Add support for binance pegged SOL to Venus core pool on BNB chain

Summary

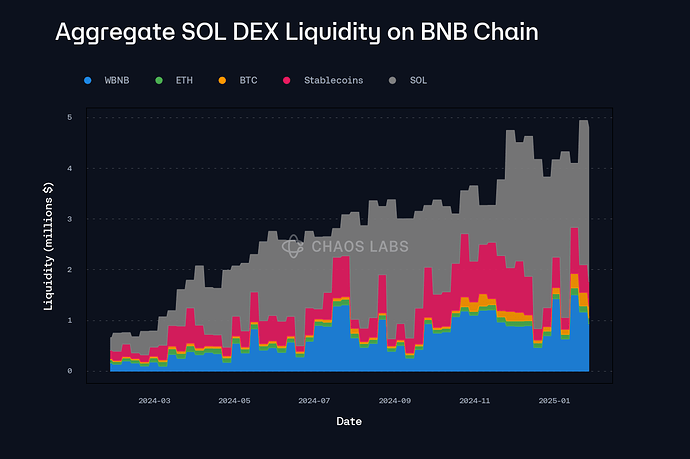

After a recent surge in Solana price and network usage, SOL on BNB Chain saw a significant raise in on chain liquidity and volume, making it an ideal asset to list on our core pool, with a lot of potential and use cases, listing SOL can bring significant revenue to Venus, as it’ll be the only EVM lending protocol for lending and borrowing Solana.

Background

Overview of the Solana Network

Solana is a blockchain platform designed to host decentralized, scalable applications. Founded in 2017, it is an open-source project currently run by the Solana Foundation based in Geneva, while the blockchain was built by San Francisco-based Solana Labs.

The network saw a significant growth in 2024, reaching over 60 Million active users in November 2024 according to TheBlock on-chain data.

About SOL

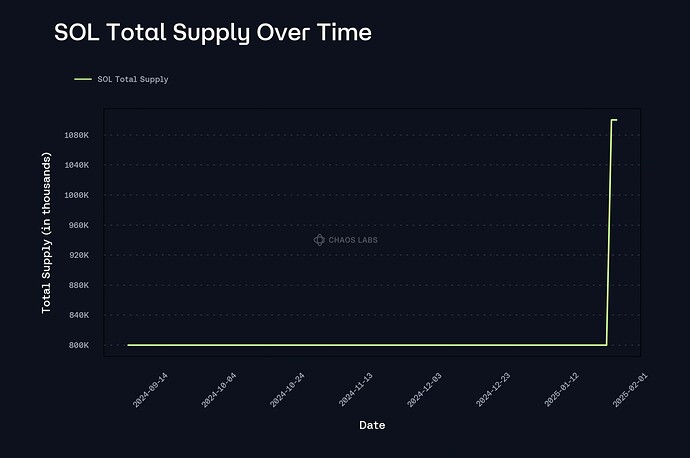

Due to the surge in usage and demand, the liquidity of wrapped Solana has seen a significant boost in on-chain liquidity, reaching over $5M on BNB chain, moreover, the daily trading volume at the time of writing is just over $5 billion.

Liquidity

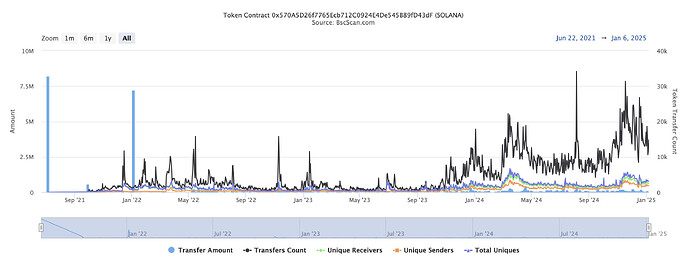

Solana is available for trading on all major CEXs, and it has vast liquidity on Pancakeswap V3 and few other DEXs on BNB Chain

PCS V3 WBNB Pair: 0x1E4600929Edf7F36B4A7eAc4C7571057D82a246c

PCS V3 USDT Pair: 0x9F5a0AD81Fe7fD5dFb84EE7A0CFb83967359BD90

Baby Swap USDT Pair: 0xAe08C9D357731FD8d25681dE753551BE14C00405

Baby Swap WBNB Pair: 0x8abd16bCC9077A6C5eD834eC5bA43Ad03b9139dc

Biswap WBNB Pair : 0x3530F7d8D55c93D778e17cbd30bf9eB07b884f35

Motivation & Benefits

The venus community has asked and requested the listing of SOL for multiple times, In addition, the proposal also aims to increase the protocol usage by attracting Solana ecosystem users, which could result in noticeable revenue boost within the core pools.

Reasons for borrowing SOL from venus could be:

-

Staking SOL to help validating the network to achieve higher APY than the Borrow APY.

-

Using SOL to buy into different IDO’s without the need to convert assets into SOL.

-

Using SOL for trading without the need to convert assets.

-

Using Sol to participate in Bybit launchpools

Specifications

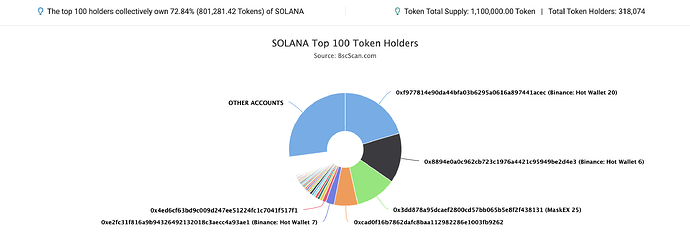

Token Address: 0x570A5D26f7765Ecb712C0924E4De545B89fD43dF

Liquidity on Dex: Over $5M

Market Cap: $120 billion

Oracle: Chainlink SOL / USD Price Feed | Chainlink

Sources

Token address: https://bscscan.com/address/0x570A5D26f7765Ecb712C0924E4De545B89fD43dF

Liquidity:

Market Cap: https://coinmarketcap.com/currencies/solana/

Trading Volume: https://coinmarketcap.com/currencies/solana/