Thanks Marcus for this feedback

Admins explained me fees were cheaper on the Venus.finance than Venus.io !

About my calculations, it was a low estimation.

In fact, we get more.

For example:

USDT lending is 4,9%

USDT borrowing is -6,63%

We gain 1,73% on the TVL provided by Autofarm vaut.

Then we add 0,01% on each compound.

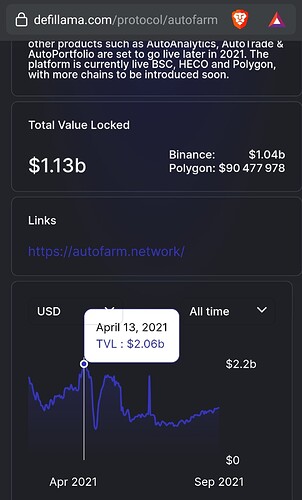

Assuming they provide 7M$ tvl on their Venus USDT Vault with 7 compounds and safemax position (50%)

7,000,000x (1,5)^7 x 1,73/100= $2,069,107

7,000,000x (1,5)^7 x 0,01/100*365= $4,365,467

The annual net income for Venus would be between $2,069,107 and $6,434,574.

I’m sure Venus team get fees even if they announce waive of withdrawal fees. I dont get why bnb tx fees are so expensive.

Nevertheless my estimation is still uncorrect, we would get more :

The more Autofarm will compound, the more is borrowed, the lower liquidity is and the higher borrowing APR we get ($$$).

Please correct me if i’m wrong

I think we should NOT discuss on how they estimated those figures.

I prefer to elaborate what they will pay to us if they dont provide the incomes announced (we have Binance on our side they will cooperate).