Overview

Chaos Labs is providing risk parameter recommendations for adding sUSDe to the Venus Core Pool on Ethereum, should the Venus community decide on its addition. Following is our analysis and risk parameter recommendations for the initial listing.

Liquidity and Market Cap

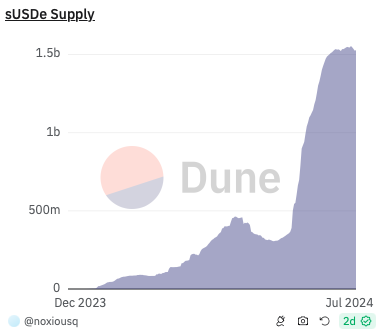

sUSDe is the staked version of Ethena’s synthetic dollar, USDe, which currently has a market cap of $3.4B; 1.5B USDe is staked as sUSDe.

Collateral Factor

Considering the volatility and the correlation of sUSDe to USD, we recommend setting the CF to 72% and the Liquidation Threshold to 75%. This is similar to other similar assets, albeit with a more conservative adjustment to account for the smaller liquidity and the asset’s relative novelty. Consequently, there might be slightly more variance expected in the future.

Supply Cap and Borrow Cap

Chaos Labs’ methodology for initial supply caps generally suggests establishing the Supply Cap at twice the liquidity available based on the Liquidation Bonus price impact. However, due to the non-atomic nature of withdrawals, evident in the 7-day sUSDe withdrawal period, we initially utilize a 1x value (using USDe) to determine the Supply Cap. In the event of increased demand, we will review and adjust our initial recommendations.

Given the current DEX liquidity profile of USDe, we recommend a supply cap of 45M sUSDe; we do not recommend allowing the asset to be borrowed given its novel risks and limited use cases for borrowing.

General Risks Associated with Ethena

The following section offers a concise overview of the external risks associated with sUSDe:

Significant LST Depeg

- Permanent LST Depeg: A permanent LST depeg could occur due to extreme validator slashing, hacks, or other unforeseen events, leading to USDe becoming under-collateralized.

- Liquidation of Ethena Hedges: In the event of a significant depeg (which is highly improbable given the current split between LSTs, ETH, and USDT), Ethena’s perpetual short positions on CEXes could be liquidated.

- Mass Redemptions for USDe: If Ethena faces mass redemptions for USDe, it could result in crystallizing losses if the protocol is required to sell an LST when it is under the peg. The primary market activity should ideally use USDT, with ETH as backup, and LST only utilized when a large proportion of USDe is redeemed within a short timeframe. Additionally, as mentioned earlier, the 7-day withdrawal period can lead to apparent short-term discounts in the sUSDe fair price, as selling effectively bypasses the queue.

Persistent Negative Funding Rates

- Insufficient Market Size: The perpetual market might be too small to absorb Ethena’s open interest, especially during periods of persistent negative funding rates.

- Drain on the Insurance Fund: A prolonged period of negative funding rates could drain Ethena’s insurance fund.

- Natural Movement to Negative Funding Rates: Ethena’s short open interest could naturally cause funding rates to move into negative territory.

Slippage and Operational Challenges

- Risk of Slippage: Multiple transactions are required to maintain balanced USDe backing and optimal backing ratios. Slippage or human errors during these transactions could lead to losses.

- Impact of Slippage on Depegging: Slippage during the closure of futures hedges may be passed on to primary market actors, posing a risk of de-pegging USDe to the extent of the slippage.

For a more in-depth quantitative analysis of the risks associated with sUSDe, please refer to our comprehensive analyses on Ethena, which are available here.

Recommendation:

| Parameter | Value |

|---|---|

| Borrowable | No |

| Collateral Asset | Yes |

| Collateral Factor | 72% |

| Liquidation Threshold | 75% |

| Liquidation Incentive | 10% |

| Supply Cap | 45,000,000 |

| Borrow Cap | 0 |

| IR — Base | - |

| IR — Multiplier | - |

| IR — Jump Multiplier | - |

| Kink | - |

| Reserve Factor | - |