Collateral Ratio of stablecoins seems to me inconsistent and risky, and may have effect of subsidizing DAI holders

Stablecoins are nearly 1:1 against each other and therefore probably should have very high collateral ratios (i.e. small haircuts or large maximum leverage). I would also think less liquid stablecoins should have a higher reserve factor, i.e, in a panic the stablecoins that could flee the fastest in volatile market.

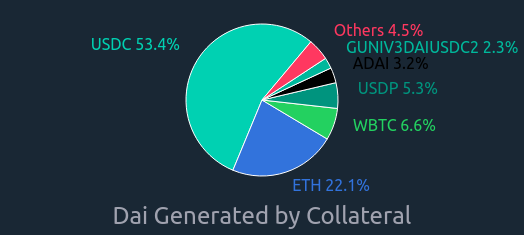

Current Setup:

USDT: 80% Collateral / 10% Reserve

BUSD: 80% Collateral / 10% Reserve

DAI: 60% Collateral / 10% Reserve

UST: 80% Collateral / 20% Reserve

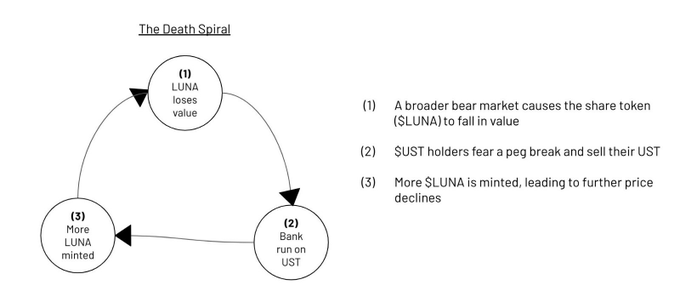

For comparison major cryptos are 80%/20% like UST. Unlike nonstable crypto, UST cannot have a short squeeze liquidity event since it can be converted back and forth with LUNA. If anything, I would think this would require it to have a lower reserve requirement than other crypto. DAI, by contrast, has no such mechanism, and thus its price can spike in short term liquidity events as we have seen in the past especially when liquidations occur and start sucking out the supply. Shouldn’t this make UST have at least as low a reserve requirement as the others, with DAI if anything deserving the highest of the stablecoins?

On the other hand, DAI with its forced liquidation mechanism has a collateral factor of only 60% compared to other stablecoins 80%. Not only is DAI older and considered more of a safe haven, but also I would expect it to be vulnerable to a run in case of a crypto crash because of the forced liquidation sucking out the extra supply.

Shouldn’t this encourage borrowing DAI (low reserve), exchanging for UST, and then depositing? This means lots of UST collateral is backing lots of DAI loans. What if there is another liquidity event and DAI price spike where DAI becomes unpegged to the upside?