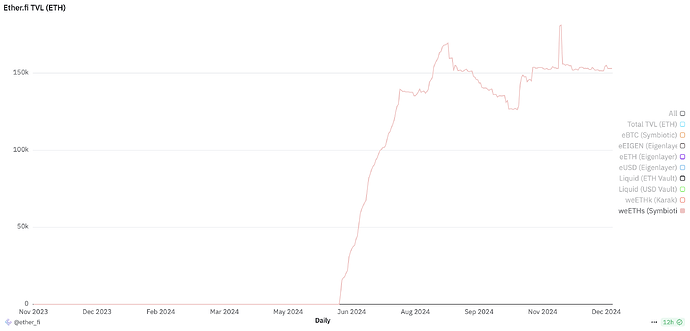

The TVL of weETHs showed rapid growth trend following its launch and has remained consistently above 120K ETH since August 2024. As of the time of writing, the TVL of weETHs stands at 153K ETH, translating to $512M.

weETHs TVL Over Time

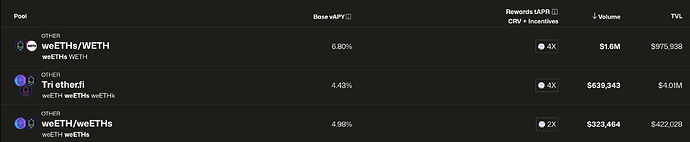

The majority of weETHs’ DEX liquidity comes from three pools on Curve: weETHs/WETH ($975K TVL), Tri ether.fi ($4.01M TVL), and weETH/weETHs ($422K TVL). As of the time of writing, a total of 636 weETHs are locked across these three pools.

weETHs Curve Liquidity Pool

Volatility

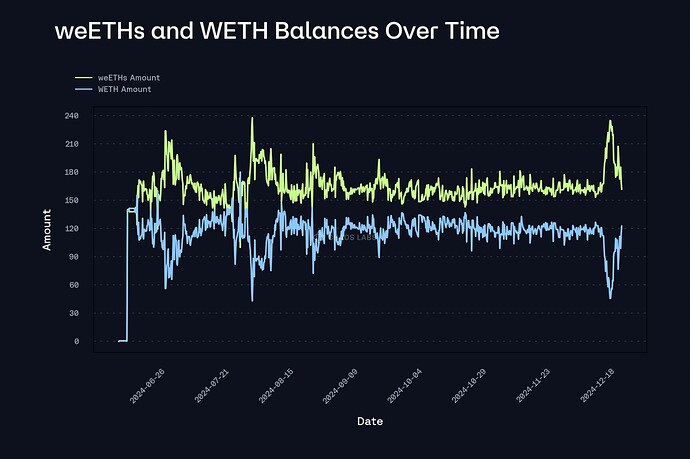

The volatility of weETHs against WETH has been relatively high, particularly over the past week, with the largest depeg reaching 300bps. Upon reviewing transactions, we found that on the December 20 and 21, multiple weETHs-for-WETH swaps occurred, likely contributing to the sharp price fluctuations. These transactions were predominantly executed through DEX aggregators, such as Odos, Paraswap, and CoW Protocol.

weETHs/WETH Curve Pool Volatility Over Time

Below, we present the balance of weETHs and WETH in the weETHs/WETH Pool over time. Around December 20, a significant number of weETHs-for-WETH swaps occurred, increasing the pool’s weETHs balance by approximately 90, leading to the observed discount. Similarly, in early August, an increase in the weETHs balance also resulted in price fluctuations and a drop in the weETHs/WETH price. These instances demonstrate that the limited DEX liquidity for weETHs contributes to its relatively high volatility.

weETHs/WETH Curve Pool Balance Over Time

Collateral Factor, Liquidation Threshold, and Liquidation Incentives

Following its growth phase, weETHs has had a consistent TVL. However, its DEX liquidity remains relatively small compared to its total supply, and it is prone to volatility relative to WETH. Therefore, we recommend setting the LT to 75%, the CF at 70%, and the Liquidation Incentive at 10%.

Supply and Borrow Cap

We recommend setting the supply cap at twice the liquidity available under the Liquidation Incentive. Using this methodology, we propose an initial supply cap of 700 weETHs.

Given the yield-bearing nature of weETHs and its limited borrowing use cases, we do not recommend enabling borrowing for weETHs.

Oracle Configuration/Pricing

Given that the token is already listed, we recommend continuing with the currently implemented pricing mechanism.

Specification

| Asset |

weETHs |

| Chain |

Ethereum |

| Pool |

Core |

| Collateral Factor |

70% |

| Liquidation Threshold |

75% |

| Liquidation Incentive |

10% |

| Supply Cap |

700 |

| Borrow Cap |

- |

| Kink |

- |

| Base |

- |

| Multiplier |

- |

| Jump Multiplier |

- |

| Reserve Factor |

- |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0