TLDR:

Gauntlet makes the following recommendation to optimize risk and capital efficiency for Venus:

- Increase the USDC CF from 80% to 82.5%.

Reasoning:

Assuming the supply of USDC stays similar, the CF change will increase capital efficiency by potentially enabling ~$1.9mm more borrows, with no impact to the VAR.

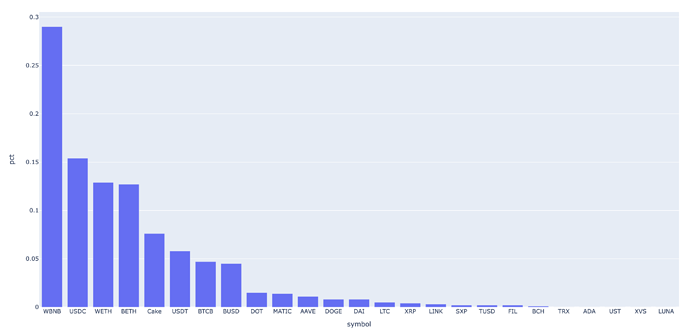

Currently, $77mm USDC supports roughly $21.3mm borrows, computed from a sum of all the debt USDC suppliers borrow, weighted by their USDC collateral size relative to other collateral they supply. Here is a breakdown of the debt USDC supports. The weighted average APR of these borrows is roughly 2.8%. At the current supply, increasing the CF by 2.5% will enable up to ~$1.9mm new borrows, which could yield $54k in extra annual revenue.

Methodology

Gauntlet’s parameter updates seek to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes daily (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be simply expressed as heuristics. As such, the input metrics we show below can help explain why some of the param recs have been made but should not be taken as the only reason for the recommendation. The individual collateral pages on the Venus Risk Dashboard cover other vital statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations.

For more details, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology.

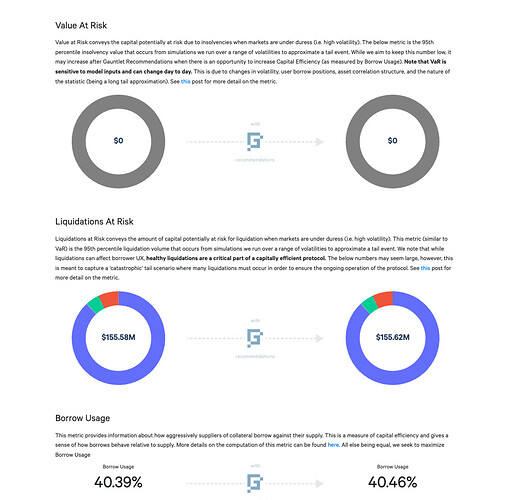

Risk Dashboard

The community should use Gauntlet’s Venus Risk Dashboard to better understand any updated parameter suggestions and general market risk in Venus. The below screenshot was taken on Jan 30th, 2023. Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event. Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event.

