Summary

Add support for the BR market on Venus Core Pool [BNB].

Background

About Bedrock

Bedrock is the first multi-asset liquid restaking protocol, pioneering Bitcoin staking with uniBTC. As the leading BTC liquid staking token, uniBTC enables holders to earn rewards while maintaining liquidity, unlocking new yield opportunities in Bitcoin’s $1T market. With a cutting-edge approach to BTCFi 2.0, Bedrock is redefining Bitcoin’s role in DeFi — while integrating ETH and DePIN assets into a unified PoSL framework.

Bedrock is backed by top investors, including OKX Ventures, Longhash, Comma3 Ventures, and Waterdrip Capital, ensuring robust security through audits by PeckShield and Blocksec.

About BR

BR is the core utility token of Bedrock, designed to fuel incentives, governance participation, and liquidity provisioning. Here’s what it offers:

- Ecosystem Participation: Distributed to participants who contribute to Bedrock’s growth, such as liquidity providers and stakers, BR enables ongoing engagement and activity within the ecosystem.

- Tradable and Liquid: BR is a freely tradable asset integrated into DeFi protocols for lending, borrowing, and liquidity pools.

- Conversion to veBR for Governance: Users can commit BR to acquire veBR, gaining governance power and enhanced rewards.

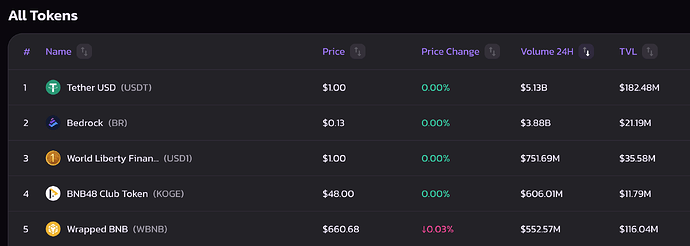

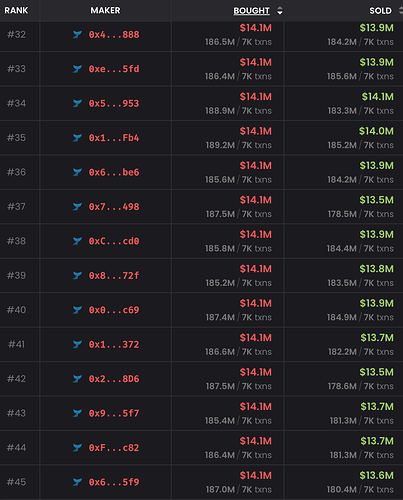

BR is listed on major centralized exchanges such as Bybit and Gateio, with over $50 million in on-chain liquidity on PancakeSwap (BNB Chain) and surpassing $4 billion in cumulative trading volume at the time of writing.

Benefits

Integrating BR as collateral on Venus Core Pool will offer several benefits:

- Enhanced Liquidity: Listing BR as collateral on Venus will significantly enhance liquidity on Venus, supported by BR’s substantial trading volume across BNB Chain. With deep liquidity and active markets, BR can serve as a reliable asset within Venus’s Core Pool.

- Increased Yield Opportunities: With Venus supporting BR as collateral in the Core Pool, users can unlock greater capital efficiency by leveraging their BR holdings. This integration drives higher potential returns from lending and borrowing activities, especially across assets like USDT, USD1, and BNB, which are already paired with BR on PancakeSwap.

- Unlocking Innovative DeFi Strategies: This integration sets the stage for more sophisticated DeFi strategies involving BR, USDT, and uniBTC. With BR liquidity pools currently generating up to 300% APR, users could soon leverage their uniBTC positions by borrowing USDT on Venus, then deploying capital into the BR/USDT LP on PancakeSwap. These types of flows can already be done with assets already available on Venus and can increase both supply and borrow demand, further enriching the Venus ecosystem.

Integrating BR into Venus’s Core Pool represents a strategic opportunity for both platforms. This partnership will enhance liquidity, attract new users, and drive innovative DeFi strategies within the BNB Chain ecosystem.

Specifications

Token Supply: 1,000,000,000 BR

Token Address(BNB Chain): 0xFf7d6A96ae471BbCD7713aF9CB1fEeB16cf56B41

Token Holders(BNB Chain): 80,565

Liquidity on PancakeSwap(BNB Chain): $50m

Additional Information

Website: https://www.bedrockdao.com/

Audit Reports: Audit reports | Bedrock DAO

X: Bedrock_DeFi