Overview

Chaos Labs provides an update to MATIC and wUSDM’s oracle configurations, as well as changes to MATIC’s supply and borrow caps.

MATIC

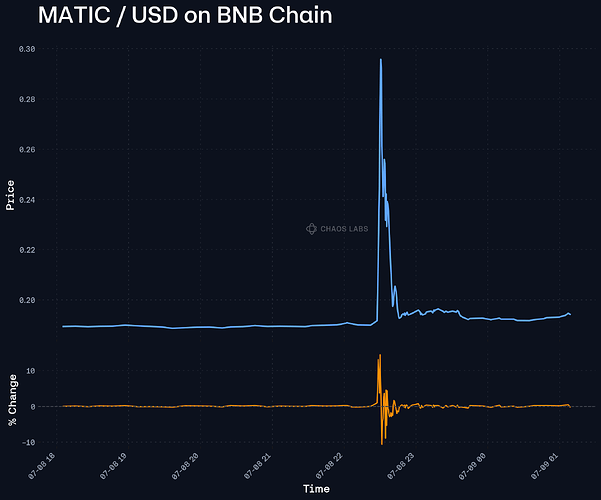

On July 8, alerts picked up an anomaly in Chainlink’s MATIC/USD feed on non-Polygon chains, including a 14.4% jump in a single block to $0.2798 and a high price of $0.29575 on BNB Chain.

Further investigation revealed that this was entirely due to price manipulation on Coinbase, where the price rose above $0.30; on-chain DEX prices did not experience such significant fluctuations.

This is the result of deteriorating MATIC liquidity as the ongoing MATIC to POL migration continues. To address this, and considering that MATIC and POL are priced 1:1 at a smart contract level, we recommend switching to a POL / USD feed, which provides appropriate prices while reflecting an asset with deeper liquidity.

Additionally, finding that the amount supplied and borrowed has decreased continuously over the past year, we recommend reducing the supply and borrow caps to prevent significant new growth in this market.

Recommendation

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap | Current Oracle | Recommended Oracle |

|---|---|---|---|---|---|---|---|

| BNB Core | MATIC | 5,500,000 | 2,500,000 | 250,000 | 100,000 | MATIC / USD | POL / USD |

wUSDM

Chainlink plans to deprecate its USDM / USD feed on ZkSync, on which the wUSDM Venus market relies. We note that this market has been paused as a result of exchange rate manipulation, meaning that no more debt can be taken against the asset, nor can any additional tokens be supplied or borrowed. As a result, it will not negatively impact the protocol or create additional risk to set its oracle to a hardcoded value of $1.00.

Recommendation

| Market | Asset | Current Oracle | Recommended Oracle |

|---|---|---|---|

| BNB Core | wUSDM | USDM / USD | Hardcode to $1.00 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.