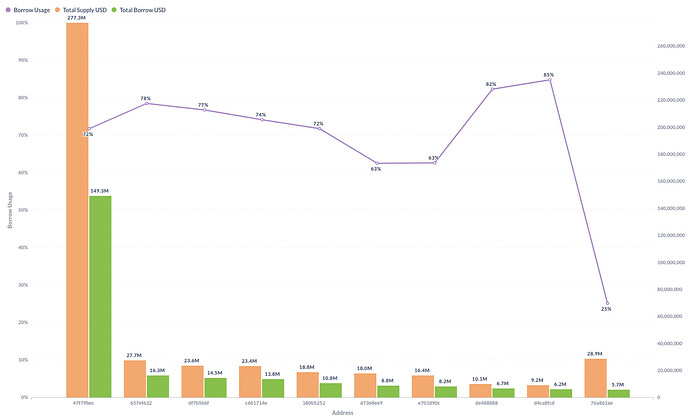

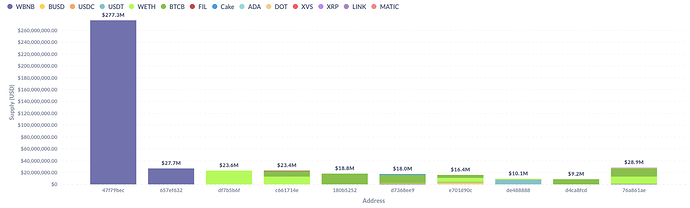

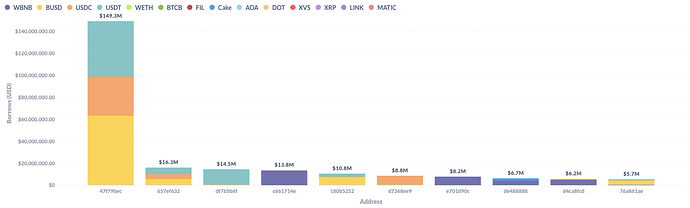

Top Borrowers

Top 10 Borrowers’ Aggregate Positions & Borrow Usages

Top 10 Borrowers’ Entire Supply

Top 10 Borrowers’ Entire Borrows

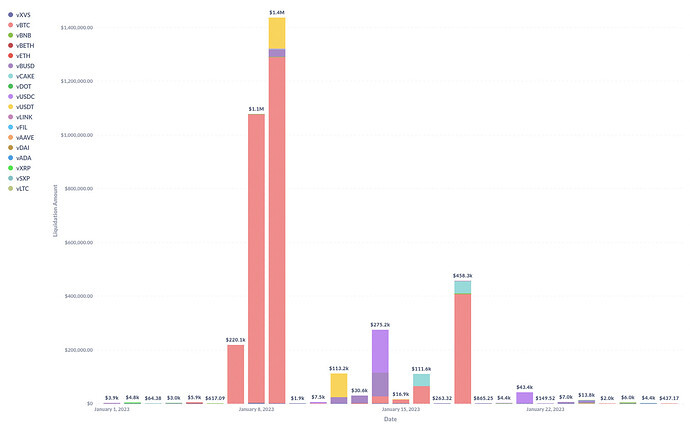

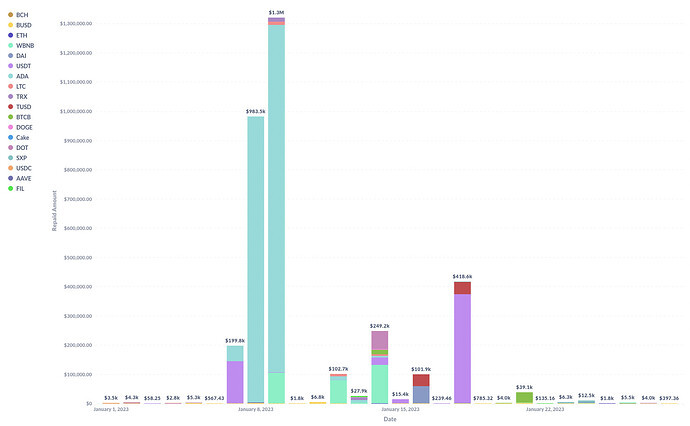

Liquidations

As Gauntlet tracks the state of the market and protocol, below shows some of the behavior we have been monitoring to ensure minimal risk. Between January 8-9, 2023, liquidations occurred for $2.36m in BTC collateral. These accounts’ borrows ($2.17m) were repaid in ADA. This was likely caused by the ~17% spike in ADA’s price between January 8 and January 9. Also, a liquidation for a single account occurred on January 18 for $408k in BTC collateral (with a borrow of $372k repaid in USDT). The price of BTC dipped 3.7% on January 18 and likely triggered the liquidation of this single user. We will continue to monitor user and protocol positions and make recommendations as needed.

Liquidations, Month To Date Time Series

Repaid Borrows, Month To Date Time Series

Helpful Quick Links

Please click below to learn about our methodologies:

Next Steps

- Gauntlet will put our recommendations up for a snapshot vote